Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

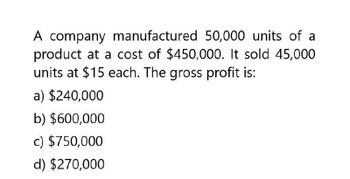

Transcribed Image Text:A company manufactured 50,000 units of a

product at a cost of $450,000. It sold 45,000

units at $15 each. The gross profit is:

a) $240,000

b) $600,000

c) $750,000

d) $270,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company manufactured 50,000 units of a product at a cost of $450,000. They sold 40,000 units for $15 each. What is the gross margin? O $600,000 O $450,000 O $240,000 O $750,000arrow_forwardHelp me with thisarrow_forwardSanchez & Ryan, Inc, sells a single product. This year, 20,000 units were sold resulting in $130,000 of sales revenue, $60,000 of variable costs, and $17,500 of fixed costs. The number of units that must be sold annually to achieve $52,500 of profits is:arrow_forward

- Wu Company incurred $40,000 of fixed cost and $50,000 of the variable cost when 4,000 units of products were made and sold. If the company's volume increases to 5,000 units, the total cost per unit will be: a. $18.00. b. $20.00. c. $20.50. d. $22 50.arrow_forwardTyson manufacturing company produces and sells 120,000 units of a single product. Variable costs total $340,000 and fixed costs total $480,000. If each unit is sold for $12, what markup percentage is the company using?arrow_forwardThe gross profit margin of the company BIOMETAL was 106.000 euros. The cost of of goods produced was 410,000 euros. The initial stocks of finished products were 65,000 euros and the final stocks of finished products were 72,000 euros. The company's sales amounted to (amounts in euros): 905.000 509.000 475.000 403.000arrow_forward

- General Accountingarrow_forwardChelsea Company has sales of $400,000, variable costs of $10 per unit, fixed costs of $100,000, and a profit of $60,000. How many units were sold?arrow_forwardWu Company incurred $40,000 of fixed cost and $50,000 of variable cost when 4,000 units of product were made and sold. If the company's volume doubles, what happens to the total cost per unit?arrow_forward

- The companys net operating income isarrow_forwardHigh Return Manufacturing company has a beginning finished goods inventory of $14,600, raw material purchases of $18,000, cost of goods manufactured of $32,500, and an ending finished goods inventory of $17,800. The cost of goods sold for this company is: A. $21,200. B. $29,300. C. $32,500. D. $47,100. E. $27,600. Paradise Corporation budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels (in units) are planned for next year. Beginning Inventory Ending Inventory Raw material* 55,000 Finished goods 95,000 65,000 65,000 * Three pounds of raw material are needed to produce each unit of finished product. If Paradise Corporation plans to sell 555,000 units during next year, the number of units it would have to manufacture during the year would be: a. 525,000 units b. 500,000 units c. 555,000 units d. 585,000 unitsarrow_forwardTyson manufacturing company produces and sells 120,000 units of a single product. Variable costs total $340,000 and fixed costs total $480,000. If each unit is sold for $12, what markup percentage is the company using? Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning