EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Need help with this question solution general accounting

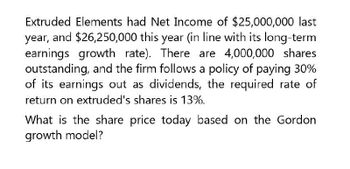

Transcribed Image Text:Extruded Elements had Net Income of $25,000,000 last

year, and $26,250,000 this year (in line with its long-term

earnings growth rate). There are 4,000,000 shares

outstanding, and the firm follows a policy of paying 30%

of its earnings out as dividends, the required rate of

return on extruded's shares is 13%.

What is the share price today based on the Gordon

growth model?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please give me answer general accountingarrow_forwardBreakaway wealth had net earnings of $336,000 this past year. dividends were paid of $77,280 on the company's book equity of $2,800,000. if Safeway has 175,000 shares outstanding with a current market price of $21 per share, what is the required rate of return?arrow_forwardFedEx Corporation (FDX) has a current share price of $157.56 and is expected to have earnings per share (EPS) next year of $11.04 per share. Analysts expect that FedEx's closest competitor, United Parcel Service, Inc. (UPS), will have earnings next year of $8.33 per share. FedEx's cost of capital is 11%. What is your current estimate of the value of one share of UPS stock using the method of comparables? OA. $118.88 OB. $208.82 OC. $75.73 OD. $14.27 OE. $154.85 OF. None of the above is withing $0.35 of the value of one share of UPS stock. Carrow_forward

- FedEx Corporation (FDX) has a current share price of $157.62 and is expected to have earnings per share (EPS) next year of $11.32 per share. Analysts expect that FedEx's closest competitor, United Parcel Service, Inc. (UPS), will have earnings next year of $8.37 per share. FedEx's cost of capital is 11%. What is your current estimate of the value of one share of UPS stock using the method of comparables? OA. $213.17 OB. $76.09 OC. $13.92 OD. $116.54 OE. $154.67 OF. None of the above is withing $0.35 of the value of one share of UPS stock.arrow_forwardGrowth Company's current share price is $19.95 and it is expected to pay a $1.00 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 3.8% per year. a. What is an estimate of Growth Company's cost of equity? b. Growth Company also has preferred stock outstanding that pays a $2.30 per share fixed dividend. If this stock is currently priced at $28.15, what is Growth Company's cost of preferred stock? C. Growth Company has existing debt issued three years ago with a coupon rate of 5.8%. The firm just issued new debt at par with a coupon rate of 6.6%, what is Growth Company's cost of det? d. Growth Company has 5.4 million common shares outstanding and 1.2 million preferred shares outstanding, and its equity has a total book value of $50.1 million. Its liabilities have a market value of $20.3 million. If Growth Company's common and preferred shares are priced as in parts (a) and (b), what is the market value of Growth Company's assets? e, Growth…arrow_forwardc. Growth Company has existing debt issued three years ago with a coupon rate of 5.5%. The firm just issued new debt at par with a coupon rate of 6.2%. What is Growth Company's cost of debt? (Select from the drop-down menus.) The pre-tax cost of debt is the firm's YTM on current debt. Since the firm recently issued debt at par, then the coupon rate of that debt must be the YTM of the debt. Thus, the pre-tax cost of debt is d. Growth Company has 4.7 million common shares outstanding and 1.1 million preferred shares outstanding, and its equity has a total book value of $50.0 million. Its liabilities have a market value of $20.1 million. If Growth Company's common and preferred shares are priced as in parts (a) and (b), what is the market value of Growth Company's assets? The market value of assets is $ million. (Round to two decimal places.) e. Growth Company faces a 22% tax rate. Given the information in parts (a) through (d), and your answers to those problems, what is Growth Company's…arrow_forward

- Growth Company's current share price is $20.10 and it is expected to pay a $0.95 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 4.5% per year. a. What is an estimate of Growth Company's cost of equity? b. Growth Company also has preferred stock outstanding that pays a $2.00 per share fixed dividend. If this stock is currently priced at $28.15, what is Growth Company's cost of preferred stock? c. Growth Company has existing debt issued three years ago with a coupon rate of 6.2%. The firm just issued new debt at par with a coupon rate of 6.3%. What is Growth Company's pretax cost of debt? d. Growth Company has 4.9 million common shares outstanding and 1.2 million preferred shares outstanding, and its equity has a total book value of $50.1 million. Its liabilities have a market value of $20.2 million. If Growth Company's common and preferred shares are priced as in parts (a) and (b), what is the market value of Growth Company's assets? e.…arrow_forwardSydney Ltd. was paid a dividend of $3.97 last year. If the company's growth in dividends is expected to be 10 percent thereafter forever, then what is the cost of equity capital for Sydney Ltd. if the price of its ordinary shares is currently $26.71? (Round to nearest percentage)arrow_forwardGrowth Company's current share price is $20.30, and it is expected to pay a $1.10 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 4.2% per year. a. What is an estimate of Growth Company's cost of equity? b. Growth Company also has preferred stock outstanding that pays a $2.30 per share fixed dividend. If this stock is currently priced at $28.05, what is Growth Company's cost of preferred stock? c. Growth Company has existing debt issued three years ago with a coupon rate of 5.6%. The firm just issued new debt d. Growth Company has 4.5 million common shares outstanding and 1.1 million preferred shares outstanding, and its equity has a total book value of $50.0 million. Its liabilities have a market value of $19.6 million. If Growth Company's common and preferred shares are priced at $20.30 and $28.05, respectively, what is the market value of Growth Company's assets? e. Growth Company faces a 40% tax rate. Given the information in parts a…arrow_forward

- Growth Company's current share price is $20.30 and it is expected to pay a $0.90 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 4.4% per year. a. What is an estimate of Growth Company's cost of equity? b. Growth Company also has preferred stock outstanding that pays a $2.25 per share fixed dividend. If this stock is currently priced at $28.25, what is Growth Company's cost of preferred stock? c. Growth Company has existing debt issued three years ago with a coupon rate of 6.1%. The firm just issued new debt at par with a coupon rate of 6.6%. What is Growth Company's cost of debt? d. Growth Company has 5.5 million common shares outstanding and 1.4 million preferred shares outstanding, and its equity has a total book value of $50.2 million. Its liabilities have a market value of $19.5 million. If Growth Company's common and preferred shares are priced as in parts (a) and (b), what is the market value of Growth Company's assets? e. Growth…arrow_forwardIvanhoe Tire Co. just paid an annual dividend of $1.20 on its common shares. If Ivanhoe is expected to increase its annual dividend by 7.10 percent per year into the foreseeable future and the current price of Ivanhoe’s common shares is $11.92, what is the cost of common stock for Ivanhoe? - Cost of common stock?arrow_forwardMcPherson Pharmaceutical has common stock that is trading for $75 per share. The company paid a dividend of $5.25 last year. This dividend is expected to increase at a rate of 3% per year. What is the cost of equity capital for McPherson? If McPherson issues new shares with a flotation cost of $2 per share, what is the company’s cost of new equity?(using excel formulas)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT