FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

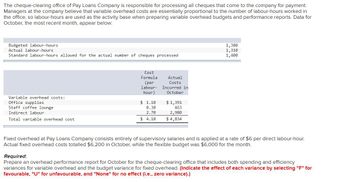

Transcribed Image Text:The cheque-clearing office of Pay Loans Company is responsible for processing all cheques that come to the company for payment.

Managers at the company believe that variable overhead costs are essentially proportional to the number of labour-hours worked in

the office, so labour-hours are used as the activity base when preparing variable overhead budgets and performance reports. Data for

October, the most recent month, appear below:

Budgeted labour-hours

Actual labour-hours

Standard labour-hours allowed for the actual number of cheques processed

Variable overhead costs:

Office supplies

Staff coffee lounge.

Indirect labour

Total variable overhead cost

Cost

Formula

(per

labour-

hour)

$ 1.10

0.30

2.70

$4.10

Actual

Costs

Incurred in

October

$ 1,391

463

2,980

$ 4,834

1,380

1,310

1,400

Fixed overhead at Pay Loans Company consists entirely supervisory salaries and is applied at a rate of $6 per direct labour-hour.

Actual fixed overhead costs totalled $6,200 in October, while the flexible budget was $6,000 for the month.

Required:

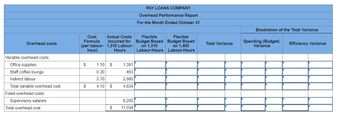

Prepare an overhead performance report for October for the cheque-clearing office that includes both spending and efficiency

variances for variable overhead and the budget variance for fixed overhead. (Indicate the effect of each variance by selecting "F" for

favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).)

Transcribed Image Text:Overhead costs

Variable overhead costs:

Office supplies

Staff coffee lounge

Indirect labour

Total variable overhead cost

Fixed overhead costs:

Supervisory salaries

Total overhead cost

Cost

Formula

(per labour-

hour)

$

$

Actual Costs

Incurred for

1,310 Labour-

Hours

1.10 S

0.30

2.70

4.10 $

$

1,391

463

2,980

4,834

6,200

11,034

PAY LOANS COMPANY

Overhead Performance Report

For the Month Ended October 31

Flexible

Budget Based

on 1,310

Labour-Hours

Flexible

Budget Based

on 1,400

Labour-Hours

Total Variance

Breakdown of the Total Variance

Spending (Budget)

Variance

Efficiency Variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- compute the budgeted factory overhead rate (i.e., the $ rate per activity base hour, etc.) for department yarrow_forwardDirect labor hours are estimated as 1,800 in Quarter 1; 1,900 in Quarter 2; 1,700 in Quarter 3; and 2,100 in Quarter 4. Indirect material per hour $1.00 Supervisory salaries $18,000 Indirect labor per hour 1.20 Maintenance Salaries 5,000 Maintenance per hour 0.20 Property taxes and insurance 6,000 Utilities per hour 0.50 Depreciation 3,500 Prepare a manufacturing overhead budget using the above overhead information. blankManufacturing Overhead BudgetFor the Year Ending Dec. 31, 2020 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Variable Costs $- Select - $- Select - $- Select - $- Select - $- Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - Total Variable Manufacturing Costs $fill in the blank 25 $fill in the blank 26 $fill in the blank 27 $fill in the blank 28 $fill in the blank 29 Fixed Costs…arrow_forwardroduction reports for the third quarter show the following data: Month Machine hours Direct labour hours Direct materials cost (£) Floor surface (square meters) Actual Overhead (£) July 10,000 44,000 25,000 150 31,200 August 15,000 37,800 21,750 170 47,000 September 13,400 59,500 32,000 210 40,100 Which variable would be the most likely basis for allocating overhead? a. Machine hours b. Labour hours c. Floor surface d. Direct materials costarrow_forward

- Swifty Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Swifty is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line (a) (1) (2) (b1) eTextbook and Media (a) Your answer is correct. (b) The total estimated manufacturing overhead was $260,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 12.25.) One mobile safe (b2) One walk-in safe (a) Your answer is correct. eTextbook and Media $ One walk-in safe $ One mobile safe $ H Your answer is incorrect. $ (b) One walk-in safe Mobile Safes Walk-in…arrow_forwardProblem 4.1: West Manufacturing Inc. (WMI) operates a job-order cost system and applies overhead on the basis of direct labor hours. When preparing the budget for the upcoming fiscal year, the following budget items determined: (1) overhead = $150,000, (2) direct labor hours (DLH) = 8,000 and (3) direct labor dollars (DL$) = $60,000. Beginning Ending Inventory Raw materials (RM) Work in process (WIP) Finished goods (FG) $21,000 $86,000 $108,000 Inventory $16,000 $71,500 $58,000 Actual results: $650,000 $133,000 $160,000 10,000 $108,000 $165,500 Actual sales Purchases Direct labor $s Direct labor hours S&A Actual MOH Required: Compute WMI's predetermined overhead rate, applied overhead, and over/under applied overhead. Compute net income using before and after the over/under applied overhead adjustment. Using the Cost Flow Worksheet, compute the inventory turnovers for each inventory Compute cost of Job 160, where the job required direct labor of $1,200 direct labor hours (average pay…arrow_forwardplease answer this with must explanation , computation , for each steps and each parts answer in text formarrow_forward

- Please do not give solution in image format thankuarrow_forwardCoronado Corporation accumulates the following data relative to jobs started and finished during the month of June 2022. Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour Overhead controllable variance $ Overhead volume variance Actual $ $4.40 11,000 $177,600 14,800 $242,800 Standard $4.30 10,100 $174,420 15,300 Overhead is applied on the basis of standard machine hours. 3.20 hours of machine time are required for each direct labor hour. The jobs were sold for $475,000. Selling and administrative expenses were $40,100. Assume that the amount of raw materials purchased equaled the amount used. Compute the overhead controllable variance and the overhead volume variance. $244,800 49,960 $89,928 $3.20 $1.80…arrow_forwardElmo Security Consultants (ESC) offer a standardized review of data security for small business owners. The following data apply to the provision of these reviews: Sales price per unit (1 unit = 1 review with recommendations) Fixed costs (per month): Selling and administration Production overhead (e.g., rent of facilities) Variable costs (per review): Labor for oversight and feedback Outsourced security analysis Materials used in reviews Review overhead Selling and administration (e.g., scheduling and billing) Number of reviews per month Required: a. Variable review (production) cost per unit b. Variable total cost per unit c. Full cost per unit d. Full absorption cost per unit e. Prime cost per unit f. Conversion cost per unit Calculate the amount for each of the following (one unit = one review) if the number of reviews is 2,500 per month. Also calculate if the number of reviews decreases to 2,000 per month. g. Contribution margin per unit h. Gross margin per unit 2,500 Reviews $ 500…arrow_forward

- A professional services firm has been analysing the cost of collecting management information by using its employees' hourly charge-out rates to estimate the costs of different activities. The firm has calculated that the following costs have been incurred during the last month: Staff completing timesheets Managers analysing costs incurred on assignments compared to fees agreed with clients Credit control team updating the receivables ledgers to write off bad debts 5,000 3,000 500 Using the information provided, what are the firm's direct data capture costs for the last month? - $500 $5,000 $8,000 $8,500arrow_forwardFactory Overhead Cost Budget Sweet Tooth Candy Company budgeted the following costs for anticipated production for August: Advertising expenses Manufacturing supplies Power and light Sales commissions Factory insurance Production supervisor wages Production control wages Executive officer salaries Materials management wages Factory depreciation Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only fixed factory costs. $297,290 16,290 48,600 328,580 28,300 142,930 37,160 303,010 40,880 23,150 Sweet Tooth Candy Company Factory Overhead Cost Budget For the Month Ending August 31 Variable factory overhead costs: Total variable factory overhead costs Fixed factory overhead costs: Total fixed factory overhead costs Total factory overhead costsarrow_forwardThe cheque-clearing office of Pay Loans Company is responsible for processing all cheques that come to the company for payment. Managers at the company believe that variable overhead costs are essentially proportional to the number of labour-hours worked in the office, so labour-hours are used as the activity base when preparing variable overhead budgets and performance reports. Data for October, the most recent month, appear below: Budgeted labour-hours 1,330 Actual labour-hours 1,285 Standard labour-hours allowed for the actual number of cheques processed 1,350 Variable overhead costs: Office supplies Staff coffee lounge Indirect labour Total variable overhead cost Cost Formula Actual Costs (per Incurred labour- hour) in October $ 0.60 0.20 2.20 $ 780 $ 3.00 317 3,527 $4,624 Fixed overhead at Pay Loans Company consists entirely of supervisory salaries and is applied at a rate of $7 per direct labour-hour. Actual fixed overhead costs totalled $7,350 in October, while the flexible…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education