FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The prompt is to prepare a

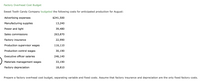

Transcribed Image Text:Factory Overhead Cost Budget

Sweet Tooth Candy Company budgeted the following costs for anticipated production for August:

Advertising expenses

$241,500

Manufacturing supplies

13,240

Power and light

39,480

Sales commissions

263,870

Factory insurance

22,990

Production supervisor wages

116,110

Production control wages

30,190

Executive officer salaries

246,140

Materials management wages

33,190

Factory depreciation

18,810

Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only fixed factory costs.

Transcribed Image Text:Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only fixed factory costs.

Sweet Tooth Candy Company

Factory Overhead Cost Budget

For the Month Ending August 31

Variable factory overhead costs:

Manufacturing supplies

Power and light

Production supervisor wages

Production control wages

Materials management wages v

Total variable factory overhead costs

Fixed factory overhead costs:

Factory insurance

Factory depreciation

Total fixed factory overhead costs

Total factory overhead costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 1. Compute an activity rate for each activity using activity-based costing.arrow_forwardGarrell Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study: Time-driven activity rate (cost per unit of activity) Activity cost pool: Receiving Calls Resolving Issues Settling Disputes Cost Object Data: Number of calls received Number of issues resolved Number of disputes settled Customer P 31 17 1 $5.46 $8.58 $13.26 Customer Q 21 10 Required: Using time-driven activity-based costing, determine the total Customer Support Department cost assigned to cach customer.arrow_forwardActivity-Based Costing CardioTrainer Equipment Company manufactures stationary bicycles and treadmills. The products are produced in the Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $22 per machine hour (mh) Assembly $12 per direct labor hour (dlh) Setup $40 per setup Inspecting $18 per inspection Production scheduling $8 per production order Purchasing $5 per purchase order The activity-base usage quantities and units produced for each product were as follows: Stationary Bicycle Treadmill Machine hours 1,680 1,070 Direct labor hours 243 131 Setups 45 20 Inspections 158 94 Production orders 60 32 Purchase orders 240 98 Units produced 500 350arrow_forward

- Oriole Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) permit installation of stairways of varying lengths and widths. All are of white oak wood. Budgeted manufacturing overhead costs for the year 2025 are as follows. Overhead Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Total budgeted overhead costs Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines For the last 4 years, Oriole Stairs Co. has been charging overhead to products on the basis of machine hours. For the year 2025, 100,000 machine hours are budgeted. Activity Cost Pools Inspecting Inventory control (raw materials and finished goods) Utilities Jeremy Nolan, owner-manager of Oriole Stairs Co., recently directed his accountant, Bill Seagren, to…arrow_forwardsee enclosed jpeg please. Explain as clear as possible how you come to the solution.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Question Content Area Activity rates and product costs using activity-based costing Idris Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity BudgetedActivity Cost Activity Base Casting $640,000 Machine hours Assembly 125,000 Direct labor hours Inspecting 30,000 Number of inspections Setup 28,000 Number of setups Materials handling 20,000 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 7,500 12,500 20,000…arrow_forward

- Please do not give solution in image format thankuarrow_forwardMatch the costs for Oracle in producing computer servers to the appropriate cost types below.A. Raw MaterialsB. Direct LaborC. Overhead CostD. N/A1. Employee Wages for Soldering electronic pieces ________________Why? ________________________________________________________________________________________________________________________________________2. Sales Commissions for Salespersons ________Why? ________________________________________________________________________________________________________________________________________3. Soldering Materials purchased in bulk at the beginning of the year ________Why? ________________________________________________________________________________________________________________________________________4. Motherboards and Processors ________________Why? ________________________________________________________________________________________________________________________________________5. Salaries for the supervisor overseeing the…arrow_forwardPlease help me with Req 4. If someone can help I will give a thumbs up. If you zoom in I believe the image should beome clearer. Thanks!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education