FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

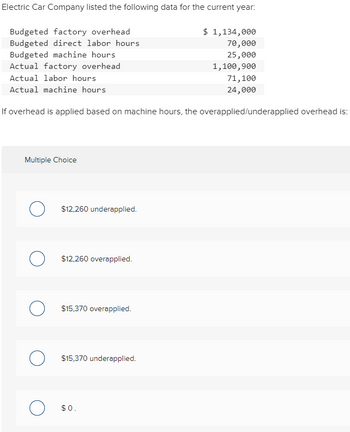

Transcribed Image Text:Electric Car Company listed the following data for the current year:

Budgeted factory overhead

Budgeted direct labor hours

Budgeted machine hours

Actual factory overhead

Actual labor hours

Actual machine hours

$ 1,134,000

70,000

25,000

1,100,900

71,100

24,000

If overhead is applied based on machine hours, the overapplied/underapplied overhead is:

Multiple Choice

○ $12,260 underapplied.

$12,260 overapplied.

$15,370 overapplied.

$15,370 underapplied.

О

○ $0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company budgets $106,800 for overhead and 7,060 direct labor hours for the year. The company's Basic model uses 2 direct labor hours per unit and its Premium model uses 3 direct labor hours per unit. The direct labor rate is $43 per hour. Direct materials cost $13 per unit for the Basic model and $19 per unit for the Premium model. Enter answers in the tabs below. Required Required Required 1 2 3 Compute overhead. cost per unit for each model. Basic Premium Plantwide Direct Labor Overhead Hours per Unit Rate Overhead Cost per Unitarrow_forwardReyes Corporation applies overhead using an actual... Reyes Corporation applies overhead using an actual costing approach. Budgeted factory overhead was $271,008, and budgeted machine-hours were 18,820. Actual factory overhead was $289,520, and actual machine-hours were 19,370. How much overhead would be applied to production? Multiple Choice $271,008 $275,920 $281,159 $289,520arrow_forwardSteel Company uses activity-based costing and reports the following for this year. Allocate overhead costs to a job that uses 40 machine hours and 30 direct labor hours. Activity Budgeted Cost Activity Cost Driver Budgeted Activity Usage Cutting $ 56,000 Machine hours (MH) 2,000 machine hours Assembly 240,000 Direct labor hours (DLH) 6,000 direct labor hours Total $ 296,000arrow_forward

- If estimated annual factory overhead is $980,500; overhead is applied using direct labor hours; estimated annual direct labor hours are 265,000; actual March factory overhead is $88,800; and actual March direct labor hours are 23,500; then overhead is: Multiple Choice $1,450 overapplied. $850 overapplied. $1,450 underapplied. $850 underapplied. $1,850 underapplied.arrow_forward- ok k int ences w 3 E Overhead information for Cran-Mar Company for October follows: Total factory overhead cost incurred Budgeted fixed factory overhead cost Total standard overhead rate per machine hour (MH) D Standard variable factory overhead rate per MH Standard MHS allowed for the units manufactured here to search Required: 1. What is the standard fixed factory overhead rate per machine hour (MH)? 2. What is the denominator activity level that was used to establish the fixed factory overhead application rate? 3. Two-way analysis (breakdown) of the total factory overhead cost variance: calculate the following factory overhead cost variances for October and indicate whether each variance is favorable (F) or unfavorable (U). a. Total flexible-budget variance. b. Production volume variance. c. Total overhead cost variance. 4. Calculate the production volume variance and indicate whether the variance is favorable (F) or unfavorable (U). Complete this question by entering your answers…arrow_forwardABC Company listed the following data for the current year: Budgeted factory overhead $1,134,000 Budgeted direct labor hours 70,000 Budgeted machine hours 25,000 Actual factory overhead 1,100,900 Actual labor hours 71,100 Actual machine hours 24,000 If overhead is applied based on direct labor hours, the overapplied/underapplied overhead is:arrow_forward

- Below is the selected information for a company for last year: Budgeted fixed manufacturing overhead cost Denominator activity (machine-hours) Standard machine-hours allowed per unit Actual number of units produced Underapplied fixed manufacturing overhead $270,000 45,000 3 14,000 $15,200 Actual fixed cost for last year was: 236,800 O 267,200 254,800 285,200arrow_forwardA company has the following overhead costs and activities: Estimated Expected Activity Product V Product W Product X Overhead Activities and Activity Measures Machine setups (setups) Processing customer orders (orders) Assembling products (assembly-hours) $9,178.00 Cost S7,234.50 $3,565.50 69 12 10 20 21 492 697 111 4. A company sells two products, one with sales of $10,000 and variable expenses of $2,500, another with sales of $46,000 and variable expenses of $15,420. Fixed expenses are $33,100. Breakeven point for the whole company is close to: А. 833,100 В. $22,900 C. $51,020 D. $48,676 A company that reduces the proportion of variable costs in its cost structure will: A. enjoys higher stability in profits. B. increase its profits more when the economy is good. C. have a loss more easily when the economy is bad. D. be indifferent. 5. 6. is normally recorded on any financial statement but irrelevant in decision making which is not. A. Sunk cost B. Incremental cost C. Differential…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education