FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

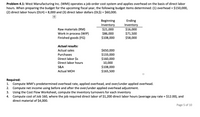

Transcribed Image Text:Problem 4.1: West Manufacturing Inc. (WMI) operates a job-order cost system and applies overhead on the basis of direct labor

hours. When preparing the budget for the upcoming fiscal year, the following budget items determined: (1) overhead = $150,000,

(2) direct labor hours (DLH) = 8,000 and (3) direct labor dollars (DL$) = $60,000.

Beginning

Ending

Inventory

Raw materials (RM)

Work in process (WIP)

Finished goods (FG)

$21,000

$86,000

$108,000

Inventory

$16,000

$71,500

$58,000

Actual results:

$650,000

$133,000

$160,000

10,000

$108,000

$165,500

Actual sales

Purchases

Direct labor $s

Direct labor hours

S&A

Actual MOH

Required:

Compute WMI's predetermined overhead rate, applied overhead, and over/under applied overhead.

Compute net income using before and after the over/under applied overhead adjustment.

Using the Cost Flow Worksheet, compute the inventory turnovers for each inventory

Compute cost of Job 160, where the job required direct labor of $1,200 direct labor hours (average pay rate = $12.00), and

direct material of $4,000.

1.

2.

3.

4.

Page 5 of 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Arensky Company uses normal costing to account for overhead in its job costing system. There are departments in the company: Designing and Machining. The Designing Dept. is labor intensive; the Machining Dept. is machine intensive. (OH- Overhead; DLH = Direct Labor Hours; MH = Machining Hours.) The budget for 2019 is as follows: Actual results are as follows: a. b. C. Est. OH Est. DLH Est. MH d. Actual OH Actual DLH Actual MH Designing $2,000,000 40,000 hours 20,000 hours Designing $2,100,000 41,500 hours 19,800 hours Machining $5,600,000 10,000 hours 70,000 hours Machining $5,650,000 11,000 hours 72,000 hours Using the most logical allocation base, calculate the OH Allocation Rate for eac department. Be sure to state your final answer in proper units. For each department, calculate how much OH is allocated. For each department, give the journal entry to record over- or under-allocated overhead. Why is the Normal Costing method preferred to the Actual Costing method? uirementsarrow_forwardTillman Corporation uses a Job Order Costing system and has two production departments--Molding and Assembly. The company applies manufacturing overhead to production orders on the basis of direct labor costs. Separate departmental predetermined overhead rates are used. Budgeted manufacturing costs for the year are as follows: Molding Assembling Direct Materials P700,000 P100,000 Direct Labor 200,000 800,000 Manufacturing Overhead 600,000 400,000 The actual material and labor costs charged to Job 432 were as follows: Direct Materials 25,000 Direct Labor Molding 8,000 Assembling 12,000 20,000 Tillman applies manufacturing overhead to production orders on the basis of direct labor cost using a departmental rate predetermined at the beginning of the year based on the annual budget. The total manufacturing cost associated with Job 432 should be?arrow_forward5arrow_forward

- ll. Subject : - Accountingarrow_forwardProblem #1. ABC Corporation uses a job-order costing system with a plantwide overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine hours required to support estimated production 150,000 Manufacturing overhead costs ₱1,350,000 Required: 1.Compute the predetermined overhead rate. 2.During the year, Job 500 was started and completed. The following information was available with respect to this job: Direct materials requisitioned ₱350 Direct labor cost ₱230 Machine hours used 30 Compute the total manufacturing costs assigned to Job 500. 3.During the year the company worked a total of 147,000 machine-hours on all jobs and incurred actual manufacturing overhead costs of ₱1,325,000. What is the amount of underapplied or overapplied overhead for the year?arrow_forwardOverhead Applied to Jobs, Departmental Overhead Rates Xania Inc. uses a normal job-order costing system. Currently, a plantwide overhead rate based on machine hours is used. Xania's plant manager has heard that departmental overhead rates can offer significantly better cost assignments than a plantwide rate can offer. Xania has the following data for its two departments for the coming year: Overhead costs (expected) Normal activity (machine hours) Required: Department A Department B 1. Compute a predetermined overhead rate for the plant as a whole based on machine hours. Round your answer to two decimal places. 5.75 ✔per machine hour Plantwide 2. Compute predetermined overhead rates for each department using machine hours. (Note: Round to two decimal places, if necessary.) 8.28 ✔ per machine hour 2.89✔ per machine hour Departmental $ 3. Conceptual Connection: Job 73 used 20 machine hours from Department A and 50 machine hours from Department B. Job 74 used 50 machine hours from…arrow_forward

- 23. Using the activity-based costing method of applying manufacturing overhead, the amount of overhead applied to Job #414 would be: A) $29,600 B) $17,412 C) $34,824 $59,200 E) $36,000 24. Using the POHR based on direct labor hours, the amount of overhead costs applied to Job#414 would be: A) $36,000 B) $34,824 $17,412 D) $29,600 E) $59,200arrow_forwardJ5arrow_forwardProblem #4:Gitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased.) In computing a predetermined overhead rate at the beginning of the year, the company’s estimates were: manufacturing overhead cost, $800,000; and direct materials to be used in production, $500,000. The company has provided the following data :BeginningEndingRaw materials$20,000$80,000Work in Process150,00070,000Finished Goods260,000400,000The following actual costs were incurred during the year:Purchase of direct raw materials $510,000Direct labor cost90,000Manufacturing overhead costs: 4Indirect labor170,000Property taxes48,000Depreciation-equipment260,000Maintenance95,000Insurance7,000Rent -Building180,000Required: 1.a. Compute the predetermined overhead rate for the yearb. Compute the amount of under-or over-applied overhead for the year.1.Prepare the statement of cost of goods…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education