FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

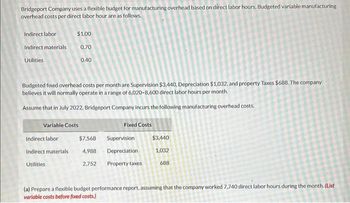

Transcribed Image Text:Bridgeport Company uses a flexible budget for manufacturing overhead based on direct labor hours. Budgeted variable manufacturing

overhead costs per direct labor hour are as follows.

Indirect labor

Indirect materials

Utilities

Budgeted fixed overhead costs per month are Supervision $3,440, Depreciation $1,032, and property Taxes $688. The company

believes it will normally operate in a range of 6,020-8,600 direct labor hours per month.

Assume that in July 2022, Bridgeport Company incurs the following manufacturing overhead costs.

$1.00

0.70

0.40

Variable Costs

Indirect labor

Indirect materials

Utilities.

$7,568

4,988

2,752

Fixed Costs

Supervision

Depreciation

Property taxes

$3,440

1,032

688

(a) Prepare a flexible budget performance report, assuming that the company worked 7,740 direct labor hours during the month. (List

variable costs before fixed costs.)

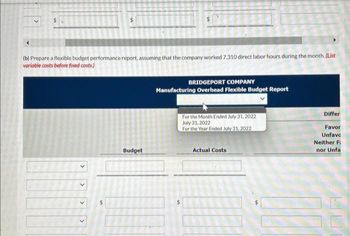

Transcribed Image Text:(b) Prepare a flexible budget performance report, assuming that the company worked 7,310 direct labor hours during the month. (List

variable costs before fixed costs.)

>

Budget

BRIDGEPORT COMPANY

Manufacturing Overhead Flexible Budget Report

For the Month Ended July 31, 2022

July 31, 2022

For the Year Ended July 31, 2022

Actual Costs

Differ

Favor

Unfavc

Neither Fi

nor Unfal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Variable Costs Total Variable Costs Depreciation Supervision Total Costs Total Fixed Costs Direct Labor Activity Level Direct Materials Fixed Costs Finished Units Overheadarrow_forwardPlease help me with required 1 and 2 and don't provide Excelarrow_forwardFlounder Company expects to produce 1,080,000 units of Product XX in 2022. Monthly production is expected to range from 72,000 to 108,000 units. Budgeted variable manufacturing costs per unit are direct materials $5, direct labor $6, and overhead $8. Budgeted fixed manufacturing costs per unit for depreciation are $2 and for supervision are $1. In March 2022, the company incurs the following costs in producing 90,000 units: direct materials $468,000, direct labor $536,400, and variable overhead $724,500. Actual fixed costs were equal to budgeted fixed costs. Prepare a flexible budget report for March. (List variable costs before fixed costs) $ Budget FLOUNDER COMPANY Manufacturing Flexible Budget Report Actual Difference Favorable Unfavorable Neither Favorable nor Unfavorable 100arrow_forward

- The Current Designs staff has prepared the annual manufacturing budget for the rotomolded line based on an estimated annual production of 3,960 kayaks during 2020. Each kayak will require 56 pounds of polyethylene powder and a finishing kit (rope, seat, hardware, etc.). The polyethylene powder used in these kayaks costs $1.00 per pound, and the finishing kits cost $150 each. Each kayak will use two kinds of labor-2 hours of type I labor from people who run the oven and trim the plastic, and 3 hours of work from type II workers who attach the hatches and seat and other hardware. The type I employees are paid $19 per hour, and the type II are paid $16 per hour. Manufacturing overhead is budgeted at $381,520 for 2020, broken down as follows. Variable costs Indirect materials Manufacturing supplies Maintenance and utilities Fixed costs Supervision Insurance Depreciation Total Polyethylene powder Finishing kits Type I labor Type II labor Indirect materials Manufacturing supplies Maintenance…arrow_forwardBlossom Company expects to produce 1,200,000 units of product XX in 2022. Monthly production is expected to range from 70,000 to 100,000 units. Budgeted variable manufacturing costs per unit are as follows: direct materials $3, direct labour $6, and overhead $9. Budgeted fixed manufacturing costs per unit for depreciation are $4 and for supervision $1. Prepare a flexible manufacturing budget for the relevant range value using increments of 15,000 units. (List variable costs before fixed costs.) BLOSSOM COMPANY Monthly Flexible Manufacturing Budget $ $ $arrow_forwardanswer in text form please (without image)arrow_forward

- Cap Incorporated manufactures ball point pens that sell at wholesale for $0.80 per unit. Budgeted production in both 2021 and 2022 was 13,000 units. There was no beginning inventory in 2021. The following data summarized the 2021 and 2022 operations: 2021 2022 Units sold 11,500 12,000 Units produced 13,000 13,000 Costs: Variable factory overhead per unit $ 0.15 $ 0.15 Fixed factory overhead $ 2,600 $ 2,600 Variable marketing per unit $ 0.30 $ 0.30 Fixed Selling and Administrative $ 320 $ 320 Full costing operating income for 2022 is calculated to be: (Do not round intermediate calculations. Round your final answers to whole dollar amounts.) Multiple Choice $1,480. $214. $2,150. $1,700. $1,518.arrow_forwardIvanhoe Manufacturing Co.'s static budget at 13,500 units of production includes $87,750 for direct labor and S20,250 for direct materials. Total fixed costs are $49,500. Determine the total costs on Ivanhoe's flexible budget for 2022 if 19,500 units are produced and sold. Total Cost Senter the total cost in dollarsarrow_forwardi need the answer quicklyarrow_forward

- Sheffield, Inc. is planning to produce 2,560 units of product in 2022. Each unit requires 3 pounds of materials at $6 per pound and a half hour of labor at $16 per hour. The overhead rate is 75% of direct labor. (a) Your answer has been saved. See score details after the due date. Compute the budgeted amounts for 2022 for direct materials to be used, direct labor, and applied overhead. Direct Materials $ (b) Direct Labor Overhead Standard Cost Save for Later $ $ $ 46080 Compute the standard cost of one unit of product. (Round answer to 2 decimal places, e.g. 52.75.) 20480 15360 Attempts: 1 of 1 used Attempts: 0 of 1 used Submit Answerarrow_forwardJackson Inc. listed the following data for 2019: Budgeted factory overhead Budgeted direct labor hours Budgeted machine hours $1,505,000 ৪6,000 43,000 Actual factory overhead Actual direct labor hours 1,402,000 ৪৪,300 41,400 Actual machine hours If overhead is applied based on machine hours, the overapplied/underapplied overhead is (round calculations to 2 significant digits): Multiple Choice $49,059 overapplied. $47000 underapplied. O s-0- $47000 overapplied. $49.059 underapplied.arrow_forwardABX Company plans to produce 50,000 units of Peace Products in 2023. Budgeted variable manufacturing costs per unit are direct materials P7, direct labor P12, and overhead P18. Annual budgeted fixed manufacturing overhead costs are P96,000 for depreciation and P45,000 for supervision. In February, Shalom produced 6,000 units and incurred the following costs: direct materials P38,900, direct labor P70,200, variable overhead P116,500, depreciation P8,000, and supervision P4,000. Need solution Direct materials: ANS: 3,100 F Total fixed manufacturing overhead: ___ How much was the total variable manufacturing cost? ANS: 222,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education