Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the number of shares outstanding? General accounting

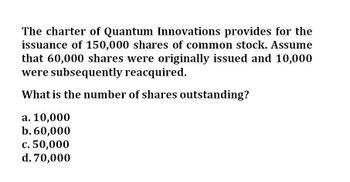

Transcribed Image Text:The charter of Quantum Innovations provides for the

issuance of 150,000 shares of common stock. Assume

that 60,000 shares were originally issued and 10,000

were subsequently reacquired.

What is the number of shares outstanding?

a. 10,000

b. 60,000

c. 50,000

d. 70,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A corporation issued 100 shares of $100 par value preferred stock for $150 per share. The resulting journal entry would include which of the following? A. a credit to common stock B. a credit to cash C. a debit to paid-in capital in excess of preferred stock D. a debit to casharrow_forwardAlert Companys shareholders equity prior to any of the following events is as follows: The company is considering the following alternative items: 1. An 8% stock dividend on the common stock when it is selling for 30 per share. 2. A 30% stock dividend on the common stock when it is selling for 32 per share. 3. A special stock dividend to common shareholders consisting of 1 share of preferred stock for every 100 shares of common stock. The preferred stock and common stock are selling for 123 and 31 per share, respectively. 4. A 2-for-1 stock split on the common stock, reducing the par value to 5 per share (assume the same date for declaration and issuance). The market price is 30 per share on the common stock. 5. A property dividend to common shareholders consisting of 100 bonds issued by West Company. These bonds are carried on the Alert Company books as an available-for sale investment at a fair value of 48,000 (which is also its cost); it has a current value of 54,000. 6. A cash dividend, consisting of a normal dividend and a liquidating dividend, on both the preferred and the common stock. The 10% preferred dividend includes a 2% liquidating dividend, and the 2.30 per share common dividend includes a 0.30 per share liquidating dividend (separate liquidating dividend contra accounts should be used). Required: For each of the preceding alternative items: 1. Record (a) the journal entry at the date of declaration and (b) the journal entry at the date of issuance. 2. Compute the balances in the shareholders equity accounts immediately after the issuance (any gains or losses are to be reflected in the retained earnings balance; ignore income taxes).arrow_forwardPrepare general journal entries for the following transactions of GOTE Company: (a) Received subscriptions for 10,000 shares of 2 par common stock for 80,000. (b) Received payment of 30,000 on the stock subscription in transaction (a). (c) Received the balance in full for the stock subscription in transaction (a) and issued the stock. (d) Purchased 1,000 shares of its own 2 par common stock for 7.50 a share. (e) Sold 500 shares of the stock on transaction (d) for 8.50 a share.arrow_forward

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.arrow_forwardMacKenzie Mining Corporation is authorized to issue 50,000 shares of $500 par value 7% preferred stock. It is also authorized to issue 5,000,000 shares of $3 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.arrow_forwardWhat is the number of shares outstanding on this accounting question?arrow_forward

- H7. The charter of a corporation provides for the issuance of 147,000 shares of common stock. Assume that 55,000 shares were originally issued and 11,500 were subsequently reacquired. What is the number of shares outstanding? a. 43,500 b. 55,000 c. 147,000 d. 11,500 Please show all step by step calculationarrow_forwardThe charter of Zion Associates provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 shares were subsequently reacquired. What is the amount of cash dividends to be paid if a $2-per-share dividend is declared? a. $80,000 b. $20,000 c. $90,000 d. $100,000 e. None of the abovearrow_forwardThe charter of a corporation provides for the issuance of 100.000 shares of common stock. Assume that 60,000 shares were originally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding? a. 5,000. b. 100.000. c. 60,000. d. 55.000.arrow_forward

- The charter of a corporation provides for the issuance of 105,000 shares of common stock. Assume that 63,000 shares were originally issued and 12,600 were subsequently reacquired. What is the number of shares outstanding? Оа. 50,400 Оb. 63,000 Oc. 12,600 Od. 105,000 Previous Nextarrow_forward1. The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 40,000 shares were originally issued and 10,000 were subsequently reacquired. What is the number of shares outstanding? A. 30,000 B. 50,000 C. 10,000 D. 40,000 2. The par value per share of common stock represents the a. minimum amount the stockholder will receive when the corporation is liquidated. b. minimum selling price of the stock established by the articles of incorporation. c. amount of dividends per share to be received each year. d. dollar amount assigned to each share.arrow_forwardGive answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,