Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Answer the following requirements

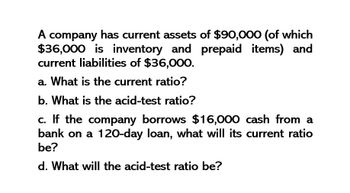

Transcribed Image Text:A company has current assets of $90,000 (of which

$36,000 is inventory and prepaid items) and

current liabilities of $36,000.

a. What is the current ratio?

b. What is the acid-test ratio?

c. If the company borrows $16,000 cash from a

bank on a 120-day loan, what will its current ratio

be?

d. What will the acid-test ratio be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Answer? ? Financial accountingarrow_forwardc) A company has current assets of $92,000 (of which $37,000 is inventory and prepaid items) and current liabilities of $37,000. What is the current ratio? What is the acid-test ratio? If the company borrows $14,000 cash from a bank on a 120-day loan, what will its current ratio be? What will the acid-test ratio be? (Round answers to 2 decimal places, e.g. 2.50.) Current Ratio enter the ratio rounded to 2 decimal places :1 Acid Test Ratio enter the ratio rounded to 2 decimal places :1 New Current Ratio enter the ratio rounded to 2 decimal places :1 New Acid Test Ratio enter the ratio rounded to 2 decimal placesarrow_forwarda company has current assets of $87,000 (of which $43,000 is inventory and prepaid items) and current liabilities of $43,000. What is the current ratio? What is the acid-test ratio? If the company borrows $14,000 cash from a bank on a 120-day loan, what will its current ratio be? What will the acid-test ratio be? Current Ratio enter the ratio rounded to 2 decimal places :1 Acid Test Ratio enter the ratio rounded to 2 decimal places :1 New Current Ratio enter the ratio rounded to 2 decimal places :1 New Acid Test Ratio enter the ratio rounded to 2 decimal places :1arrow_forward

- What is the amount of current liabilities?arrow_forwardI need answer of this accounting questionsarrow_forwardYou are given the following information. What is your liquidity ratio? Annual disposable income: $45,000 Total liabilities: $17,400 Annual savings: $2,400 Long-term assets: $85,000 Current ratio: 2 Debt-to-asset ratio: 0.2 Select one: a. 0.90 b. 0.56 c. 0.89 d. 0.53arrow_forward

- Do npt give image formatarrow_forwardA firm has $ 1.2 million in current assets and $ 1 million in current liabilities. If the company uses $ 0.5 million of cash to pay part of its accounts payable, what will happen to the “current ratio”?arrow_forwardProvide answer financial accountingarrow_forward

- a)Assume that the following data is extracted from the financial statements of Richy-Rich bank: equity is $350 million, interest expense is $115 million, provision for loan loss (P) is $35 million, noninterest income is $30 million, noninterest expense is $50 million and a tax rate is 33%. What is the minimum total interest income required to give a return on equity (ROE) of 20%? Show workings when necessary. b) Be-smart Bank reported an equity multipler ratio of 6.5 at the end of year 2021. If the bank’s total debt at the end of year 2021 was $5 million, how much of its assets were financed with equity? Show calculations when necessary. c) What are the main sources of funding for commercial banks? Using bullet points, classify these sources and briefly describe each category.arrow_forwardProvide correct option is general accountingarrow_forwardplease help me solve this equationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you