Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN: 9781337395250

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

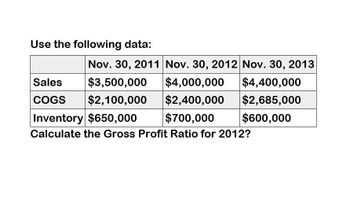

Calculate the gross profit ratio for 2012?

Transcribed Image Text:Use the following data:

Nov. 30, 2011 Nov. 30, 2012 Nov. 30, 2013

Sales

COGS

$3,500,000

$2,100,000

$4,000,000

$4,400,000

$2,400,000

$2,685,000

Inventory $650,000

$700,000

$600,000

Calculate the Gross Profit Ratio for 2012?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of goods sold 660.0 Gross profit 135.0 Selling expenses 73.5 EBITDA 61.5 Depreciation expenses 12.0 Earnings before interest and taxes (EBIT) 49.5 Interest expenses 4.5 Earnings before taxes (EBT) 45.0 Taxes (40%) 18.0 Net income 27.0 a. Calculate the ratios you think would be useful in this analysis. b. Construct a DuPont equation, and compare the companys ratios to the industry average ratios. c. Do the balance-sheet accounts or the income statement figures seem to be primarily responsible for the low profits? d. Which specific accounts seem to be most out of line relative to other firms in the industry? e. If the firm had a pronounced seasonal sales pattern or if it grew rapidly during the year, how might that affect the validity of your ratio analysis? How might you correct for such potential problems?arrow_forwardUse the following information for the Quick Studies below. (Algo) ($ thousands) Net sales Current Year $ 802,213 393,339 Prior Year $ 453,350 134,505 Cost of goods sold QS 13-7 (Algo) Trend percents LO P1 Determine the Prior Year and Current Year trend percents for net sales using the Prior Year as the base year. (Enter the answers in thousands of dollars.) Current Year: Prior Year: Numerator: Trend Percent for Net Sales: 1 1 1 Denominator: = = = Trend Percent 0% 0 %arrow_forwardNonearrow_forward

- Describe how to develop a pro forma income statement .arrow_forward! Required information Use the following information for the Quick Studies below. (Algo) ($ thousands) Net sales Current Year $ 803,470 394,775 Prior Year $ 455,095 135,878 Cost of goods sold QS 17-7 (Algo) Trend percents LO P1 Determine the Prior Year and Current Year trend percents for net sales using the Prior Year as the base year. (Enter the answers in thousands of dollars.) Current Year: Prior Year: Numerator: Trend Percent for Net Sales: 1 1 1 1 Denominator: = = = Trend Percent 0 % 0 %arrow_forwardQuestion 5 Marks: BigBoss Inc. provides the following extracts from income statement for the year 2009: Net sales $500,000, Cost of Goods Sold (150,000), Gross profit $350,000, Calculate the gross profit percentage.arrow_forward

- Calculate the Gross Profit Percentage using the following information: Net Sales Cost of Goods Sold Operating Expenses Income Taxes 60% 32.5% 30% 120% 5,000,000 2,000,000 500,000 875,000arrow_forward2020 Revenue $432,000 Returns, allowances, discounts ($21,600) Cost of goods sold ($280,800) Operating expenses ($45,000) Net Income $84,600 Use the above information to calculated the gross margin/profit ratio.arrow_forwardWant correct answer step by steparrow_forward

- Operating data for Joshua Corporation are presented as follows: Net Sales Cost of Goods Sold Selling Expenses Administrative Expenses Income Tax Expense Net Income 2022 800,000 520,000 120,000 60,000 30,000 70,000 Instructions Prepare a schedule showing a vertical analysis for 2022 and 2021. Net Sales Cost of Goods Sold Gross Profit Selling Expenses Your Answers: FYI: Format the percent cols to one decimal place. Ex 99.9% 2022 Administrative Expenses Total Operating Expenses Income Before Income Taxes Income Tax Expense Net Income 2021 600,000 408,000 72,000 48,000 24,000 48,000 Amount 800,000 520,000 280,000 120,000 60,000 180,000 100,000 30,000 70,000 Percent 100.0% 2021 Amount Percent 600,000 100.0% 408,000 192,000 72,000 48,000 120,000 72,000 24,000 48,000arrow_forwardSOLVE THIS ONE PLSEarrow_forwardSolvency and Profitability Trend Analysis Addai Company has provided the following comparative information: 20Y8 20Y7 20Y6 20Y5 20Y4 Net income $273,406 $367,976 $631,176 $884,000 $800,000 Interest expense 616,047 572,003 528,165 495,000 440,000 Income tax expense 31,749 53,560 106,720 160,000 200,000 Total assets (ending balance) 4,417,178 4,124,350 3,732,443 3,338,500 2,750,000 Total stockholders’ equity (ending balance) 3,706,557 3,433,152 3,065,176 2,434,000 1,550,000 Average total assets 4,270,764 3,928,396 3,535,472 3,044,250 2,475,000 Average total stockholders' equity 3,569,855 3,249,164 2,749,588 1,992,000 1,150,000 You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the following levels for the last five years: 20Y4–20Y8 Return on total assets 28%…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning