FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

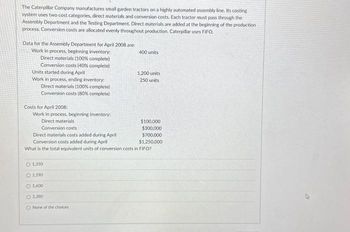

Transcribed Image Text:The Caterpillar Company manufactures small garden tractors on a highly automated assembly line. Its costing

system uses two cost categories, direct materials and conversion costs. Each tractor must pass through the

Assembly Department and the Testing Department. Direct materials are added at the beginning of the production

process. Conversion costs are allocated evenly throughout production. Caterpillar uses FIFO.

Data for the Assembly Department for April 2008 are:

Work in process, beginning inventory:

Direct materials (100% complete)

Conversion costs (40% complete)

Units started during April

Work in process, ending inventory:

Direct materials (100% complete)

Conversion costs (80% complete)

Costs for April 2008:

Work in process, beginning inventory:

Direct materials

400 units

O 1.350

O 1.190

O 1600

O 1,390

O None of the choices

1,200 units

250 units

$100,000

$300,000

$700,000

$1,250,000

Conversion costs

Direct materials costs added during April

Conversion costs added during April

What is the total equivalent units of conversion costs in FIFO?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- XYZ, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor Batch processing Order processing Customer service Activity Measure Number of direct labor-hours. Number of batches. Number of orders Number of customers The company just completed a single order from I Truck for 1,600 custom seat cushions. The order was produced in three batches. Each seat cushion required 0.3 direct labor-hours. The selling price was $141.80 per unit, the direct materials cost was $106 per unit, and the direct labor cost was $13.90 per unit. This was I Truck's only order during the year. Required: Calculate the customer margin on sales to I Truck for the year. Costs: Interstate Trucking Customer Margin-ABC Analysis Customer margin Activity Rate $10 per direct labor-hour $92 per batch $280…arrow_forwardJulio produces two types of calculator, standard and deluxe. The company is currently using a traditional costing system with machine hours as the cost driver but is considering a move to activity-based costing. In preparing for the possible switch, Julio has identified two cost pools: materials handling and setup. The collected data follow: Number of machine hours Number of material moves Number of setups Total estimated overhead costs are $332,860, of which $158,400 is assigned to the material handling cost pool and $174,460 is assigned to the setup cost pool. Required: 1. Calculate the overhead assigned to each product using the traditional cost system. 2. Calculate the overhead assigned to each product using ABC. Required 1 Required 2 Standard Model Deluxe Model 30,400 870 520 Complete this question by entering your answers in the tabs below. Standard Model Deluxe Model 25,400 570 90 Calculate the overhead assigned to each product using the traditional cost system. (Round the…arrow_forwardBlue Water Company produces premium bottled water. In the second department, the Bottling Department, conversion costs are incurred evenly throughout the bottling process, but packaging materials are not added until the end of the process. Costs in beginning Work-in-Process Inventory include transferred in costs of $1,200, direct labor of $600, and manufacturing overhead of $530 March data for the Bottling Department follow (Click the icon to view the data.) Read the requirements Divided by: Total EUP Cost per equivalent unit Costs accounted for Mar. 31 $ Finished Goods Inventory Work-in-Process Inventory-Bottling $ 180,000 $ 0.77 $ Completed and transferred out Ending work-in-process Total costs accounted for Requirement 2. Prepare the journal entry to record the cost of units completed and transferred out. (Record debits first, th Date Accounts Credit Debit 203,050 119,350 $ 19,250 138,600 S 155,000 0.18 S Work-in-Process Inventory-Bottling 172,500 0 36 27,900 S 0 27,900 S 55,800 $…arrow_forward

- Old Victrola, Inc., produces top-quality stereos and uses process costing. The manufacture of stereos is such that direct materials, labor, and overhead are all added evenly throughout the production process. Due to the smooth production process, only one cost category-manufacturing costs-is used for equivalent unit calculations. Old Victrola had the following cost and production information available for the months of March and April. Direct materials costs Direct labor costs Manufacturing overhead applied Total manufacturing costs Units in beginning work in process Units transferred to finished goods Units in ending work in process Req A Beginning work in process was 30 percent complete in March and 60 percent complete in April. Ending work in process was 60 percent complete in March and 35 percent complete in April. Req B1 March April a. For each of the two months, calculate the equivalent units of production. b-1. For each of the two months, calculate the manufacturing cost per…arrow_forwardCarson Paint Company, which manufactures quality paint to sell at premium prices, uses a single production department. Production begins by blending the various chemicals that are added at the beginning of the process and ends by filling the paint cans. The gallon cans are then transferred to the shipping department for crating and shipment. Direct labor and overhead are added continuously throughout the process. Factory overhead is applied at the rate of $3 per direct labor dollar. The company combines direct labor and overhead in computing product cost. Prior to May, when a change in the manufacturing process was implemented, Work - in - Process Inventories were insignificant. The changed manufacturing process, which has resulted in increased equipment capacity, allows increased production but also results in considerable amounts of Work-in - Process Inventory. Also, the company had 1,000 spoiled gallons in May-one-half of which was normal spoilage and the rest abnormal spoilage. The…arrow_forwardPlease help me. Thankyou.arrow_forward

- ces Foam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers The company just completed a single order from Interstate Trucking for 2,300 custom seat cushions. The order was produced in three batches. Each seat cushion required 0.6 direct labor-hours. The selling price was $142.40 per unit, the direct materials cost was $110 per unit, and the direct labor cost was $14.30 per unit. This was Interstate Trucking's only order during the year. Costs: Required: Calculate the customer margin on sales to Interstate Trucking for the year. Activity Rate $ 14 per direct labor-hour $ 86 per batch $ 287 per order $…arrow_forwardAlpesharrow_forwardMcKnight Handcraft is a manufacturer of picture frames for large retailers. Every picture frame passes through two departments: the assembly department and the finishing department. This problem focuses on the assembly department. The process-costing system at McKnight has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added when the assembly department process is 10% complete. Conversion costs are added evenly during the assembly department's process. McKnight uses the weighted-average method of process costing. Consider the following data for the assembly department in April: (Click the icon to view the data.) Required Work in process, ending Accounted for Equivalent units of work done to date Now summarize the total costs to account for. Work in process, beginning Costs added in current period Total costs to account for Completed and transferred out Work in process, ending IZU 570 Total costs accounted…arrow_forward

- Xie Company identified the following activities, costs, and activity drivers for this year. The company manufactures two types of go- karts: Deluxe and Basic. Activity Handling materials Inspecting product Processing purchase orders Paying suppliers Insuring the factory. Designing packaging Activity Required: Compute the activity rate for each activity, assuming the company uses activity-based costing. (Round activity rate answers to 2 decimal places.) Handling material Inspecting product Processing orders Paying suppliers Insuring factory Designing packaging Expected Costs $700,000 975,000 180,000 250,000 375,000 150,000 Expected Costs $ $ Expected Activity 100,000 parts 1,500 batches 700 orders 500 invoices 40,000 square feet 2 models. 700,000 975,000 180,000 250,000 375,000 150,000 2,630,000 Activity Driver 100,000 parts 1,500 batches 700 orders 500 invoices 40,000 square feet 2 models Activity Ratearrow_forwardNichols Inc. manufactures remote controls. Currently the company uses a plant- wide rate for allocating manufacturing overhead. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers: Activities Material handling Assembly Inspection Cost driver Number of parts Labour hours Time at inspection station The current traditional cost method allocates overhead based on direct manufacturing abour hours using a rate of £200 per labour hour. a. b. Allocation Rate £2 per part £20 per hour £3 per minute What are the indirect manufacturing costs per remote control assuming an activity- based-costing method is used and a batch of 50 remote controls are produced? The batch requires 100 parts, 6 direct manufacturing labour hours, and 2.5 minutes of inspection time. £4.00 per remote control £6.55 per remote control £24.00 per remote control £327.50 per remote control C. d.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education