FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

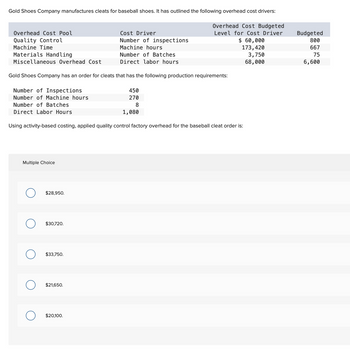

Transcribed Image Text:Gold Shoes Company manufactures cleats for baseball shoes. It has outlined the following overhead cost drivers:

Overhead Cost Pool

Quality Control

Machine Time

Materials Handling

Miscellaneous Overhead Cost

Number of Inspections

Number of Machine hours

Number of Batches

Direct Labor Hours

Gold Shoes Company has an order for cleats that has the following production requirements:

Multiple Choice

$28,950.

Using activity-based costing, applied quality control factory overhead for the baseball cleat order is:

$30,720.

$33,750.

Cost Driver

Number of inspections

Machine hours

Number of Batches

Direct labor hours

$21,650.

$20,100.

Overhead Cost Budgeted

Level for Cost Driver

$ 60,000

173,420

450

270

8

1,080

3,750

68,000

Budgeted

800

667

75

6,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maxey & Sons manufactures two types of storage cabinets-lype A and Type B-and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Descriptions Anticipated volume (units) Direct-material cost per unit Direct-labor cost per unit Descriptions The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow. Setups Machine hours Outgoing shipments Type A 140 48,000 200 Required 1 Type A 24,000 $28 33 Required 2 Required 3 The firm's total overhead of $13,860,000 is subdivided as follows: manufacturing setups, $3,024,000; machine processing. $8,316,000; and product shipping, $2,520,000. Required: 1. Compute the unit manufacturing cost of Type A and Type B…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 10. Using the ABC system, how much total manufacturing overhead cost would be assigned to Product Z? (Round your…arrow_forwardHaresharrow_forward

- Riverbed Delights manufactures a wide variety of holiday and seasonal decorative items. Riverbed's activity-based costing overhead rates are: Purchasing Storing Machining Supervision Total cost $394 per order S $2 per square foot/days $100 per machine hour The Snow Man project involved 3 purchase orders, 5,400 square feet/days, 74 machine hours, and 54 direct labor hours. The cost of direct materials on the job was $20,400 and the direct labor rate is $32 per hour. Determine the total cost of the Snow Man project. $5 per direct labor hourarrow_forwardGreenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Windows DESKTOP- Windows Number of setups Number of products Direct labor-hours Total overhead cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y FEB +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y an Product Z? (F your intermediate calculations to 2 decimal places. Round your answers to 2…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 231,000 11,000 MHs Machine setups Number of setups $ 180,000 300 setups Production design Number of products $ 94,000 2 products General factory Direct labor-hours $ 260,000 10,000 DLHs Activity Measure Product Y Product Z Machining 9,000 2,000 Number of setups 60 240 Number of products 1 1 Direct labor-hours 9,000 1,000 4. What is the activity rate for the Machine Setups activity cost pool?arrow_forward

- O&G Company manufactures console tables and uses an activity-based costing system to allocate all manufacturing conversion costs. Each console table consists of 40 separate parts totaling $250 in direct materials and requires 5.0 hours of machine time to produce. Additional information follows: Activity Materials handling Allocation Base Number of parts Machine hours Number of parts Number of finished units Machining Assembling Packaging What is the number of finished console tables? OA 200 OB. 467 OC. 25 OD. Cannot be determined from the information given Cost Allocation Rate $3.00 per part $4.80 per machine hour $1.00 per part $4.00 per finished unitarrow_forwardGreenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining DESKTOP- Windows Number of setups Number of products Direct labor-hours General factory cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 40 240 1 1 8,800 3,200 % 15. Using the ABC system, what percentage of the General Factory cost is assigned to Product Y and Product Z? (Round your intermediate calculations and final answers to 2 decimal places.) Product Z (@ 2 0…arrow_forwardDeoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity Setting up equipment Number of setups Ordering costs Number of orders Machine costs Receiving Direct materials Direct labor Deoro produces two models of dishwashers with the following expected prime costs and activity demands: Model A Units completed Direct labor hours Number of setups Number of orders $627,000 481,000 16,200 6,400 370 5,800 24,900 3,700 The company's normal activity is 7,900 direct labor hours. Machine hours Receiving hours Required: Model A Model B $482,510 372,000 864,000 410,000 Receiving hours Model A Machine hours $ del B Model B Unit Cost $836,000 497,000 8,500 1,500 240 1. Determine the unit cost for each model using direct labor hours to apply overhead. Round intermediate calculations and final answers to nearest cent. 12,800 18,300 6,300 610 18,600 43,200 10,000 2. Determine the unit cost for…arrow_forward

- Greenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 3. What is the activity rate for the Machining activity cost pool? (Round your answer to 2 decimal places.)arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y and…arrow_forwardXie Company identified the following activities, costs, and activity drivers for this year. The company manufactures two types of go- karts: Deluxe and Basic. Activity Handling materials Inspecting product Processing purchase orders Paying suppliers Insuring the factory. Designing packaging Activity Required: Compute the activity rate for each activity, assuming the company uses activity-based costing. (Round activity rate answers to 2 decimal places.) Handling material Inspecting product Processing orders Paying suppliers Insuring factory Designing packaging Expected Costs $700,000 975,000 180,000 250,000 375,000 150,000 Expected Costs $ $ Expected Activity 100,000 parts 1,500 batches 700 orders 500 invoices 40,000 square feet 2 models. 700,000 975,000 180,000 250,000 375,000 150,000 2,630,000 Activity Driver 100,000 parts 1,500 batches 700 orders 500 invoices 40,000 square feet 2 models Activity Ratearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education