FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

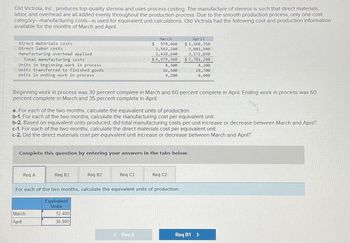

Transcribed Image Text:Old Victrola, Inc., produces top-quality stereos and uses process costing. The manufacture of stereos is such that direct materials,

labor, and overhead are all added evenly throughout the production process. Due to the smooth production process, only one cost

category-manufacturing costs-is used for equivalent unit calculations. Old Victrola had the following cost and production information

available for the months of March and April.

Direct materials costs

Direct labor costs

Manufacturing overhead applied

Total manufacturing costs

Units in beginning work in process

Units transferred to finished goods

Units in ending work in process

Req A

Beginning work in process was 30 percent complete in March and 60 percent complete in April. Ending work in process was 60

percent complete in March and 35 percent complete in April.

Req B1

March

April

a. For each of the two months, calculate the equivalent units of production.

b-1. For each of the two months, calculate the manufacturing cost per equivalent unit.

b-2. Based on equivalent units produced, did total manufacturing costs per unit increase or decrease between March and April?

c-1. For each of the two months, calculate the direct materials.cost per equivalent unit.

c-2. Did the direct materials cost per equivalent unit increase or decrease between March and April?

Complete this question by entering your answers in the tabs below.

March

978,460

2,562,260

3,438,640

$6,979,360

Req B2

12,400

30,900

$

Req C1

8,300

16,500

4,200

< Req A

For each of the two months, calculate the equivalent units of production.

Equivalent

Units

April

$ 1,168,310

3,041,940

3,571,030

$7,781,280

Req C2

4,200

28,700

6,400

Req B1 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Weighted Average Method, Single-Department AnalysisRefer to the information for Millie Company above.Required:Prepare a production report for the assembly department for June using the weighted averagemethod of costing. The report should disclose the physical flow of units, equivalent units, andunit costs and should track the disposition of manufacturing costs.arrow_forwardPure Spring Company produces premium bottled water. In the second department, the Bottling Department, conversion costs are incurred evenly throughout the bottling process, but packaging materials are not added until the end of the process. Costs in beginning Work-in-Process Inventory include transferred in costs of $1,700, direct labor of $600, and manufacturing overhead of $900. March data for the Bottling Department follow: View the data. Read the requirements. Requirement 1. Prepare a production cost report for the Bottling Department for the month of March. The company uses the weighted-average method. (Complete all input fields. Enter a "0" for any zero balances. Round all cost per unit amounts to the nearest cent and all other amounts to the nearest whole dollar. Abbreviation used: EUP = equivalent units of production.) UNITS Units to account for: Total units to account for Units accounted for: Total units accounted for Pure Spring Company Production Cost Report - Bottling…arrow_forwardMcGregor's Hot Sauce uses a process costing system to determine its product's cost. The last of the three processes is packaging. The Packaging Department reported the following information for the month of July: (Click the icon to view the reported information for July.) The units in ending work in process inventory were 90% complete with respect to direct materials but only 60% complete with respect to conversion. Requirement Summarize the flow of physical units and compute output in terms of equivalent units in order to arrive at the missing figures (a) through (1). McGregor's Hot Sauce Packaging Department Month Ended July 31 Flow of Production Units to account for: Beginning work in process, July 1 Plus: Transferred in during July Total physical units to account for Units accounted for: Completed and transferred out during July Plus: Ending work in process, July 31 Total physical units accounted for Total Equivalent Units Step 1: Flow of Physical Step 2: Equivalent Units Units…arrow_forward

- Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Windows DESKTOP- Windows Number of setups Number of products Direct labor-hours Total overhead cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y FEB +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y an Product Z? (F your intermediate calculations to 2 decimal places. Round your answers to 2…arrow_forwardKropf Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours. Inputs Direct materials. Direct labor Variable manufacturing overhead Actual output Raw materials purchased Actual cost of raw materials purchased Raw materials used in production Actual direct labor-hours Actual direct labor cost Actual variable overhead cost Standard Quantity or Hours per Unit of Output The company has reported the following actual results for the product for September: Required: a. Compute the materials price variance for September. b. Compute the materials quantity variance for September.. c. Compute the labor rate variance for September. a. Materials price variance b. Materials quantity variance c. Labor rate variance 7.60 liters 0.60 hours 0.60 hours d. Labor efficiency variance e. variable overhead spending variance 1. Variable overhead efficiency variance 9,800 units…arrow_forwardDaosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forward

- Mercier Manufacturing produces a plastic part in three sequential departments: Extruding, Fabricating, and Packaging. Mercier uses the weighted-average process costing method to account for costs of production in all three departments. The following information was obtained for the Fabricating Department for the month of September. Work in process on September 1 had 15,000 units made up of the following: Degree of Amount Completion Prior department costs transferred in from the Extruding Department Costs added by the Fabricating Department Direct materials Direct labor Manufacturing overhead Work in process, September 1 Direct materials Direct labor Manufacturing overhead Total costs added During September, 75,000 units were transferred in from the Extruding Department at a cost of $356,250. The Fabricating Department added the following costs: $ 214, 200 64,800 33,480 $ 312,480 Manufacturing overhead Direct materials. 100% Direct labor 60 50 $ 75,750 $36,000 9,300 8,520 $ 53,820 $…arrow_forwardCranbrook Textiles Company makes silk banners and uses the weighted-average method of process costing. Direct materials are added at the beginning of the process, and conversion costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process. Spoiled units are disposed of at zero net disposal value. (Click the icon to view the process costing data.) Determine the equivalent units of work done in July, and calculate the cost of units completed and transferred out (including normal spoilage), the cost of abnormal spoilage, and the cost of units in ending inventory. - X Data table Physical Units Direct Conversion Enter the physical units in first, then calculate the equivalent units. (Banners) Materials Costs 1,300 $195,000 $8,000 Work in process, (July 1)" Started in July 2020 Good units completed and transferred out in July Normal spoilage Abnormal spoilage Physical 37,500 20,500 9,000 Flow of Production Units Work in process beginning…arrow_forwardAlpesharrow_forward

- Please help I am having issues solving this problem, Kansas Supplies is a manufacturer of plastic parts that uses the weighted-average process costing method to account for costs of production. It produces parts in three separate departments: Molding, Assembling, and Packaging. The following information was obtained for the Assembling Department for the month of April. Work in process on April 1 had 108,000 units made up of the following. Amount Degree of Completion Prior department costs transferred in from the Molding Department $ 147,960 100 % Costs added by the Assembling Department Direct materials $ 97,200 100 % Direct labor 35,696 60 % Manufacturing overhead 22,244 50 % $ 155,140 Work in process, April 1 $ 303,100 During April, 508,000 units were transferred in from the Molding Department at…arrow_forwardCullumber Inc. manufactures a single product in a continuous processing environment. All materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. To assign costs to inventories, the company uses weighted-average process costing. The following information was available for 2022: Sales (selling price per unit, $43) Actual manufacturing overhead Selling and administrative expenses Unit production costs: Direct materials (1 kilogram) Direct labour (1/2 hour) Manufacturing overhead Total $5,000,900 752,400 373,920 $6.00 8.00 9.00 $23.00 Units completed and transferred to finished goods Materials purchased Materials used in process (a) Raw materials Work in process inventory (45% complete) Finished goods An inventory count at year end (December 31, 2022) revealed that the inventories had the following balances: Calculate the following amounts for Cullumber Inc.: 159,600 units The January 1, 2022, work in process inventory units…arrow_forwardEasy Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's firs processing department for a recent month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Materials cost Conversion cost Work in process, ending: Units in process Percent complete with respect to materials Percent complete with respect to conversion Required: Using the FIFO method: Complete this question by entering your answers in the tabs below. Req A and B Req C and D $ $ a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education