FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

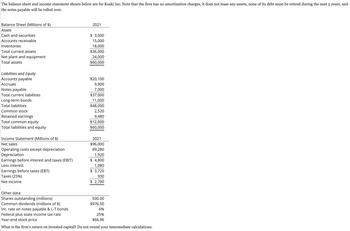

Transcribed Image Text:The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and

the notes payable will be rolled over.

Balance Sheet (Millions of $)

Assets

Cash and securities

Accounts receivable

Inventories

Total current assets

Net plant and equipment

Total assets

Liabilities and Equity

Acco nts payable

Accruals

Notes payable

Total current liabilities

Long-term bonds

Total liabilities

Common stock

Retained earnings

Total common equity

Total liabilities and equity

Income Statement (Millions of $)

Net sales

Operating costs except depreciation

Depreciation

Earnings before interest and taxes (EBIT)

Less interest

Earnings before taxes (EBT)

Taxes (25%)

Net income

2021

$ 3,000

15,000

18,000

$36,000

24,000

$60,000

$20,100

9,900

7,000

$37,000

11,000

$48,000

2,520

9,480

$12,000

$60,000

2021

$96,000

89,280

1,920

$ 4,800

1,080

$ 3,720

930

$ 2,790

Other data:

Shares outstanding (millions)

Common dividends (millions of $)

Int. rate on notes payable & L-T bonds

Federal plus state income tax rate

Year-end stock price

What is the firm's return on invested capital? Do not round your intermediate calculations.

500.00

$976.50

6%

25%

$66.96

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The trial balance of Rollins Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Loss on sale of investments Loss on debt investments Gain on projected benefit obligation Cost of goods sold Selling expense Restructuring costs Interest expense General and administrative expense Debits $ 20,000 100,000 3,500,000 300,000 130,000 10,000 200,000 Credits $ 4,900,000 35,000 210,000 The loss on debt investments represents a decrease in the fair value of debt securities and is classified as part of other comprehensive ncome. Rollins had 100,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a 2024 multiple-step income statement for Rollins Incorporated with earnings per share disclosure. Note: Round Earnings per share answer to 2 decimal places.arrow_forwardClayton Industries has the following account balances: Current assets Noncurrent assets The company wishes to raise $45,000 in cash and is considering two financing options: Clayton can sell $45,000 of bonds payable, or it can issue additional common stock for $45,000. To help in the decision process, Clayton's management wants to determine the effects of each alternative on its current ratio and debt-to-assets ratio. Required a-1. Compute the current ratio for Clayton's management. Note: Round your answers to 2 decimal places. Currently If bonds are issued If stock is issued $ 22,000 Current liabilities 77,880 Noncurrent liabilities stockholders' equity Currently If bonds are issued If stock is issued Current Ratio 2.44 to 1 a-2. Compute the debt-to-assets ratio for Clayton's management. Note: Round your answers to 1 decimal place. Bonds Stock to 1 to 1 Debt to Assets Ratio Additional Retained Earnings $ 9,000 50,000 48,888 % % % b. Assume that after the funds are invested, EBIT…arrow_forwardThe current assets and current liabilities sections of the balance sheet of Sunland Co. appear as follows. Sunland Co.Balance Sheet (Partial)As of December 31, 2017 Cash $ 17,900 Accounts payable $ 29,500 Accounts receivable $ 39,600 Notes payable 15,400 Less: Allowance for doubtful accounts 3,200 36,400 Unearned revenue 3,800 Inventory 61,100 Total current liabilities $ 48,700 Prepaid expenses 7,400 Total current assets $ 122,800 The following errors in the corporation’s accounting have been discovered: 1. Keane collected $ 5,200 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company’s controller recorded the amount as revenue. 2. The inventory amount reported included $ 2,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $ 1,600 had been received on…arrow_forward

- i need the answer quicklyarrow_forwardDo not give answer in imagearrow_forwardCurrent Attempt in Progress Presented below are a number of balance sheet items for Culver, Inc. for the current year, 2017. Goodwill $ 211,800 Accumulated depreciation-equipment $ 467,100 Payroll taxes payable 67,100 Inventory 400,400 Bonds payable 501,800 Rent payable (short-term) 41,800 Discount on bonds payable 35,100 Income tax payable 112,600 Cash 62,800 Rent payable (long-term) 81,800 Land 352,800 Common stock, $1 par value 251,800 Notes receivable 162,300 Preferred stock, $25 par value 1,251,800 Notes payable (to banks) 266,700 Prepaid expenses 70,560 Accounts payable 348,800 Equipment 1,387,800 Retained earnings ? Equity investments (trading) 376,800 Income taxes receivable 47,400 Accumulated depreciation-buildings 361,300 Unsecured notes payable (long-term) 1,301,800 Buildings 2,801,800 Prepare a classified…arrow_forward

- Sherwood, Inc., had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $4,165 $4,528 Short-term investments, at cost 2,958 8,408 Accounts and notes receivable, net 9,404 8,624 Inventories 1,771 787 Prepaid expenses and other current assets 590 291 Short-term obligations (liabilities) 315 3,342 Accounts payable and other current liabilities 7,453 6,813 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4arrow_forwardMoore Company is preparing its statement of cash flows for the current year. During the year, the company retired two issuances of debt and properly recorded the transactions. These transactions were as follows: Paid cash of $12,700 to retire bonds payable with a face value of $15,000 and a book value of $13,300. Paid cash of $48,000 to retire bonds payable with a face value of $45,000 and a book value of $47,000. Required: Record, in journal entry form, the entries that Moore would make for the preceding transactions on its spreadsheet to prepare its statement of cash flows. If an amount box does not require an entry, leave it blank.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education