Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

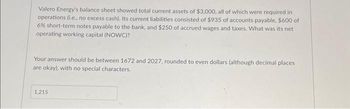

Transcribed Image Text:Valero Energy's balance sheet showed total current assets of $3,000, all of which were required in

operations (i.e., no excess cash). Its current liabilities consisted of $935 of accounts payable, $600 of

6% short-term notes payable to the bank, and $250 of accrued wages and taxes. What was its net

operating working capital (NOWC)?

Your answer should be between 1672 and 2027, rounded to even dollars (although decimal places

are okay), with no special characters.

1.215

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your Company borrowed $50,000 on October 1, 2022. The loan was for 12-months and the interest rate was 6%. Both interest and principal are payable at maturity. How is repaying the $50,000 in 2023 best classified? Asset exchange O Asset source O Claims exchange O Asset usearrow_forwardTo calculate the change in Net Working Capital (NWC) during FY24, we first need to find the NWC for both FY23 and FY24 using the formula: NWC=Current Assets−Current Liabilities Step 1: Calculate NWC for FY23 Current Assets (FY23): Cash: 211,000,000 Accounts Receivable: 508,000,000 Inventory: 41,000,000 Total Current Assets (FY23): 760,000,000 Current Liabilities (FY23): Accounts Payable: 622,000,000 Notes Payable: 377,000,000 Total Current Liabilities (FY23): 999,000,000 NWC (FY23)=760,000,000−999,000,000=−239,000,000 Step 2: Calculate NWC for FY24 Current Assets (FY24): Cash: 329,800,000 Accounts Receivable: 626,800,000 Inventory: 100,400,000 Total Current Assets (FY24): 1,057,000,000 Current Liabilities (FY24): Accounts Payable: 531,000,000 Notes Payable: 442,000,000 Total Current Liabilities (FY24): 973,000,000NWC (FY24)=1,057,000,000−973,000,000=84,000,000 Step 3: Calculate the Change in NWC during FY24 Change in NWC=NWC (FY24)−NWC…arrow_forwardSwifty Corp. has decided to expand its operations. The bookkeeper recently completed the following statement of financial position in order to obtain additional funds for expansion: SWIFTY CORP.Statement of Financial PositionFor the Year Ended December 31, 2020 Current assets Cash (net of bank overdraft of $35,000) $ 290,000 Accounts receivable (net) 510,000 Inventory at the lower of cost and net realizable value 551,000 FV-NI investments (at cost—fair value $180,000) 150,000 Property, plant, and equipment Buildings (net) 720,000 Equipment (net) 180,000 Land held for future use 335,000 Intangible assets Goodwill 90,000 Investment in bonds to collect cash flows, at amortized cost 97,000 Prepaid expenses 22,000 Current liabilities Accounts payable 225,000 Notes payable (due next year) 295,000…arrow_forward

- Valero’s energy’s balance sheet showed total current assets of $3000 all of which were required in operations. It’s current liabilities consists of $905 of accounts payable $600 of 6% short term notes payable to the bank and $250 of acute wages and taxes. What was its net operating working capital?arrow_forwardSuppose McDonald's 2025 financial statements contain the following selected data (in millions). Current assets $3,461.5 Interest expense $480.0 Total assets 30,250.0 Income taxes 1,942.0 Current liabilities 3,010.0 Net income 4,538.0 Total liabilities 16,637.5 (a1) Compute the following values. a. Working capital. (Round to 1 decimal place in millions, e.g. 5,275.5.) $ 451.5 millions b. Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) 1.15 :1 C. Debt to assets ratio. (Round to O decimal places, e.g. 62%.) 55 % d. Times interest earned. (Round to 2 decimal places, e.g. 6.25.) 14.50 timesarrow_forwardHow much is the maximum amount of loan that ABC Co. can get from the bank? (Round up answer to the nearest thousand pesos.)arrow_forward

- Prezas Company's balance sheet showed total current assets of $3,250, all of which were required in operations. Its current liabilities consisted of 5975 of accounts payable. What was its working capital? options: $1,701 $2,309 $2,275 $1,620arrow_forwardsarrow_forwardi need the answer quicklyarrow_forward

- During 2022, Churchill Inc. constructed assets costing £4,200,000. The weighted- average accumulated expenditures on these assets the year was £2,600,000. Churchill took out a 7% construction loan of £4,000,000 on January 1, 2022, and funds not needed for construction were temporarily invested in short-term securities, yielding £30,000 in interest revenue. Other than the construction loan, the only other debt outstanding during the year was a £2,000,000, 5-year, 9% note payable dated January 1, 2018. What is the amount of interest that should be capitalized by Churchill during 2022? £152,000. £182,000. £280,000. £330,000. a. b. C. d.arrow_forwardIntella's current assets total to $20 million versus $10 million of current liabilities, while AWD's current assets are $10 million versus $20 million of current liabilities. Both firms would like to "window dress" their end-of-year financial statements, and to do so they tentatively plan to borrow $10 million on a short-term basis and to then hold the borrowed funds in their cash accounts. Which of the statements below best describes the results of these transactions? OA. The transactions would improve Intella's financial strength as measured by its current ratio but lower AWD's current ratio. O B. The transactions would lower Intella's financial strength as measured by its current ratio but raise AWD's current ratio. O C. The transactions would have no effect on the firm' financial strength as measured by their current ratios. O D. The transactions would lower both firm' financial strength as measured by their current ratios. O E. The transactions would improve both firms' financial…arrow_forwardMuffins masonry incs balance sheet list next fixed assets as $ 14 million. The fixed assets could currently be sold for 19 million dollars. muffins current balance sheet shows current liabilities of 5.5 million dollars and networking capital of 4.5 million dollars. if all the current accounts were liquidated today the company would receive 7.25 million dollars cash after paying the 5.5 million incurrent liabilities. what is the book value of muffins missionaries assets today and market value of these assets? Enter answers in millions of dollars rounded to 2 decimal places Book value. Market value. Current assets: Fixed assets: Total:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education