FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

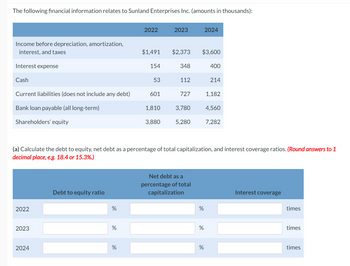

Transcribed Image Text:The following financial information relates to Sunland Enterprises Inc. (amounts in thousands):

2022

2023

2024

Income before depreciation, amortization,

interest, and taxes

$1,491

$2,373

$3,600

Interest expense

154

348

400

Cash

53

112

214

Current liabilities (does not include any debt)

601

727

1,182

Bank loan payable (all long-term)

1,810

3,780

4,560

Shareholders' equity

3,880

5,280

7,282

(a) Calculate the debt to equity, net debt as a percentage of total capitalization, and interest coverage ratios. (Round answers to 1

decimal place, e.g. 18.4 or 15.3%.)

Debt to equity ratio

2022

%

2023

%

Net debt as a

percentage of total

capitalization

Interest coverage

%

times

%

times

2024

%

%

times

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 44. Subject :- Accountingarrow_forwardThe financial statements of Carrier Office Furniture Company include the following items: 2025 $44,000 14,000 98,000 149,000 553,000 290,000 60,000 Cash Short-term Investments Net Accounts Receivable Merchandise Inventory Total Assets Total Current Liabilities Long-term Note Payable What is working capital for 2026? O A. $37,500 OB. $98,500 O C. $191,000 O D. $66,500 2026 $48,500 29,000 95,000 165,000 526,000 271,000 64,000arrow_forwardFlint Corp. Statement of Financial Position For the Year Ended December 31, 2023 Current assets Cash (net of bank overdraft of $40,000 ) $450,000 Accounts receivable (net) Inventory at the lower of cost and net realizable value FV-NI investments (at cost-fair value $320,000 ) Property, plant, and equipment Buildings (net) 590,000 Equipment (net) 190,000 Land held for future use ,265,000 Intangible assets Goodwill Investment in bonds to collect cash flows, at amortized cost 100,000 Prepaid expenses Current liabilities Accounts payable 365,000 Notes payable (due next year) Pension obligation Rent payable 505,000 511,000 340,000 265,000 Long-term liabilities Bonds payable 681,000 Shareholders' equity Common shares, unlimited authorized, 380,000 issued 380,000 Contributed surplus 210,000 Retained earningsarrow_forward

- What is net income ? 251+113 = 364 ??? İs true or notarrow_forwardHansabenarrow_forwardDex Corporation, part of banking industry but performing quasi - banking function had the following transactions for the 4th quarter of 2020: Loans, 10%, 6 years, 10/1 2020. P 100,000 Rental income, net of 5% EWT from its Property P19,000 Trading gain (loss): 3rd Quarter: (10,000) October. 20,000 November. (5,000) December. 25,000 Jan. 2021. 30,000 1. How much is the OPT of Dex Corporation for the 4th Qtr. of 2020? A. 3,525 B. 4,225 C. 3,600 D. 3,455arrow_forward

- Vijayarrow_forwardBnB Construction Inc.Balance Sheet (Millions of Dollars) Assets 2021 Est 2020 2019 Liabilities 2021 Est 2020 2019 Cash and Cash Equivalents 15 10 15 Accounts payable 115 60 30 Short-Term Investments 10 0 65 Overdrafts 115 110 60 Accounts Receivable 420 375 315 Accruals 260 140 130 Inventories 700 615 415 Total Current Liabilities 490 310 220 Total Current Assets 1145 1000 810 Long -Term Bonds and New Loan 1300 754 580 Net Plant and Equipment 1884 1190 870 Total Debt 1790 1064 800 Preferred Stock 40 40 40 Common Stock 130 130 130 Retained Earnings 1069 956 710 Total Common Equity 1199 1086 840 Total Assets 3029 2190 1680 Total Liabilities and Equity 3,029 2,190 1,680 Included is the Income Statement. Requirements: 1. Calculate the EPS, DPS, and BVPS, and Cash…arrow_forward25. Coronado Inc., a greeting card company, had the following statements prepared as of December 31, 2020. CORONADO INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $5,900 $7,000 Accounts receivable 61,400 51,500 Short-term debt investments (available-for-sale) 35,000 18,200 Inventory 40,000 60,500 Prepaid rent 5,000 4,100 Equipment 152,900 131,100 Accumulated depreciation—equipment (35,200 ) (25,100 ) Copyrights 45,800 50,000 Total assets $310,800 $297,300 Accounts payable $46,100 $40,100 Income taxes payable 3,900 5,900 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,100 10,000 Long-term loans payable 60,400 69,300 Common stock, $10 par 100,000 100,000…arrow_forward

- Smirnoff Corporation's net cash flows from operating activities on its cash flows statement for 2024 are? Thank you!arrow_forwardAssume the company generated $3,400 in net operating profits after taxes. Using the information below, calculate the free cash flow for 2020. Balance Sheet as of December 31 (Millions of Dollars) 2020 2019 2020 2019 Assets Liabilities and Equity $900 Accounts payable Cash $1,026 $1,634 $1,436 Short-term Investments 90 100 Accruals 550 500 Accounts Receivable 1,968 1,726 Notes 645 575 payable Inventories 4,971 4,367 Total Current 2,829 2,511 Liabilities Total Current 8,055 7,093 Assets Long-term 2,173 2,815 debt Net plant and equipment १.943 8,733 Total Liabilities 5,002 5,326 Common Total Assets $17,998 $15.826 2.400 2,500 stock Retained earnings 10,595 8,000 Total common 12.995 10,500 equity Total liabilitics and $17.998 $15,826 cquity O $1.423 $1.739 O $1.467 O $1,534arrow_forwardAm. 359.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education