FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

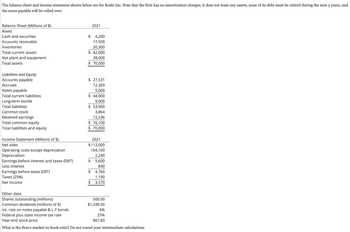

Transcribed Image Text:The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and

the notes payable will be rolled over.

Balance Sheet (Millions of $)

Assets

Cash and securities

Accounts receivable

Inventories

Total current assets

Net plant and equipment

Total assets

Liabilities and Equity

Accounts payable

Accruals

Notes payable

Total current liabilities

Long-term bonds

Total liabilities

Common stock

Retained earnings

Total common equity

Total liabilities and equity

Income Statement (Millions of $)

Net sales

Operating costs except depreciation

Depreciation

Earnings before interest and taxes (EBIT)

Less interest

Earnings before taxes (EBT)

Taxes (25%)

Net income

Other data:

Shares outstanding (millions)

Common dividends (millions of $)

2021

$4,200

17,500

20,300

$ 42,000

28,000

$ 70,000

$ 27,531

12,369

5,000

$ 44,900

9,000

$ 53,900

3,864

12,236

$ 16,100

$ 70,000

2021

$112,000

104,160

2,240

5,600

840

$

$ 4,760

1,190

$ 3,570

500.00

$1,249.50

Int. rate on notes payable & L-T bonds

6%

Federal plus state income tax rate

25%

Year-end stock price

$67.83

What is the firm's market-to-book ratio? Do not round your intermediate calculations.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Suppose the following items were taken from the 2022 financial statements of Texas Instruments, Inc. (All dollars are in millions.) Common stock Prepaid rent Equipment Stock investments (long-term) Debt Investments (short-term) Income taxes payable Cash $2.826 164 6,705 637 1,743 128 1,182 Accumulated depreciation-equipment Accounts payable Patents Notes payable (long-term) Retained earnings Accounts receivable V Inventory TEXAS INSTRUMENTS, INC. Balance Sheet (in millions) Assets $3.547 1,459 2,210 Prepare a classified balance sheet in good form as of December 31, 2022. (List Current Assets in order of liquidity) $ 810 6,896 1,823 1,202 Liabilities and Stockholders' Equity $ $ $ $arrow_forwardThe trial balance of Rollins Incorporated included the following accounts as of December 31, 2024: Sales revenue Interest revenue Loss on sale of investments Loss on debt investments Gain on projected benefit obligation Cost of goods sold Selling expense Restructuring costs Interest expense General and administrative expense Debits $ 20,000 100,000 3,500,000 300,000 130,000 10,000 200,000 Credits $ 4,900,000 35,000 210,000 The loss on debt investments represents a decrease in the fair value of debt securities and is classified as part of other comprehensive ncome. Rollins had 100,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required: Prepare a 2024 multiple-step income statement for Rollins Incorporated with earnings per share disclosure. Note: Round Earnings per share answer to 2 decimal places.arrow_forwardClayton Industries has the following account balances: Current assets Noncurrent assets The company wishes to raise $45,000 in cash and is considering two financing options: Clayton can sell $45,000 of bonds payable, or it can issue additional common stock for $45,000. To help in the decision process, Clayton's management wants to determine the effects of each alternative on its current ratio and debt-to-assets ratio. Required a-1. Compute the current ratio for Clayton's management. Note: Round your answers to 2 decimal places. Currently If bonds are issued If stock is issued $ 22,000 Current liabilities 77,880 Noncurrent liabilities stockholders' equity Currently If bonds are issued If stock is issued Current Ratio 2.44 to 1 a-2. Compute the debt-to-assets ratio for Clayton's management. Note: Round your answers to 1 decimal place. Bonds Stock to 1 to 1 Debt to Assets Ratio Additional Retained Earnings $ 9,000 50,000 48,888 % % % b. Assume that after the funds are invested, EBIT…arrow_forward

- PLEASE HELP MEarrow_forwardThe assets of the River & Stone Corp. company include current assets, property, plant and equipment and does not have excess cash (Free Cash). It has assets valued at $ 4 million and its fixed assets are valued at $ 3 million. It reports debts payable of $ 350,000, long-term debts of $ 650,000 and equity of $ 2 million. Your balance sheet reflects that you have accounts payable and accumulated debts. Generally, the company operates on a debt and equity basis. 1. Determine the total amount of the company's debt. 2. Calculate the balance of current assets and liabilities. 3. Determine the net working capital of the company. 4. Calculate the net operating working capital. 5. Explain how net working capital and operating working capital can support managerial decisions and strategic goals.arrow_forwardCurrent Attempt in Progress Suppose the following items were taken from the 2027 financial statements of Texas Instruments, Inc. (All dollars are in millions.) Common stock $3,006 Accumulated depreciation-equipment $3,607 Prepaid rent 224 Accounts payable 1,519 Equipment 6,765 Patents 2,270 Stock investments (long-term) 697 Notes payable (long-term) 870 Debt investments (short-term) 1,803 Retained earnings 6,956 Income taxes payable 188 Accounts receivable 1,883 Cash 1,242 Inventory 1,262 Prepare a classified balance sheet in good form as of December 31, 2027. (List Current Assets in order of liquidity.) TEXAS INSTRUMENTS, INC. Balance Sheet (in millions) Assetsarrow_forward

- i need the answer quicklyarrow_forwardDo not give answer in imagearrow_forwardSherwood, Inc., had the following current assets and current liabilities at the end of two recent years: Year 2(in millions) Year 1(in millions) Cash and cash equivalents $4,165 $4,528 Short-term investments, at cost 2,958 8,408 Accounts and notes receivable, net 9,404 8,624 Inventories 1,771 787 Prepaid expenses and other current assets 590 291 Short-term obligations (liabilities) 315 3,342 Accounts payable and other current liabilities 7,453 6,813 a. Determine the (1) current ratio and (2) quick ratio for both years. Round to one decimal place. Year 2 Year 1 Current ratio fill in the blank 1 fill in the blank 2 Quick ratio fill in the blank 3 fill in the blank 4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education