Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve this problem

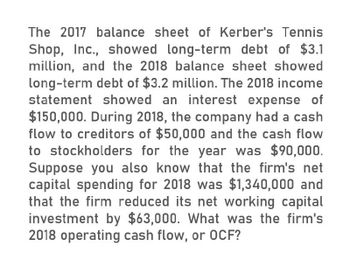

Transcribed Image Text:The 2017 balance sheet of Kerber's Tennis

Shop, Inc., showed long-term debt of $3.1

million, and the 2018 balance sheet showed

long-term debt of $3.2 million. The 2018 income

statement showed an interest expense of

$150,000. During 2018, the company had a cash

flow to creditors of $50,000 and the cash flow

to stockholders for the year was $90,000.

Suppose you also know that the firm's net

capital spending for 2018 was $1,340,000 and

that the firm reduced its net working capital

investment by $63,000. What was the firm's

2018 operating cash flow, or OCF?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The 2017 balance sheet of Kerber's Tennis Shop, Inc., showed long-term debt of $5.7 million, and the 2018 balance sheet showed long-term debt of $5.9 million. The 2018 income statement showed an interest expense of $190,000. During 2018, the company had a cash flow to creditors of –$10,000 and the cash flow to stockholders for the year was $70,000. Suppose you also know that the firm’s net capital spending for 2018 was $1,420,000, and that the firm reduced its net working capital investment by $79,000. What was the firm’s 2018 operating cash flow, or OCFarrow_forwardThe 2017 balance sheet of Kerber's Tennis Shop, Inc., showed long-term debt of $3.1 million, and the 2018 balance sheet showed long-term debt of $3.2 million. The 2018 income statement showed an interest expense of $150,000. During 2018, the company had a cash flow to creditors of $50,000 and the cash flow to stockholders for the year was $90,000. Suppose you also know that the firm's net capital spending for 2018 was $1,340,000, and that the firm reduced its net working capital investment by $63,000. What was the firm's 2018 operating cash flow, or OCF? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) Operating cash flowarrow_forwardThe 2017 balance sheet of Kerber's Tennis Shop, Incorporated, showed $3.05 million in long-term debt, $790,000 in the common stock account, and $6.05 million in the additional paid-in surplus account. The 2018 balance sheet showed $3.8 million, $905,000, and $8.45 million in the same three accounts, respectively. The 2018 income statement showed an interest expense of $300,000. The company paid out $660,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $790,000, and the firm reduced its net working capital investment by $165,000, what was the firm's 2018 operating cash flow, or OCF? Multiple Choice O O $-2,305,000 $-3,000,000 $2,635,000 $-1,680,000 $-4,250,000arrow_forward

- The 2018 balance sheet of Speith's Golf Shop, Inc., showed long-term debt of $6.2 million, and the 2019 balance sheet showed long-term debt of $6.45 million. The 2019 income statement showed an interest expense of $215,000. The 2018 balance sheet showed $610,000 in the common stock account and $2.5 million in the additional paid-in surplus account. The 2019 balance sheet showed $650,000 and $3 million in the same two accounts, respectively. The company paid out $610,000 in cash dividends during 2019. Suppose you also know that the firm's net capital spending for 2019 was $1,470,000, and that the firm reduced its net working capital investment by $89,000. What was the firm's 2019 operating cash flow, or OCF? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) t Operating cash flow 3 F5 F6 ences Mc Graw :0 F2 20 F3 000 F4 ◄◄ F7 ▶11arrow_forwardThe 2017 balance sheet of Kerber’s Tennis Shop, Incorporated, showed $2.4 million in long-term debt, $720,000 in the common stock account, and $6.05 million in the additional paid-in surplus account. The 2018 balance sheet showed $4.1 million, $895,000, and $8.3 million in the same three accounts, respectively. The 2018 income statement showed an interest expense of $190,000. The company paid out $600,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $860,000, and the firm reduced its net working capital investment by $115,000, what was the firm's 2018 operating cash flow, or OCF?arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1.38 million, and the December 31, 2022, balance sheet showed long-term debt of $1.52 million. The 2022 income statement showed an interest expense of $104,500. What was the firm’s cash flow to creditors during 2022?arrow_forward

- The 2017 balance sheet of Kerber's Tennis Shop , Incorporated, showed $2.4 million long-term debt, $760,000 in the common stock account, and $5.95 million in the additional paid-in surplus account. The 2018 balance sheet showed $3.95 million $985,000, and $8.05 million in the same three accounts , respectively . The 2018 income statement showed an interest expense of $ 310,000 . The company paid out $590,000 in cash dividends during 2018. If the firm's net capital spending for 2018 was $690,000 , and the firm reduced its net working capital Investment by $185,000 , what was the firm's 2018 operating cash flow , or OCF ? Typed solutionarrow_forwardThe 2018 balance sheet of Spieth’s Golf Shop, Inc., showed long-term debt of $1.565 million, and the 2019 balance sheet showed long-term debt of $1.645 million. The 2019 income statement showed an interest expense of $170,000. What was the firm’s cash flow to creditors during 2019? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)arrow_forwardUsing the Value Line Investment Survey report in Exhibit 11.5, find the following information for Apple. What was the amount of revenues (i.e., sales) generated by the company in 2017? What were the latest annual dividends per share and dividend yield? What is the earnings per share (EPS) projection for 2019? How many shares of common stock were outstanding? What were the book value per share and EPS in 2017? How much long-term debt did the company have in the third quarter of 2018?arrow_forward

- The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt of $2.5 million, and the 2021 balance sheet showed long-term debt of $2.65 million. The 2021 income statement showed an interest expense of $100,000. What was the firm's cash flow to creditors during 2021? (A negative answer should be indicated by a minus sign. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) Cash flow to creditorsarrow_forwardThe 2014 balance sheet of Sugarpova's Tennis Shop, Inc., showed long- term debt of $3.3 million, and the 2015 balance sheet showed long-term debt of $3.4 million. The 2015 income statement showed an interest expense of $155,000. During 2015, the company had a cash flow to creditors of $55,000 and the cash flow to stockholders for the year was $60,000. Suppose you also know that the firm s net capital spending for 2015 was $1,350,000 and that the firm reduced its net working capital investment by $65,000. What was the firm's 2015 operating cash flow, or OCF?arrow_forwardThe King Mattress Company had the following operating results for 2018-2019. In addition, the company paid dividends in both 2018 and 2019 of $67,200 per year and made capital expenditures in both years of $30,000 per year. The company's stock price in 2018 was $8 and $7 in 2019. The industry average earnings multiple for the mattress industry was 9 in 2019 and the free cash flow and sales multiples were 18 and 1.5, respectively. The company is publicly owned and has 1,600,000 shares of outstanding stock at the end of 2019. Balance Sheet, Dec 31, 2019 2018 Cash $ 364,000 $ 124,000 Accounts Receivable $ 374,000 $ 424,000 Inventory $ 274,000 $ 324,000 Total Current Assets $ 1,012,000 $ 872,000 Long-lived Assets 1,320,000 1,340,000 Total Assets $ 2,332,000 $ 2,212,000 Current Liabilities $ 224,000 $ 324,000 Long-term Debt 624,000 524,000 Shareholder Equity 1,484,000 1,364,000 Total Debt and Equity $ 2,332,000 $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning