Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

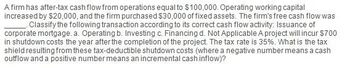

Transcribed Image Text:A firm has after-tax cash flow from operations equal to $100,000. Operating working capital

increased by $20,000, and the firm purchased $30,000 of fixed assets. The firm's free cash flow was

Classify the following transaction according to its correct cash flow activity: Issuance of

corporate mortgage. a. Operating b. Investing c. Financing d. Not Applicable A project will incur $700

in shutdown costs the year after the completion of the project. The tax rate is 35%. What is the tax

shield resulting from these tax-deductible shutdown costs (where a negative number means a cash

outflow and a positive number means an incremental cash inflow)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Fleming Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 25 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Investment Sales revenue Operating costs Depreciation Net working capital spending Net income Cash flow $ Year 1 NPV 3,975 $ $ Year 0 Year O 34,000 $ 400 a. Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.) Year 1 $ 17,500 3,700 8,500 450 Year 2 4,275 $ Year 1 5,300 $18,000 Year 2 Year 3 b. Compute the incremental cash flows of the investment for each year. (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) Year 3 4,575 $ Year 2 3,800 3,900 8,500 8,500 500 400 $18,500 $15,500 3,100 8,500 ? Year 4 Year 4…arrow_forwardThe Fleming Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 23 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Investment Sales revenue Operating costs Depreciation Net working capital spending Net income $ Year 1 Year O 42,000 480 Year 1 Year 2 Year 3 Year 2 22,500, $21,500 $ 22,000$ 4,500 4,600 4,700 10,500 10,500 10,500 530 580 480 a. Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.) Year 3 Year 4 Year 4 $19,500 3,900 10,500 ?arrow_forwardThe Fancy Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 21 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Year 1 Year 2 a. Investment Sales revenue Operating costs Depreciation Net working capital spending 305 Year 0 $ 26,400 C. $ 13,500 2,950 6,600 205 Year 3 $15,100 3,125 4,300 6,600 6,600 235 $16,500 155 Year 4 $13,000 2,900 6,600 ? Compute the incremental net income of the investment for each year. (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Compute the incremental cash flows of the investment for each year. (A negative amount should be b. indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number,…arrow_forward

- Joetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment Annual cash inflows Salvage value of equipment Life of the investment Required rate of return $ 31,000 $ 6,400 $ 0 15 years 10% The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The simple rate of return for the investment (rounded to the nearest tenth of a percent) is: Multiple Choice 21.4% О о 19.2% 10.4% о 14.0%arrow_forwardThe Best Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 34 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Investment Sales revenue Operating costs Depreciation Net working capital spending Net income Year O $27,000 Year 1 $ Cash flow 330 Year 1 $14,000 $14,500 3,000 6,750 380 280 a. Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.) Year 2 Year 2 Year O $-27330 Year 3 3,100 3,200 6,750 6,750 430 330 3069 $15,000 $12,000 2,400 6,750 ? Year 1 $ Year 4 Year 3 b. Compute the incremental cash flows of the investment for each year. (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) 3333 Year 4 $ Year 2 $ c. Suppose the…arrow_forwardThe management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment Cash Inflow 1 $ 61,000 $ 3,000 2 $ 5,000 $ 6,000 3 $ 12,000 4 $ 13,000 5 $ 16,000 6 $ 10,000 7 $ 8,000 8 $ 10,000 9 $ 9,000 10 $ 9,000 Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large? REQUIRED 1 Determine the payback period of the investment. (Round your answer to 1 decimal place.) Payback period ______ yearsarrow_forward

- The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year Investment Cash Inflow 1 $ 58,000 $ 4,000 2 $ 8,000 $ 8,000 3 $ 11,000 4 $ 14,000 5 $ 17,000 6 $ 15,000 7 $ 13,000 8 $ 11,000 9 $ 10,000 10 $ 10,000 Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large?arrow_forwardJoetz Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment $ 36,000 Annual cash inflows $ 8,400 Salvage value of equipment $ 0 Life of the investment 15 years Required rate of return 10 % The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The simple rate of return for the investment (rounded to the nearest tenth of a percent) is: (Round your answer to 1 decimal place.)arrow_forwardThe Fleming Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 25 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Year 0 Year 1 Year 2 Year 3 Year 4 Investment $ 34,000 Sales revenue $ 17,500 $ 18,000 $ 18,500 $ 15,500 Operating costs 3,700 3,800 3,900 3,100 Depreciation 8,500 8,500 8,500 8,500 Net working capital spending 400 450 500 400 ? a. Compute the incremental net income of the investment for each year. (Do not round intermediate calculations.) b. Compute the incremental cash flows of the investment for each year. (Do not round intermediate calculations. A…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT