FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

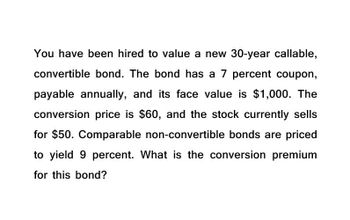

Transcribed Image Text:You have been hired to value a new 30-year callable,

convertible bond. The bond has a 7 percent coupon,

payable annually, and its face value is $1,000. The

conversion price is $60, and the stock currently sells

for $50. Comparable non-convertible bonds are priced

to yield 9 percent. What is the conversion premium

for this bond?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help mearrow_forwardGive true answerarrow_forwardThe market price of a 10-year bond is 957$, its yield to maturity is 8% per year, and annual coupon payments are equal to 957$. The face value of the bond is $1000. Calculate the present value of the bond. Would you buy it? The answer is to be written in the reasons box. Round your answer to the nearest tenth. Optional: Provide calculation details in the reasons box. Answer: Give your reasonsarrow_forward

- Your client is considering the purchase of a bond that is currently selling for $1058.15. The client wants to know what annual rate of return can they expect to earn on the bond. The bond has 27 years to maturity, pays a coupon rate of 7.8% (payments made semi-annually), and a face value of $1000, (Round to 100th of a percent and enter your answer as a percentage, e.g. 12.34 for 12.34%) Answer: Checkarrow_forwardYou purchase a bond with an invoice price of $1,041. The bond has a coupon rate of 5.63 percent, it makes semiannual payments, and there are 5 months to the next coupon payment. The par value is $1,000. What is the clean price of the bond?arrow_forwardConsider a(n) Ten-year, 14.5 percent annual coupon bond with a face value of $1,000. The bond is trading at a rate of 11.5 percent. a. What is the price of the bond?b. If the rate of interest increases 1 percent, what will be the bond’s new price?c. Using your answers to parts (a) and (b), what is the percentage change in the bond’s price as a result of the 1 percent increase in interest rates? (Negative value should be indicated by a minus sign.)d. Repeat parts (b) and (c) assuming a 1 percent decrease in interest rates. (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. Price of the bond b. Bond's new price c. Percentage change % d. Bond's new price Percentage change %arrow_forward

- You purchase a bond with a par value of $1,000 and an invoice price of $1,044. The bond has a coupon rate of 5.1 percent, and there are 4 months to the next semiannual coupon date. What is the clean price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Clean price _arrow_forwardYou are considering the purchase of a Zero Coupon Bond. This bond has a coupon rate of 0%, a face value of $1000 and a 17-year maturity. The seller is offering the bonds at a price of $830. What is the YTM the seller is offering on the bonds? Assume annual compounding.arrow_forwardYou have just been offered a $1,000 par value bond for $847.88. The coupon rate is 8 percent, payable annually, and yields to maturity on new issues of similar risk are 10 percent. You want to know how many more interest payments you will receive, but the party selling the bond cannot remember. Can you determine how many interest payments remain?arrow_forward

- You are considering the purchase of a $1,000 par value bond with a coupon rate of 5.7% (with interest paid semiannually) that matures in 12 years. If the bond is priced to yield 8%, what is the bond's current price? The bond's current price is $ (Round to the nearest cent.) 0 www.arrow_forwardA convertible bond has a coupon of 9 percent, paid semiannually, and will mature in 12 years. If the bond were not convertible, it would be priced to yield 8 percent. The conversion ratio on the bond is 25 and the stock is currently selling for $43 per share. What is the minimum value of this bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Minimum valuearrow_forwardYour broker offers to sell you a CleenWtr Bond for $1150. The bond has a coupon rate of 3%, semiannual interest payments, and a maturity of 9 years. If the interest rate on comparable debt is 2.0% is your broker fairly pricing the bond? (What is the curent price of the bond)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education