Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

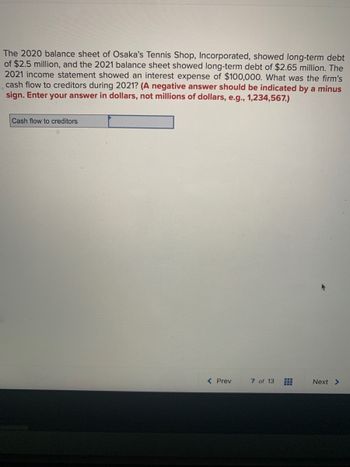

Transcribed Image Text:The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt

of $2.5 million, and the 2021 balance sheet showed long-term debt of $2.65 million. The

2021 income statement showed an interest expense of $100,000. What was the firm's

cash flow to creditors during 2021? (A negative answer should be indicated by a minus

sign. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)

Cash flow to creditors

< Prev

7 of 13

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Interest expense for Rhodes Manufacturing was $500,000 in 2018. During 2018, $3.7 million in old debt was repaid and $1.6 million was raised through new borrowing. Dividends of $460,000 were paid and $1.7 million was raised through new share sales. a. Calculate the cash flow to bondholders. Treat interest as a financing flow. (Enter answers in dollar, not in millions of dollar. Use minus sign to enter cash or financing outflows, if any.)arrow_forwardThe 2017 balance sheet of Kerber’s Tennis Shop, Inc., showed long-term debt of $3.1 million, and the 2018 balance sheet showed long-term debt of $3.3 million. The 2018 income statement showed an interest expense of $105,000. What was the firm’s cash flow to creditors during 2018? (A negative answer should be indicated by a minus sign. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)arrow_forwardMinta Corporation, is a leading manufacturer of sports apparel, shoes, and equipment. The company's 2020 financial statements contain the following information ($ in millions): 2020 $ 3,574 229 2019 $ 5,097 75 Balance sheets: Accounts receivable, net Allowance for uncollectible accounts Income statements: Sales revenue Statement of Cash Flows: Amortization, impairment and other Decrease in accounts receivable $ 39,728 413 1,254 Assume that all sales are made on a credit basis. Required: What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and2019? Assume that bad debt expense is included in "amortization, impairment and other," such that the 2020 decrease in accounts receivable of $1,254 reflects only the difference between sales and collections. Prepare a T account that depicts how sales, collections, bad debt expense, and writeoffs of bad debts affect the balance of net accounts receivable with a debit, a credit or not at all, and estimate…arrow_forward

- The management of Maxlab Ltd. has provided you with the following data relating to their operations for the last two financial periods. 2021 2020 Notes receivable $ 20,000 $ -0- Accounts receivable $182,000 $140,000 Sales $930,000 $750,000 Operating expenses $170,000 $200,000 Payables $45,000 $20,000 Required: Calculate the percentage change for each item as reported above using 2020 as the base year and explain your result.arrow_forwardson.6arrow_forwardPlease help me to solve this problemarrow_forward

- i need the answer quicklyarrow_forwardCash flow identity. Use the data from the following financial statements in the popup window, . The company paid interest expense of $17,100 for 2017 and had an overall tax rate of 40% for 2017. Verify the cash flow identity: cash flow from assets = cash flow to creditors + cash flow to owners The cash flow from assets is $ 24,380. (Round to the nearest dollar.) The cash flow to creditors is $ (Round to the nearest dollar.)arrow_forwardThe 2017 balance sheet of Kerber’s Tennis Shop, Inc., showed long-term debt of $6.5 million, and the 2018 balance sheet showed long-term debt of $6.4 million. The 2018 income statement showed an interest expense of $175,000. What was the firm’s cash flow to creditors during 2018? (A negative answer should be indicated by a minus sign. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education