EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General Accounting Question Solution

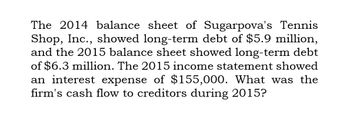

Transcribed Image Text:The 2014 balance sheet of Sugarpova's Tennis

Shop, Inc., showed long-term debt of $5.9 million,

and the 2015 balance sheet showed long-term debt

of $6.3 million. The 2015 income statement showed

an interest expense of $155,000. What was the

firm's cash flow to creditors during 2015?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please Provide Answerarrow_forwardWhat was the firm's 2015 operating cash flow, or OCF on these general accounting question?arrow_forwardThe December 31, 2015, balance sheet of Schism, Inc., showed long-term debt of $1,730,000, and the December 31, 2016, balance sheet showed long-term debt of $1,420,000. The 2016 income statement showed an interest expense of $97,000. What was the firm's cash flow to creditors during 2016? (A negative answer should be indicated by a minus sign. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)arrow_forward

- The 2017 balance sheet of Kerber’s Tennis Shop, Inc., showed long-term debt of $6.5 million, and the 2018 balance sheet showed long-term debt of $6.4 million. The 2018 income statement showed an interest expense of $175,000. What was the firm’s cash flow to creditors during 2018? (A negative answer should be indicated by a minus sign. Enter your answer in dollars, not millions of dollars, e.g., 1,234,567.)arrow_forwardThe 2008 balance sheet of Maria's Tennis Shop, Inc., showed long-term debt of $2.35 million, and the 2009 balance sheet showed long-term debt of $4.3 million. The 2009 income statement showed an interest expense of $180,000. What was the firm's cash flow to creditors during 2009?arrow_forwardWhat was the firm's 2015 operating cash flow on these general accounting question?arrow_forward

- Need answerarrow_forwardNeed answer this questionarrow_forwardBold Company’s 2016 income statement reported total credit revenue of $250,000. Bold’s accounts receivable balance on January 1, 2016 was $30,000, and its December 31, 2016 accounts receivable balance was $10,000. Bold’s accounts payable balance on January 1, 2016 was $25,000, and its December 31, 2016 accounts payable balance was $35,000. How much did Bold collect from customers during 2016?arrow_forward

- What is the 2017 profit margin on this accounting question?arrow_forwardThe 2014 balance sheet of Sugarpova's Tennis Shop, Inc., showed long- term debt of $3.3 million, and the 2015 balance sheet showed long-term debt of $3.4 million. The 2015 income statement showed an interest expense of $155,000. During 2015, the company had a cash flow to creditors of $55,000 and the cash flow to stockholders for the year was $60,000. Suppose you also know that the firm s net capital spending for 2015 was $1,350,000 and that the firm reduced its net working capital investment by $65,000. What was the firm's 2015 operating cash flow, or OCF?arrow_forwardThe below tables shows Dynamic Mattress’s year-end 2016 and 2018 balance sheets, and its income statement for 2017. Dynamic MattressYear-End Balance Sheet for 2016(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 22 Bank loans $ 22 Marketable securities 11 Accounts payable 80 Accounts receivable 111 Inventory 155 Total current assets $ 299 Total current liabilities $ 102 Fixed assets: Gross investment $ 251 Long-term debt 26 Less depreciation 71 Net worth (equity and retained earnings) 351 Net fixed assets $ 180 Total assets $ 479 Total liabilities and net worth $ 479 Dynamic MattressYear-End Balance Sheet for 2017(figures in $ millions) Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities: Cash $ 32.0 Debt due within a year (bank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College