Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

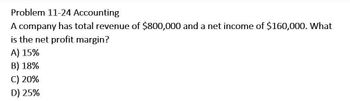

Transcribed Image Text:Problem 11-24 Accounting

A company has total revenue of $800,000 and a net income of $160,000. What

is the net profit margin?

A) 15%

B) 18%

C) 20%

D) 25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 17arrow_forwardChapter 17 Revenue and expense data for the current calendar year for Smith Electronics Company and for the electronics industry are as follows. The Smith Electronics Company data are expressed in dollars. The electronics Industry averages are expressed in percentages. Smith Electronics Electronics Industry Company Average $3,142,000 103.0% Sales 3.0% 150,000 Sales returns and allowances $2,992,000 100.0% Net sales 60.0% 1,850,000 Cost of goods sold 40.0% $1,142,000 Gross profit $750,000 23.0% Selling expenses 257,000 10.0% Administrative expenses 33.0% $1,007,000 Total operating expenses 7.0% $135,000 Operating income Other income 50,000 1.5% $185,000 8.5% 42,500 1.0% Other expense Income before income tax $142,500 7.5% Income tax expense 5.0% 76,000 $66,500 Net Income 2.5% a. Prepare a common-sized income statement comparing the results of operations for Smith Electronics Company with the industry average Round to one decimal place. b. As far as the data permit, comment on…arrow_forwardProblem 29-2 Performance measures Keller Cosmetics maintains an operating profit margin of 8.70% and a sales-to-assets ratio of 3.30. It has assets of $640,000 and equity of $440,000. Assume that interest payments are $44,000 and the tax rate is 34%. a. What is the return on assets? b. What is the return on equity? Note: For all requirement, enter your answers as a percent rounded to 2 decimal places. a. Return on assets b. Return on equity 14.41 % 20.33 %arrow_forward

- Assume the following sales data for a company: Current year $1,025,000 Preceding year 820,000 What is the percentage increase in sales from the preceding year to the current year? Oa. 125% Ob. 25% Oc. 75% Od. 100%arrow_forwardFinance MCQarrow_forwardAssume the following sales data for a company: Year 2 $562,500 Year 1 $450,000 What is the percentage increase in sales from Year 1 to Year 2 (to the nearest whole percent)? O a. 20% O b. 125% О с. 25% O d. 80%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning