Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the contribution margin per unit for this accounting question?

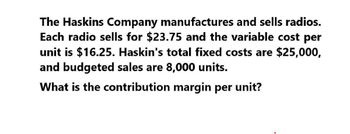

Transcribed Image Text:The Haskins Company manufactures and sells radios.

Each radio sells for $23.75 and the variable cost per

unit is $16.25. Haskin's total fixed costs are $25,000,

and budgeted sales are 8,000 units.

What is the contribution margin per unit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Goldfarb Company manufactures and sells toasters. Each toaster sells for $23.35 and the variable cost per unit is $16.15. Goldfarb's total fixed costs are $24,600, and budgeted sales are 7,600 units. What is the contribution margin per unit?arrow_forwardCM PER UNIT?arrow_forwardBerhannan's Cellular sells phones for $100. The unit variable cost per phone is $50 plus a selling commission of 10%. Fixed manufacturing cost total $1,250 per month, while fixed selling and administrative costs total $2,510. What is the contribution margin per phone? What is the breakeven point in phones ?arrow_forward

- Atlantic Manufacturing produces and sells children’s bikes at an average price of $80. Its costs are as follows: direct materials = $15; direct labour = $7; variable overhead = $3; sales commission is 5% of price. Its fixed monthly costs are $50,000. Required: 1. Using the above cost data, set up a monthly cost equation. Y=___+___x 2. What is the company’s contribution margin percentage? (Round your answer to 2 decimal places.) Contribution Margin %arrow_forwardA company that sells radios has yearly fixed costs of $600,000. It costs the company $45 to produce each radio. Each radio will sell for $65. The company's costs and revenue are modeled by the following functions, where x represents the number of radios produced and sold: C(x) = 600,000 + 45x This function models the company's costs. R(x) = 65x. This function models the company's revenue. Find and interpret (R – C)(20,000), (R – C)(30,000), and (R - C)(40,000).arrow_forwardMackler, Inc. sells a product with a contribution margin of $50 per unit. Fixed costs are $8,000 per month. How many units must Mackler sell to break even? Please show the formula you used and show your work in the space provided.arrow_forward

- Cheetah Company manufactures custom-designed skins (covers) for iPods® and other portable electronic devices. Variable costs are $9.20 per custom skin, the price is $19, and fixed costs are $104,860. 1. What is the contribution margin for one custom skin? 2. How many custom skins must Cheetah Company sell to break even? 3. If Cheetah Company sells 13,000 custom skins, what is the operating income? Calculate the margin of safety in units and in sales revenue if 13,000 custom skins are sold.arrow_forwardJuniper Enterprises sells handmade clocks. Its variable cost per clock is $6, and each clock sells for $24. Calculate Juniper’s contribution margin per unit and contribution margin ratio. If the company’s fixed costs total $6,660, determine how many clocks Juniper must sell to break even. 1. Calculate Juniper’s contribution margin per unit and contribution margin ratio. unit contribution margin contribution marjin ratio 2. If the company’s fixed costs total $6,660, determine how many clocks Juniper must sell to break even.arrow_forwardTequila Mockingbird, Inc. has total costs of $70,000 when it sells 10,000 units. If total fixed costs are $40,000, what is variable cost per unit?arrow_forward

- Hawk Homes, Inc., makes one type of birdhouse that it sells for $29.40 each. Its variable cost is $13.20 per house, and its fixed costs total $14,013.00 per year. Hawk currently has the capacity to produce up to 2,700 birdhouses per year, so its relevant range is 0 to 2,700 houses. Required:1. Prepare a contribution margin income statement for Hawk assuming it sells 1,280 birdhouses this year. 2. Without any calculations, determine Hawk’s total contribution margin if the company breaks even. 3. Calculate Hawk’s contribution margin per unit and its contribution margin ratio. 4. Calculate Hawk’s break-even point in number of units and in sales revenue. 5. Suppose Hawk wants to earn $25,000 this year. Determine how many birdhouses it must sell to generate this amount of profit.arrow_forwardRST Company produces a product that has a variable cost of $6 per unit. The company's fixed costs are $30,000. The product sells for $10 per unit. RST desires to earn a profit of $20,000. The contribution margin per unit is $arrow_forwardThe haskin company manufacturers accounting questions solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning