FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need Help Provide answer if you provide Correct Solution I give Upvote

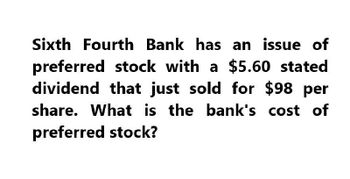

Transcribed Image Text:Sixth Fourth Bank has an issue of

preferred stock with a $5.60 stated

dividend that just sold for $98 per

share. What is the bank's cost of

preferred stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Holdup Bank has an issue of preferred stock with a $1.93 stated dividend that just sold for $27.73 per share. What is the bank's cost of preferred stock? Enter the answer with 4 decimals (e.g. 0.1234).arrow_forwardCoaldale Bank has an issue of preferred stock with a $5.15 stated dividend that just sold for $101 per share. What is the bank's cost of preferred stock? (Round the final answer to 2 decimal places.) Cost of preferred stockarrow_forwardWhat is the price of the stock on these accounting question?arrow_forward

- How would this example look in the basic accounting equation?Investors selling their own stock to other investors for 140$ per share of stock.arrow_forwardWhat is the amount of earnings per share for common stock (after tax)? What was the P/E ratio on the date of the last Treasury Stock Transaction? Net Income after taxes = $353,018 Last Treasury Stock Transaction: 9/12/2021 Cash 98,800 Paid-In Capital - Treasury Stock 13,000 Treasury Stock 85,800arrow_forwardBlossom Company has the following items: common stock, $1583000; treasury stock, $216000; deferred income taxes, $241000 and Retained Earnings, $790000. What total amount should Blossom Company report as stockholders' equity? O $2589000 O $1367000 $2398000 O $2157000arrow_forward

- Need help with this accounting questionarrow_forwardCan you please give me answer?arrow_forwardAdditional information: 1. The market price of Pina’s common stock was $7.00, $7.50, and $8.50 for 2020, 2021, and 2022, respectively. 2. You must compute dividends paid. All dividends were paid in cash. Compute the following ratios for 2021 and 2022. 2022 2021 Profit margin enter percentages % enter percentages % (Round answers to 1 decimal place, e.g. 1.5%.) Gross profit rate enter percentages % enter percentages % (Round answers to 1 decimal place, e.g. 1.5%.) Asset turnover enter asset turnover in times times enter asset turnover in times times (Round answers to 2 decimal places, e.g. 1.83.) Earnings per share $enter earnings per share in dollars $enter earnings per share in dollars (Round answers to 2 decimal places, e.g. 1.83.) Price-earnings ratio enter price-earnings ratio in times times enter price-earnings ratio in times times (Round answers to 1 decimal place,…arrow_forward

- Copperhead Trust has the following classes of stock: LOADING... (Click the icon to view the data.) Read the requirements LOADING... . Requirement 1. Copperhead declares cash dividends of $44,000 for 2024. How much of the dividends goes to preferred stockholders? How much goes to common stockholders? (Complete all input boxes. Enter "0" for any zero amounts.) Copperhead's dividend would be divided between preferred and common stockholders in this manner: Total Dividend Dividend to preferred stockholders: Dividend in arrears Current year dividend Total dividend to preferred stockholders Dividend to common stockholders Data Table Preferred Stock—6%, $12 Par Value; 8,500 shares authorized, 7,000 shares issued and outstanding Common Stock—$0.10 Par Value; 2,100,000 shares authorized, 1,400,000 shares issued and outstanding Requirements 1. Copperhead…arrow_forward17. Analyze the equity section of Gingerbread Corp's balance sheet and determine the following. Be careful to discriminate between a non monetary value and a monetary value. Use a $ sign to indicate a dollar value. 1.Number of shares of common stock that have been issued 2.Number of shares of preferred stock that have been issued 3.BlankDollar value the company paid to repurchase their own stock 4.How many shares of stock are in treasury stock?arrow_forwardFolic Acid Inc. has $28 million in earnings, pays $3.8 million in interest 1 bondholders, and $2.4 million in dividends to preferred stockholders. What are the common stockholders' residual claims to earnings? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places (e.g., $1.23 million should be entered as "1.23").) Residual claims to earnings millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education