Century 21 Accounting Multicolumn Journal

11th Edition

ISBN: 9781337679503

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Thech pro uses the straight line method solve this accounting questions

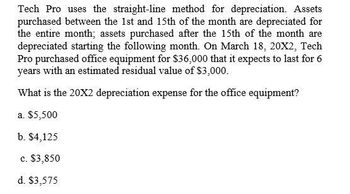

Transcribed Image Text:Tech Pro uses the straight-line method for depreciation. Assets

purchased between the 1st and 15th of the month are depreciated for

the entire month; assets purchased after the 15th of the month are

depreciated starting the following month. On March 18, 20X2, Tech

Pro purchased office equipment for $36,000 that it expects to last for 6

years with an estimated residual value of $3,000.

What is the 20X2 depreciation expense for the office equipment?

a. $5,500

b. $4,125

c. $3,850

d. $3,575

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forwardLoban Company purchased four cars for 9,000 each and expects that they will be sold in 3 years for 1,500 each. The company uses group depreciation on a straight-line basis. Required: 1. Prepare journal entries to record the acquisition and the first years depreciation expense. 2. If one of the cars is sold at the beginning of the second year for 7,000, what journal entry is required?arrow_forwardRayco uses the straight line method.assets purchased betweenarrow_forward

- Golden Sales has bought $135,000 in fixed assets on January 1st associated with sales equipment. The residual value of these assets is estimated at $10,000 at the end of their 4-year service life. Golden Sales managers want to evaluate the options of depreciation. (a) Compute the annual straight-line depreciation and provide the sample depreciation journal entry to be posted at the end of each of the years. (b) Write the journal entries for each year of the service life for these assets using the double declining balance method.arrow_forwardOn July 1, Harding Construction purchases a bulldozer for $228,000. The equipment has an 8-year life with a residual value of $16,000. Harding uses straight-line depreciation. (a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31. (b) Calculate the third year’s depreciation expense and provide the journal entry for the third year ending December 31. (c) Calculate the last year’s depreciation expense and provide the journal entry for the last year.arrow_forwardSwindall Industries uses straight-line depreciation on all of its depreciable assets. The company records annual depreciation expense at the end of each calendar year. On January 11, 2017, the company purchased a machine costing $117,000. The machine's useful life was estimated to be 12 years with an estimated residual value of $17,200. Depreciation for partial years is recorded to the nearest full month. In 2021, after almost five years of experience with the machine, management decided to revise its estimated life from 12 years to 20 years. No change was made in the estimated residual value. The revised estimate of the useful life was decided prior to recording annual depreciation expense for the year ended December 31, 2021. a. Prepare journal entries in chronological order for the given events, beginning with the purchase of the machinery on January 11, 2017. Show separately the recording of depreciation expense in 2017 through 2021. (Do not round intermediate calculations. Round…arrow_forward

- On July 1, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8-year life with a residual value of $16,000. Harding uses straight-line depreciation. Required: (a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31.* (b) Calculate the third year’s depreciation expense and provide the journal entry for the third year ending December 31.* (c) Calculate the last year’s depreciation expense and provide the journal entry for the last year.* *Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Harding Construction General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 121 Equipment 122 Accumulated Depreciation 132 Goodwill 133 Patents LIABILITIES 210 Accounts Payable 211…arrow_forwardSSG bought a machine for $40,000 in January 19W8. The machine had an expected useful life of six years and an expected residual value of $10,000. The machine was depreciated on the straight-line basis. In December 20X1, the machine was sold for $15,000. The company has a policy in its internal accounts of combining the depreciation charge with the profit or loss on disposal of assets. The total amount of depreciation and profit/loss charged to the internal income statement over the life of the machine was $ ........................................arrow_forwardOn April 1, 2021, Parks Co. purchased machinery at a cost of $42,000. The machinery is expected to last 10 years and to have a residual value of $6,000. Record the depreciation for office equipment purchased on March 31, 2018 for $24,000 having no residual value sold on September 30, 2021 , depreciated over a five-year life using the straight-line method, with depreciation based on months in service. Prepare the journal entries to record 2021 depreciation and the sale of the equipment. Please don't give image based answer..thankuarrow_forward

- Phillips Ltd. purchased a machine on 26 March 20X3 for $136,000 and began to use it immediately. The estimated useful life of the machine is 5 years, and it has an expected residual value of $12,100 at that time. Phillips uses straight-line depreciation. Required:1 & 2. Calculate annual depreciation for 20X3 through 20X8 assuming that depreciation is calculated to the nearest month using three accounting conventions: Half-year convention Full-first-year convention Final-year convention Year Month Half year Full first year Final year 20X3 20X4 20X5 20X6 20X7 20X8 3. Calculate the gain or loss on disposal assuming that the asset is unexpectedly sold for $7,600 at the end of 20X6, using net book value from requirement 1, and then from the three alternatives in requirement 2. Year Month Half Year Full First Year Final Year Proceeds, 20X6 Net book…arrow_forwardAdkins Bakery uses the modified half-month convention to calculate depreciation expense in the year an asset is purchased or sold. Adkins has a calendar year accounting period and uses the straight-line method to compute depreciation expense. On March 17, 2018, Adkins acquired equipment at a cost of $220,000. The equipment has a residual value of $43,000 and an estimated useful life of 4 years. What amount of depreciation expense will be recorded for the year ending December 31, 2018? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) $44,250 $33,188 $36,875 $22,125arrow_forwardSheridan's Repair Service uses the straight-line method of depreciation. The company's fiscal year-end is December 31. The following transactions and events occurred during the first three years. Purchased equipment from the Equipment Center for $7,900 cash plus sales tax of $580, and shipping costs of $490. 2021 July 1 Nov. 3 Incurred ordinary repairs on computer of $280. Dec. 31 Recorded 2021 depreciation on the basis of a four-year life and estimated salvage value of $450. 2022 Dec. 31 Recorded 2022 depreciation. Paid $2,900 fora major upgrade of the equipment. This expenditure is expected to increase the operating efficiency and capacity of the equipment. 2023 Jan. 1 Prepare the necessary entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Prepare the necessary…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning