Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

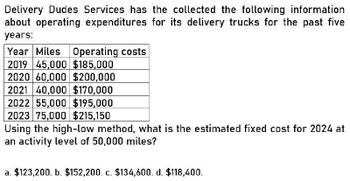

Transcribed Image Text:Delivery Dudes Services has the collected the following information

about operating expenditures for its delivery trucks for the past five

years:

Year Miles Operating costs

2019 45,000 $185,000

2020 60,000 $200,000

2021 40,000 $170,000

2022 55,000 $195,000

2023 75,000 $215,150

Using the high-low method, what is the estimated fixed cost for 2024 at

an activity level of 50,000 miles?

a. $123,200. b. $152,200. c. $134,600. d. $118,400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Apollo Delivery Service has the following information about its truck fleet miles and operating costs Year 2018 2019 2020 Miles 500,000 600,000 700,000 Operating Costs $320,000 $370,000 $420,000 What is the best estimate of fixed costs for fleet operating expenses using the high-low method? $100,000 $370,000 $70,000 $200,000arrow_forwardNonearrow_forwardNeed answerarrow_forward

- Please show workarrow_forwardOak Island Amusements Center provides the following data on the costs of maintenance and the number of visitors for the last three years. Number of Visitors per Year(thousands) Maintenance Costs($000) 1,830 $ 2,316 2,010 2,559 2,700 3,360 Required: a. Use the high-low method to estimate the fixed cost of maintenance annually and the variable cost of maintenance per visitor. (Enter your answers in dollars not in thousands of dollars. Round "Variable cost" answer to 2 decimal places.) b. The company expects a record 2,000,000 visitors next year. What would be the estimated maintenance costs? (Enter your answer in dollars not in thousands of dollars.)arrow_forwardShale Remodeling uses time and materials pricing. It is setting prices for next year using the following information: Labor rate, including fringe benefits $ 93 per hour Annual labor hours 6,410 hours Annual materials purchases $ 1,237,750 Materials purchasing, handling, and storage $ 247,550 Overhead for depreciation, taxes, insurance, etc. $ 711,510 Target profit margin for both labor and materials 25 % What is the total price for a project requiring 220 direct labor hours and $210,000 of materialsarrow_forward

- The company will have to allocate funds to net working capital (NWC) for parts inventories equivalent to 8% of annual sales, spent in year 1 and sold off in last year at the end of the project. Determine the amount of NWC that will be allocatedarrow_forwardSolve this problemarrow_forwardPlease show workarrow_forward

- Please show workarrow_forwardRosman Company has an opportunity to pursue a capital budgeting project with a five-year time horizon. After careful study, Rosman estimated the following costs and revenues for the project: Cost of new equipment needed Sale of old equipment no longer needed Working capital needed Equipment maintenance in each of Years 3 and 4 Annual revenues and costs: Sales revenues Variable expenses Fixed out-of-pocket operating costs $430,000 $ 82,000 $ 67,000 $ 22,000 $430,000 $185,000 $104,000 The new piece of equipment mentioned above has a useful life of five years and zero salvage value. The old piece of equipment mentioned above would be sold at the beginning of the project and there would be no gain or loss realized on its sale. Rosman uses the straight-line depreciation method for financial reporting and tax purposes. The company's tax rate is 30% and its after-tax cost of capital is 11%. When the project concludes in five years the working capital will be released for investment elsewhere…arrow_forwardSuppose that a company is spending 60,000 per year for inspecting, 30,000 for purchasing, and 40,000 for reworking products. A good estimate of nonvalue-added costs would be a. 70,000. b. 130,000. c. 40,000. d. 90,000. e. 100,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning