Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the net income under absorption costing get solution

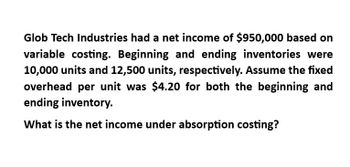

Transcribed Image Text:Glob Tech Industries had a net income of $950,000 based on

variable costing. Beginning and ending inventories were

10,000 units and 12,500 units, respectively. Assume the fixed

overhead per unit was $4.20 for both the beginning and

ending inventory.

What is the net income under absorption costing?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- To determine the effect of different levels of production on the company’s income, move to cell B7 (Actual production). Change the number in B7 to the different production levels given in the table below. The first level, 100,000, is the current level. What happens to the operating income on both statements as production levels change? Enter the operating incomes in the following table. Does the level of production affect income under either costing method? Explain your findings.arrow_forwardWhat is net income under absorption costing???arrow_forwardWhat is net income under absorption costing?arrow_forward

- What is net income under absorption costing? General accountingarrow_forwardWhat is the net income under absorption costing for this general accounting question?arrow_forwardA company has a net income of $918,000 based on variable costing method. Beginning and ending inventories were 56,800 units and 55,600 units. Assume the fixed overhead per unit was $2.15 for both the beginning and ending inventory. What will be the net income under absorption costing?arrow_forward

- Net income under variable costing is P 30,000. Data shows: the total manufacturing cost per unit is P 20; total variable cost per unit is P 15 per unit and variable period cost is P 3 per unit. Beginning and ending inventories are 1,000 units and 1,500 units, respectively. What is the income under absorption costing?arrow_forwardX Corp produces single product. Income under variable costing and absorption costing are 36,400 and 25,600, respectively. Product cost per unit under Variable costing and absorption costing are 18 and 20 per unit, respectively. Ending inventory is 2,600 units, what is the beginning inventory in units?A. 5,400B. 2,800C. 8,000D. 13,400arrow_forwardNani Lighting Inc. produces and sells lighting fixtures. An entry light has a total cost of $125 per unit, of which $80 is product cost and $45 is selling and administrative expenses. In addition, the total cost of $125 is made up of $90 variable cost and $35 fixed cost. The desired profit is $55 per unit. Determine the markup percentage on product cost to above financial accounting problem.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning