Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide answer the financial accounting question

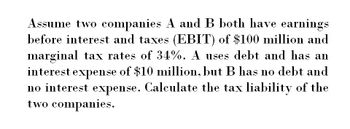

Transcribed Image Text:Assume two companies A and B both have earnings

before interest and taxes (EBIT) of $100 million and

marginal tax rates of 34%. A uses debt and has an

interest expense of $10 million, but B has no debt and

no interest expense. Calculate the tax liability of the

two companies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Haricot Corporation and Pinto Corporation both have operating profits of $195 million. Haricot is financed solely by equity, while Pinto has issued $245 million of 6% debt. If the corporate tax rate is 21%: Required: a. How much tax does each company pay? b. What is the total payout to investors (debtholders plus shareholders) of each company? Complete this question by entering your answers in the tabs below. Required A Required B How much tax does each company pay? Note: Enter your answer in dollars not in millions. Tax Amount Haricot Pintoarrow_forwardAnswer the following questions based on the information in the table. Assume a tax rate of 30 percent. For simplicity, assume that the companies have no other liabilities other than the debt shown. (All dollars are in millions.) \table[[,\table[[Atlantic],[Corporation]],Pacific],[Earnings before interest and taxes,$470,$470arrow_forwardHaricot Corporation and Pinto Corporation both have operating profits of $135 million. Haricot is financed solely by equity, while Pinto has issued $185 million of 6% debt. If the corporate tax rate is 21%: Required: a. How much tax does each company pay? b. What is the total payout to investors (debtholders plus shareholders) of each company? Complete this question by entering your answers in the tabs below. Required A Required B How much tax does each company pay? Note: Enter your answer in dollars not in millions. Haricot Pinto Tax Amountarrow_forward

- Please need help with this financial accounting questionarrow_forwardYou are given the financial information for the Unic Company: Earnings Before Interest and Tax (EBIT) = $126.58 Corporate tax rate (TC) = 0.21 Debt (D) = $500 Unlevered cost of capital (RU) = 0.20 The cost of debt capital is 10 percent. Question: Determine the value of Unic Company equity? Determine the cost of equity capital for Unic Company? Determine the WACC for Unic Company?arrow_forwardNeed answer of this Questionarrow_forward

- Sea Harbor, Inc. has a marginal tax rate of.... Please need answer the accounting questionarrow_forwardNeed Help with this Questionarrow_forwardMolteni Motors Inc. recently reported $6 million of net income. Its EBIT was$13 million, and its tax rate was 40%. What was its interest expense? (Hint:Write out the headings for an income statement and then fill in the knownvalues. Then divide $6 million net income by 1 - T = 0.6 to find the pretax income. The difference between EBIT and taxable income must be theinterest expense. Use this procedure to work some of the other problems.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning