Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide correct answer general Accounting

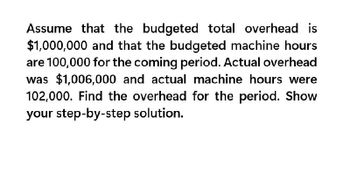

Transcribed Image Text:Assume that the budgeted total overhead is

$1,000,000 and that the budgeted machine hours

are 100,000 for the coming period. Actual overhead

was $1,006,000 and actual machine hours were

102,000. Find the overhead for the period. Show

your step-by-step solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The controller of the Stump Company is preparing the budget for 2021 and needs to estimate a cost function for delivery costs. Information regarding delivery costs incurred in the prior 2 months are: LOADING... (Click the icon to view the information.) Requirements 1. Estimate the cost function for delivery. 2. Can the constant in the cost function be used as an estimate of fixed delivery cost per month? Explain. Requirement 1. Estimate the cost function for delivery. Delivery costs = + ( × ) Delivery costs = + ( × ) Requirement 2. Can the constant in the cost function be used as an estimate of fixed delivery cost per month? Explain. The cost function in requirement 1 is an estimate of how costs behave ▼ outside of within the relevant range, not at cost levels ▼ outside within the relevant range. If there are no months with zero miles driven represented in the delivery cost…arrow_forwardEstimating a cost function. The controller of the Javier Company is preparing the budget for 2018 and needs to estimate a cost function for delivery costs. Information regarding delivery costs incurred in the prior two months are:arrow_forwardEstimating a cost function. The controller of the Javier Company is preparing the budget for 2018 and needs to estimate a cost function for delivery costs. Information regarding delivery costs incurred in the prior two months are:arrow_forward

- 5. A company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 ? per ?. Budgeted direct labor: $1,500,000 ? per ?. Estimated machine hours: 100,000 ? per ?. PLEASE NOTE: Predetermined overhead rates will be rounded to two decimal places and shown with "$" and commas as needed (i.e. $12,345.67). The rates will include their proper label according to the textbook examples (no abbreviations).arrow_forwardSince, the predetermined overhead rate and the budgeted factory overhead is given. We need to calculate the amount of the allocation base in order to know how Mystic Inc. computed its predetermined overhead rate for 2010. Equation to compute the Predetermined Overhead rate: Given: Predetermined Overhead rate = Predetermined rate: $4.25 per direct labor dollar Budgeted Factory Overhead: $1,275,000 Solution: $4.25 = ? = $300,000 = = $300,000 is the budgeted direct labor cost.arrow_forwardA company estimates its manufacturing overhead will be $630,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 72,000 $______ per direct labor hour B. Budgeted direct labor expense: $1,800,000 $_____ per direct labor dollar C. Estimated machine hours: 120,000 $_____ per machine hourarrow_forward

- Jefferson Company expects to incur $572,760 in manufacturing overhead costs during the current year. Other budget information follows: Direct labor hours Machine hours Department A 16,650 8,880 Required: a. Use direct labor hours as the cost driver to compute the allocation rate. Determine the amount of budgeted overhead cost for each department. b. Use machine hours as the cost driver to compute the allocation rate. Determine the amount of budgeted overhead cost for each department. c. Assume that Department A manufactured a product that required 160 direct labor hours and 85 machine hours. If overhead is allocated based on direct labor hours, how much overhead would be allocated to this product? d. Assume that Department A manufactured a product that required 160 direct labor hours and 85 machine hours. If overhead is allocated based on machine hours, how much overhead would be allocated to this product? Req A and B Req C and D Department B Department C 5,550 22, 200 11,100 13,320…arrow_forwardA company estimates its manufacturing overhead will be $1,080,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 72,000 $fill in the blank 1 per direct labor hour B. Budgeted direct labor expense: $1,800,000 $fill in the blank 2 per direct labor dollar C. Estimated machine hours: 120,000 $fill in the blank 3 per machine hourarrow_forwardKindly refer to the attached photo in answering the questions: Thank you!☺️ Refer to a table below. What is the cumulative budgeted cost at the end of week 6? Below is the table of actual costs. What is the cumulative actual cost at the end of week 6? Below is the table for cumulative percentages of work completed by the end of week 6. What is the cumulative earned value of the project at the end of week 6? What is the CPI at the end of week 6? (round up to 2 decimal place) What is the value of CV? Calculate the FCAC using the first two methods described in the chapter. Compute for the TCPI.arrow_forward

- How do I prepare the bugdet and replace all question marks into formula?arrow_forwardIf a factory operates at 100% of capacity one month, 90% of capacity the next month, and 105% of capacity the next month, will a different cost per unit be charged to the work-in-process account each month for factory overhead assuming that a predetermined annual overhead rate is used?arrow_forwardUsing Regression to Calculate Fixed Cost, Calculate the Variable Rate, Construct a Cost Formula, and Determine Budgeted Cost Refer to the information for Pizza Vesuvio on the previous page. Coefficients shown by a regression program for Pizza Vesuvios data are: Required: Use the results of regression to make the following calculations: 1. Calculate the fixed cost of labor and the variable rate per employee hour. 2. Construct the cost formula for total labor cost. 3. Calculate the budgeted cost for next month, assuming that 675 employee hours are budgeted. (Note: Round answers to the nearest dollar.) Use the following information for Brief Exercises 3-17 through 3-20: Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College