ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

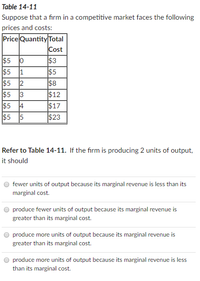

Transcribed Image Text:Table 14-11

Suppose that a firm in a competitive market faces the following

prices and costs:

Price Quantity Total

Cost

$5

$5

$5

$3

$5

$8

2

$5

$12

$17

3

$5

$5

4

$23

Refer to Table 14-11. If the firm is producing 2 units of output,

it should

fewer units of output because its marginal revenue is less than its

marginal cost.

produce fewer units of output because its marginal revenue is

greater than its marginal cost.

produce more units of output because its marginal revenue is

greater than its marginal cost.

produce more units of output because its marginal revenue is less

than its marginal cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- $150 $145 $140 MC $135 $130 $125 $120 $115 ATC $110 $105 $100 $95 $90 $85 $80 AVC $75 $70 $65 $60 $55 $50 $45 $40 $35 $30 $25 0 1 2 3 5 6 Quantity Produced 7 8 9 10 11 The graph above shows the cost functions for a perfectly competitive profit maximizing firm. If the market price of the product is $70 per unit, the firm will produce units, will cover make an economic profit of dollars. dollars of its fixed cost, and willarrow_forward67. In a perfectly competitive market, industry demand is given by Q = 1000 – 20P. The typical firm’s average cost is TC = 300 + Q2 /3, and marginal cost by MC = (2/3)Q. Suppose there are 10 identical firms in the market. What is the market supply? A. 30Q B. 40Q C. 15Q D. 5Qarrow_forwardAnswer the questions based on the table below - Complete the table below. - In which market does this firm operate? Explain your reasons. - Determine the equilibrium output. Calculate whether the firm will it be earning a profit or suffering a loss at equilibrium. Quantity(unit) Total Revenue($) Average Revenue($) MarginalRevenue($) TotalCost($) MarginalCost($) 1 10 5 2 18 11 3 24 16 4 28 20 5 30 23 6 30 25arrow_forward

- 1) If a firm in a purely competitive industry is confronted with an equilibrium price of $5, its marginal revenue: 2) A firm that is motivated by self interest should 3) If price is above the equilibrium level, competition among sellers to reduce the resulting 4) Camille's Creations and Julia's Jewels both sell beads in a competitive market. If at the market price of $5, both are running out of beads to sell (they can't keep up with the quantity demanded at that price), then we would expect both Camille's and Julia's to 5) Since their introduction, prices of DVD players have fallen and the quantity purchased has increased. This statement 6) In a market economy the distribution of output will be determined primarily by 7) In a competitive market economy firms will select the least-cost production technique because 8) Suppose that the price of peanuts falls from $3 to $2 per bushel and that, as a result, the total revenue received by peanut…arrow_forwardProblem #1: Assume that the following marginal costs exist in catfish production: 17 Quantity Produced (units per day) Marginal Cost (per unit) 10 11 12 13 14 15 16 $4 6 8 10 12 14 16 18 (a) Graph the MC curve. (b) Use the data on market demand below and graph the demand and MR curves on the same graph. Quantity demanded (units per day) 10 Price (per unit) 11 12 13 14 15 16 17 $25 24 23 22 21 20 19 18 (c) At what rate of output is MR = MC?arrow_forwardComplete the table below to answer questions 46. and 47.: Price Quantity Cost $18 16 14 12 10 8 642 012345678 Total Revenue Marginal Revenue Marginal $0 X $2.00 $16 $16 2.50 28 12 3.00 3.50 4.00 4.50 5.00 5.50 6.00 What is the profit-maximizing number of units to produce? What is the profit-maximizing price? 46 46. a. 2 b. 4 c. 6 d. 8 47. a. $14 b. $10 c. $6 d. $4arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward3 Suppose an industry consists of 100 firms with identical cost structures (represented by the "typical individual firm" in the figure below). The price is $10. Price/Cost ($) 60 50 40 40 30 20 20 10 0 10 20 MC 30 30 40 40 Quantity ATC AVC 50 60 Instructions: Round your answers to the nearest whole number. The typical firm's output at the equilibrium price is units. The market output at the equilibrium price is units.arrow_forwardIf the price is P, the firm in a perfectly competitive market is making a profit when producing the profit maximizing quantity Q1. Why would this situation lead to new entrants? Why would this increase in the number of firms competing in the market lead this firm to reduce output to Q (depicted in the right panel)? INDUSTRY S S¹ FIRM Costs - Revenue MC ATC K P P AR = MR ــة p1 Q Q¹ Use the editor to format your answer Outputarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education