ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Macmillan Learning

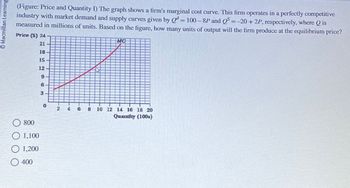

(Figure: Price and Quantity I) The graph shows a firm's marginal cost curve. This firm operates in a perfectly competitive

industry with market demand and supply curves given by Qd=100-8P and Q = =-20+2P, respectively, where Qis

measured in millions of units. Based on the figure, how many units of output will the firm produce at the equilibrium price?

Price ($) 24

21

18

15

12-

9

222522

MC

800

1,100

1,200

400

6

3

0

2

4 6

8 10 12 14 16 18 20

Quantity (100s)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Using the above graph, The minimum level of output this firm would produce is 12 units. The firm's total fixed costs is $56. (Do NOT enter the '$' in your response; enter only the whole dollar amount, NOT cents.) The profit maximizing output level for this firm is 16 units. The economic profit that this firm is earning is $28. (Do NOT enter the '$' in your response; enter only the whole dollar amount, NOT cents.) If this profit level is typical of the industry that the firm is operating in, what do you expect to happen? Blank 5arrow_forwardConsider a firm that operates in a market that competes aggressively in prices. Due to the high fixed cost of obtaining the technology associated with entering this market, only a limited number of other firms exist. Furthermore, over 70 percent of the products sold in this market are protected by patents for the next eight years. Does this industry conform to an economist’s definition of a perfectly competitive market?arrow_forwardThe average cost at this quantity is [ Answer53 ] dollars per unit.arrow_forward

- The graph shows the average total cost (ATC) curve, the marginal cost (MC) curve, the average variable cost (AVC) curve, and the marginal revenue (MR) curve (which is also the market price) for a perfectly competitive firm that produces terrible towels. Answer the three accompanying questions, assuming that the firm is profit-maximizing and does not shut down in the short run. What is the firm's total revenue? Price $485 $450 $300 $225 205 260 Quantity 336 365 MC ATC AVC MR Parrow_forwardFirm Profit, Loss, and Shut Down Based upon the graph, answer the following questions: 1) What is the production level that will maximize the profit for the firm? 2) What is the profit-maximizing price the firm will charge? 3) Will the firm incur an economic gain or economic loss? 4) What will the dollar amount of economic gain or economic loss be? 5) What will be the price and quantity where the firm will shut down?arrow_forward50 MC ATC 40 30 MR 10 10 20 30 40 Quantity (per day) The figure above shows a perfectly competitive firm. The firm is operating; that is, the firm has not shut down. a) What is the output level should the firm produce to maximize the profit? b) What is the price does the firm charge at this output level? Price and costs (dollars) 20arrow_forward

- Concept: Calculate Profit Farmer Jones grows sugar. The average total cost and marginal cost of growing sugar for an individual farmer are illustrated in the graph to the right. Assume the rharket for sugar is perfectly competitive. According to the graph, farmer Jones will earn profit (positive economic profit as opposed to losses) at any market price above $10 per bushel. (Enter a numeric response using an integer.) Assume that the market price specifically is $24 per bushel. If farmer Jones produces the profit maximizing quantity, what will be her profit? $ To more easily identify the price and quantity, click on the graph to the right, and then adjust the slider to change the price and quantity. Each increment will increase the price by $2. Enter your answer in the answer box and then click Check Answer. 40- 36- 32- MC 28- 24- 20- Price and cost (dollars per bushel) 12- ATC 46 20 30 40 50 60 70 80 90 100 Quantity of Sugar (bushels per month) Question Help Qarrow_forwardConsider the perfectly competitive market for titanium. Assume that, regardless of how many firms are in the industry, every firm in the industry is identical and faces the marginal cost ( MCMC ), average total cost ( ATCATC ), and average variable cost ( AVCAVC ) curves shown on the following grapharrow_forwardSolve it correctlyarrow_forward

- The table below shows the weekly marginal cost (MC) and average total cost (ATC) for Buddies, a purely competitive firm that produces novelty ear buds. Assume the market for novelty ear buds is a competitive market and that the price of ear buds is $6.00 per pair. Buddies Production Costs Quantity MC ATC of Ear Buds ($) ($) 20 1.00 25 2.00 1.20 30 2.46 1.41 35 3.51 1.71 40 4.11 2.01 45 5.43 2.39 50 5.99 2.75 55 8.47 3.27 Instructions: In part a, enter your answer as the closest given whole number. In parts b-d, round your answers to two decimal places. a. If Buddies wants to maximize profits, how many pairs of ear buds should it produce each week? pairs b. At the profit-maximizing quantity, what is the total cost of producing ear buds? 2$ c. If the market price for ear buds is $6 per pair, and Buddies produces the profit-maximizing quantity of ear buds, what will Buddies profit or loss be per week? 2$arrow_forwardOn the graph input tool, change the number found in the Quantity Demanded field to determine the prices that correspond to the production of 0, 6, 12, 15, 18, 24, and 30 units of output. Calculate the total revenue for each of these production levels. Then, on the following graph, use the green points (triangle symbol) to plot the results. Calculate the total revenue if the firm produces 6 versus 5 units. Then, calculate the marginal revenue of the sixth unit produced. The marginal revenue of the sixth unit produced is________. Calculate the total revenue if the firm produces 12 versus 11 units. Then, calculate the marginal revenue of the 12th unit produced. The marginal revenue of the 12th unit produced is_________.arrow_forwardUnit10 - Microeconomics Multiple choice A firm in perfect competition is a price taker because there are no good substitutes for its good. they are profit maximizers. it is very large. many other firms produce identical products. Under what condition would a perfectly competitive firm who is incurring an economic loss temporarily stay in business? if the total revenue is positive if the total revenue exceeds the variable cost if the total revenue exceeds the fixed cost if the total revenue is increasing When firms in a perfectly competitive market are making earning an economic profit, in the long run, firms will exit the market. firms will continue to earn a profit. average cost will shift downward. firms will enter the market.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education