Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

??

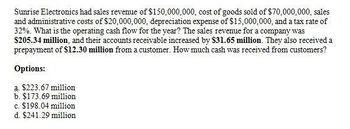

Transcribed Image Text:Sunrise Electronics had sales revenue of $150,000,000, cost of goods sold of $70,000,000, sales

and administrative costs of $20,000,000, depreciation expense of $15,000,000, and a tax rate of

32%. What is the operating cash flow for the year? The sales revenue for a company was

$205.34 million, and their accounts receivable increased by $31.65 million. They also received a

prepayment of $12.30 million from a customer. How much cash was received from customers?

Options:

a. $223.67 million

b. $173.69 million

c. $198.04 million

d. $241.29 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Help mearrow_forwardI want to answer this questionarrow_forwardThompson Manufacturing had sales revenue of $120,000,000, cost of goods sold of $50,000,000, sales and administrative costs of $15,000,000, depreciation expense of $12,000,000, and a tax rate of 25%. What is the operating cash flow for the year? If a company's sales revenue was $89.45 million, and their accounts receivable increased by $17.23 million, while also having prepaid expenses of $9.58 million, what was the cash received from customers? Options: a. $96.88 million b. $62.22 million c. $105.13 million d. $88.49 millionarrow_forward

- Give me answerarrow_forwardNot aiarrow_forwardGreen Valley Farms had sales revenue of $95,000,000, cost of goods sold of $45,000,000, sales and administrative costs of $10,000,000, depreciation expense of $8,000,000, and a tax rate of 28%. What is the operating cash flow for the year? A company reported $145.78 million in sales revenue, with accounts receivable increasing by $29.87 million. Additionally, the company made a one-time credit sale adjustment of $6.45 million. How much cash did they receive from customers? Options: a. $175.32 million b. $119.33 million c. $129.78 million d. $136.42 millionarrow_forward

- Give me answerarrow_forwardSheryl’s Shipping had sales last year of $16,000. The cost of goods sold was $7,700, general and administrative expenses were $2,200, interest expenses were $1,700, and depreciation was $2,200. The firm’s tax rate is 21%. What are earnings before interest and taxes? What is net income? What is cash flow from operations?arrow_forwardFor the past year, Kayla, Inc., has sales of $46,382, interest expense of $3,854, cost of goods sold of $16,659, selling and administrative expense of $11,766, and depreciation of $6,415 . If the tax rate is 35 percent, what is the operating cash flow?arrow_forward

- For the past year, Kayla, Incorporated, has sales of $46,967, interest expense of $4,088, cost of goods sold of $17,184, selling and administrative expense of $12,051, and depreciation of $6,850. If the tax rate is 21 percent, what is the operating cash flow?arrow_forwardhe Brenmar Sales Company had a gross profit margin (gross profits÷sales) of 34 percent and sales of $8.3 million last year. 79 percent of the firm's sales are on credit, and the remainder are cash sales. Brenmar's current assets equal $1.5 million, its current liabilities equal a. If Brenmar's accounts receivable equal $563,000, what is its average collection period? b. If Brenmar reduces its average collection period to 25 days, what will be its new level of accounts receivable? c. Brenmar's inventory turnover ratio is 8.9 times. What is the level of Brenmar's inventories? $303,100, and it has $104,400 in cash plus marketable securities.arrow_forwardConsider the following operating results for the past year for Sanitation Inc.: Sales = $22,561 Depreciation = $1,390 Interest Expense = $1,120 Costs $16,530 Tax Rate = 21 percent What was the company's operating cash flow (OCF)? =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning