EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

not use ai please

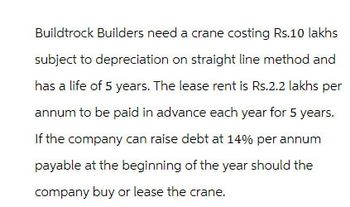

Transcribed Image Text:Buildtrock Builders need a crane costing Rs.10 lakhs

subject to depreciation on straight line method and

has a life of 5 years. The lease rent is Rs.2.2 lakhs per

annum to be paid in advance each year for 5 years.

If the company can raise debt at 14% per annum

payable at the beginning of the year should the

company buy or lease the crane.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A construction company can purchase a used backhoe for $90,000 and spend $450 per day in operating costs. The equipment will have a 5 -year life then sell it at salvage for $3,000. Alternatively, the company can lease the equipment for $800 per day. How many days per year must the company use the equipment in order to justify its purchase at an interest rate of 6% per year.arrow_forwardThe Company owns a machine with a value of $50,000 and a 5-year useful life. The estimated salvage value in five years is $10,000. The number of payments will be five (5) and the first payment is due immediately. The remaining payments are due at the end of each of the next four years. Assume your client desires a 10% rate of return. What amount of payment should be specified in the lease contract? Consider the salvage value. When you consider the salvage value, in Excel, the future value is a negative number, and the present value is positive. State your answer without commas or dollar signs, and no decimals.arrow_forwardA construction company can purchase a used backhoe for $90,000 and spend $450 per day in operating costs. The equipment will have a 5-year life with no salvage value. Alternatively, the company can lease the equipment for $800 per day. How many days per year must the company use the equipment in order to justify its purchase at an interest rate of 8% per yeararrow_forward

- Mauer Mining Company leases a special drilling press with annual payments of $100,000. The contract calls for rent payments at the beginning of each year for a minimum of 6 years. Mauer Mining can buy a similar drill for $490,000, but it will need to borrow the funds at 10%. a. Determine the present value of the lease payments at 10%. b. Should Mauer Mining lease or buy this drill?arrow_forwardA bulldozer can be purchased for $380,000 and used for 6 years, when its salvage value is 15% of the first cost. Alternatively, it can be leased for $60,000 a year. (Remember that lease payments occur at the start of the year.) The firm’s interest rate is 12%. (a) What is the interest rate for buying versus leasing? Which is the better choice? (b) If the firm will receive $65,000 more each year than it spends on operating and maintenance costs, should the firm obtain the bulldozer? What is the rate of return for the bulldozer using the best financing plan?arrow_forwardAn investor is considering buying a property for shillings 500,000. The cost of land is 20% of the purchase price. The building will however be depreciated over 40 years on a straight-line basis. The investor will take a loan of 50% of the purchase price at 10% per annum payable monthly for 20 years . The net operating income for the next 2 years is sh 40000 and sh 50000 . The property can be sold for 600,000 at the end of year 2. The tax on current income is 30% of the capital gain tax is 15% of price appreciation and 30% on price depreciation recapture.Required:Calculate the after tax equity IRR. IS THE PROJECT VIABLE ASSUMING THE INVESTOR HAS A REQUIRED RATE OF RETURN OF 15%.arrow_forward

- A manufacturer can lease a machine for 7 years at $3,000 per quarter, payable at the beginning of each quarter. Alternatively, they can purchase the machine for $78,000 and sell it for $8,700 in 7 years. The cost of capital is 6.2% compounded annually. a. What is the present value of the cost: (enter a positive value accurate to the nearest dollar) i) of the lease option? $ ii) of the purchase option? $ b. Should the manufacturer purchase or lease? O Purchase since Purchase PV is higher than Lease PV O Lease since Lease PV is higher than Purchase PV O Lease since Purchase PV is lower than Lease PV O Purchase since Lease PV is lower than Purchase PV Lease since Lease PV is lower than Purchase PV Purchase since Lease PV is higher than Purchase PV Submit Questionarrow_forwardBird Wing Bedding can lease an asset for 4 years with payments of $16,000 due at the beginning of the year. The firm can borrow at a 6% rate and pays a 25% federal-plus-state tax rate. The lease qualifies as a tax-oriented lease. What is the cost of leasing?arrow_forwardVishuarrow_forward

- The Olsen Company has decided to acquire a new truck. One alternativeis to lease the truck on a 4-year contract for a lease payment of $10,000 per year, withpayments to be made at the beginning of each year. The lease would include maintenance.Alternatively, Olsen could purchase the truck outright for $40,000, financing with a bankloan for the net purchase price, amortized over a 4-year period at an interest rate of 10%per year, payments to be made at the end of each year. Under the borrow-to-purchasearrangement, Olsen would have to maintain the truck at a cost of $1,000 per year, payableat year-end. The truck falls into the MACRS 3-year class. The applicable MACRS depreciationrates are 33%, 45%, 15%, and 7%. The truck has a salvage value of $10,000, which is theexpected market value after 4 years, at which time Olsen plans to replace the truck regardlessof whether the firm leases the truck or purchases it. Olsen has a federal-plus-state taxrate of 40%.a. What is Olsen’s PV cost of…arrow_forwardMunabhaiarrow_forwardA manufacturer can lease a machine for 6 years at $3,680 per quarter, payable at the beginning of each quarter. Alternatively, they can purchase the machine for $76,000 and sell it for $8,700 in 6 years. The cost of capital is 9.1% compounded annually. a. What is the present value of the cost: (enter a positive value accurate to the nearest dollar) i) of the lease option? ii) of the purchase option? GAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT