Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

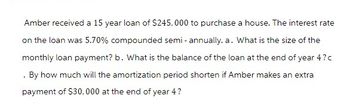

Transcribed Image Text:Amber received a 15 year loan of $245,000 to purchase a house. The interest rate

on the loan was 5.70% compounded semi-annually. a. What is the size of the

monthly loan payment? b. What is the balance of the loan at the end of year 4?c

. By how much will the amortization period shorten if Amber makes an extra

payment of $30,000 at the end of year 4?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sarah secured a bank loan of $155,000 for the purchase of a house. The mortgage is to be amortized through monthly payments for a term of 15 years, with an interest rate of 3%/year compounded monthly on the unpaid balance. She plans to sell her house in 10 years. How much will Sarah still owe on her house? (Round your answer to the nearest cent.)$arrow_forwardReggie availed of a deferred payment scheme from a bank that gave her an option to pay ₱5,500 monthly for 2 years. The first payment is due after 3 months. How much is the present value of the loan if the interest rate is 12% converted monthly?arrow_forwardAnushka and Benicio borrowed $47,000 at 7% compounded semi-annually as a second mortgage loan against their current home. Repayment amount is $9,400 at the end of every year. a. How many payments are required to repay the loan? Number of payments b. Use the given information to complete the amortization table below. Determine the missing values for the first two payment intervals, the last two payment intervals, and the totals. Report results to the nearest cent. Payment Number 0 1 2 ⠀ : N-1 N Total Amount Paid ($) 9,400.00 9,400.00 ⠀ ⠀ 9,400.00 Interest Paid ($) Principal Repaid ($) Outstanding Balance ($) 47,000.00 0.00arrow_forward

- Ma. Nochna Pula borrowed $10,000 at 6% annual compound interest. She agreed to repay the loan with five equal annual payments at end of each year. How much is the annual payment?arrow_forwardA borrower has a 30-year mortgage loan for $200,000 with an interest rate of 6% APR compounded monthly and level monthly payments. At the end of year 10, she unexpectedly won a lottery and received an after-tax cash of $10,000. She used that cash to pay down the principal of her mortgage loan and will keep paying the same monthly payment till she pays off the mortgage loan. How many more months will she has to payarrow_forwardMs. C took a loan of $150,000 at a rate of 7 percent. She can pay equal installments of $25,000 at the end of each year. In how many years she can repay the loan if? Required: Calculate the approximate number of years over which she can repay the loan amount.arrow_forward

- Natalia will owe $6,050 to repay a personal loan she took out to go on vacation. The loan was for a term of 10 months at 5.2% ordinary interest. What was the original amount of her loan?arrow_forwardFreddy agreed to make quarterly payments of $781.25 for 4 years on a loan of $10,000. What simple interest rate is he paying?arrow_forwardBeatrice takes out a 7 year loan of $5000. The interest rate is 4.5%. What are Beatrice's monthly payments? Suppose after 5 years Beatrice decides to pay off the remaining balance of the loan. What is the payoff amount?arrow_forward

- Lily borrows USD200,000 for 30 years at 6% annually. She agrees to make annual payments of USD12,000 for the first 10 years, and USD12,000 + P for the next 20 years. By answering the following questions correct to two decimal places, a. Find P. b. Find the outstanding loan balance at the end of 5 years. c. Find the outstanding loan balance at the end of 20 years. d. Find the total of interest amount paid of the loan over 30 years.arrow_forwardAnthony planned to buy a house but could afford to pay only $9,000 at the end of every 6 months for a mortgage with an interest rate of 5.70% compounded semi-annually for 25 years. She paid $30,000 as a down payment. a. What was the maximum amount she could afford to pay for a house? b. What was her total amount spent for the house through the mortgage period including the down payment (not taking the time-value of money into account)? c. What was the total amount of interest paid through the mortgage period?arrow_forwardVictoria buys a property for $2,500,000 by paying $500,000 down payment and the rest on a 15-year credit with a 12% annual capitalizable interest rate each month. How much of the 55th payment is used to cover interest?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education