Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

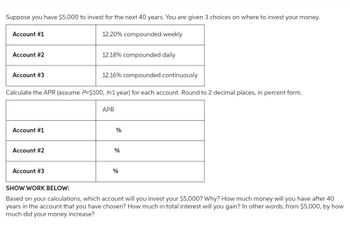

Transcribed Image Text:Suppose you have $5,000 to invest for the next 40 years. You are given 3 choices on where to invest your money.

Account #1

12.20% compounded weekly

Account #2

12.18% compounded daily

12.16% compounded continuously

Account #3

Calculate the APR (assume P-$100, t=1 year) for each account. Round to 2 decimal places, in percent form.

APR

Account #1

%

Account #2

%

Account #3

%

SHOW WORK BELOW:

Based on your calculations, which account will you invest your $5,000? Why? How much money will you have after 40

years in the account that you have chosen? How much in total interest will you gain? In other words, from $5,000, by how

much did your money increase?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You put $600 in the bank for 3 years at 15%. A. If Interest Is added at the end of the year, how much will you have in the bank after one year? Calculate the amount you will have in the bank at the end of year two and continue to calculate all the way to the end of the third year. B. Use the future value of $1 table In Appendix B and verify that your answer is correct.arrow_forwardSuppose that you deposited $5,999 at the end of each year in a Roth IRA account earning an annual rate of 5.01% for the next 15 years. How much would be on deposit at the end of the 15th year? In the space below, please indicate what the following variables are (enter answers to four decimal places and be mindful as to whether the variable is a positive or negative number): 1. PV 2. FV 3. Rate % 4. Periods 5. Paymentarrow_forwardSuppose you deposit $1,751.00 into an account today that earns 5.00%. It will take ___ years for the account to be worth $2,806.00. Answer format: Number: Round to: 2 decimal places.arrow_forward

- i need the bottom portion of this.arrow_forwardYou deposit $5100 in an account earning 4% compound interest for 3 years. Find the future value and the interest earned for each of the following compounding frequencies. Round all answers to two decimal places where applicable. Enter positive values for the Interest Earned. (For this question: 1 year = 365 days, including leap years) Frequency Semiannually Daily > Next Question (P/Y = C/Y) N Future Value FA $ Interest earnedarrow_forwardFind the amount of interest paid on on a $800 Investment that earns 4.9% simple annual interest for 30 days. In this problem, use the Bankers' Rule, which stipulates that 1 year 360 days. Round to the nearest cent (two decimal places.) Sarrow_forward

- Find the final amount of money in an account if $1,400 is deposited at 2% interest compounded weekly and the money is left for 9 years. The final amount is $ . Round answer to 2 decimal placesarrow_forwardYou initially invest $400 in a savings account that pays a yearly interest rate of 3%. (a) Write a formula for an exponential function giving the balance in your account as a function of the time since your initial investment. (Let B be the account balance in dollars and t be the number of years since the initial investment.) 8(t)= dollars (b) What monthly interest rate best represents this account? Round your answer to three decimal places. % (c) Calculate the decade growth factor. (Round your answer to two decimal places.) (d) Use the formula you found in part (a) to determine how long it will take for the account to reach $536. (Round your answer to the nearest whole number.) yr Explain how this is consistent with your answer to part (c), At the end of one decade, there will be $ where the account reaches $536 at the end of This --Select-- o the answer found above years,arrow_forwardSuppose you invest $1,000.00 in an account with an annual interest rate of 6% compounded monthly (6%÷÷12 = 0.5% each month). At the end of each month, you deposit $275.00 into the account.Use this information to complete the table below. Round to the nearest cent in each step as needed. Month Prior Balance 0.5% Intereston Prior Balance Monthly Deposit Ending Balance 0 $1,000.00 1 $1,000.00 $275.00 2 $275.00 $1,561.40 3 $1,561.40 $275.00 4 $9.22 $275.00arrow_forward

- Suppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forwardSuppose you want to have $600,000 for retirement in 25 years. Your account earns 4% interest. How muc would you need to deposit in the account each month? Submit Question /course/showcalendar.php?cid=179278 Searcharrow_forwardYou want to receive $275 at the end of every three months for 5 years. Interest is 5.7% compounded quarterly. (a) How much would you have to deposit at the beginning of the 5-year period? (b) How much of what you receive will be interest? Question content area bottom Part 1 (a) The deposit is $enter your response here. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Part 2 (b) The interest is $enter your response here. (Round the final answer to the nearest cent as needed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College