Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

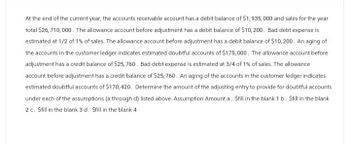

Transcribed Image Text:At the end of the current year, the accounts receivable account has a debit balance of $1,935,000 and sales for the year

total $26,710,000. The allowance account before adjustment has a debit balance of $10,200. Bad debt expense is

estimated at 1/2 of 1% of sales. The allowance account before adjustment has a debit balance of $10,200. An aging of

the accounts in the customer ledger indicates estimated doubtful accounts of $175,000. The allowance account before

adjustment has a credit balance of $25,760. Bad debt expense is estimated at 3/4 of 1% of sales. The allowance

account before adjustment has a credit balance of $25,760. An aging of the accounts in the customer ledger indicates

estimated doubtful accounts of $170, 420. Determine the amount of the adjusting entry to provide for doubtful accounts

under each of the assumptions (a through d) listed above. Assumption Amount a. Still in the blank 1 b. Sfill in the blank

2 c. Sfill in the blank 3 d. Sfill in the blank 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto Parts had an accounts receivable balance of $31,800 and a balance in the allowance for doubtful accounts of $2,980 (credit). During the year, Tennyson had credit sales of $624,300, collected accounts receivable in the amount of $602,700, wrote off $18,600 of accounts receivable, and had the following data for accounts receivable at the end of the period: Required: 1. Determine the desired post adjustment balance in allowance for doubtful accounts. 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 3. Compute bad debt expense. 4. Prepare the adjusting entry to record bad debt expense.arrow_forwardTonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit sales will be uncollectible. Allowance for Doubtful Accounts has a credit balance of 275. Prepare the adjusting entry at year-end for the estimated bad debt expense. (a) Based on an aging of its accounts receivable, Kyles Cyclery estimates that 3,200 of its year-end accounts receivable will be uncollectible. Allowance for Doubtful Accounts has a debit balance of 280 at year-end. Prepare the adjusting entry at year-end for the estimated uncollectible accounts.arrow_forwardAt the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in Allowance for Doubtful Accounts. Martel has now been in business for three years and wants to base its estimate of uncollectible accounts on its own experience. Assume that Martel Co.s adjusting entry for uncollectible accounts on December 31, 20-2, was a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts of 25,000. (a) Estimate Martels uncollectible accounts percentage based on its actual bad debt experience during the past two years. (b) Prepare the adjusting entry on December 31, 20-3, for Martel Co.s uncollectible accounts.arrow_forward

- Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardLast year, Tobys Hats had net sales of 45,000,000 and cost of goods sold of 29,000,000. Tobys had the following balances: Refer to the information for Tobys on the previous page. Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardAt the end of the current year, the accounts receivable account has a debit balance of $1,191,000 and sales for the year total $13,510,000. a. The allowance account before adjustment has a debit balance of $16,100. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a debit balance of $16,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $51,500. c. The allowance account before adjustment has a credit balance of $8,600. Bad debt expense is estimated at 3/4 of 1% of sales. d. The allowance account before adjustment has a credit balance of $8,600. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $71,400. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. 51,450 X a. b. $ C. $ d. $ Feedbackarrow_forward

- At the end of the current year, the accounts receivable account has a debit balance of $1,117,000 and sales for the year total $12,670,000. a. The allowance account before adjustment has a credit balance of $15,100. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a credit balance of $15,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $48,300. c. The allowance account before adjustment has a debit balance of $6,400. Bad debt expense is estimated at 1/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $6,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $53,100. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. b. $ C. $ d. $arrow_forwardAt the end of the current year, the accounts receivable account has a debit balance of $2,700,000 and sales for the year total $32,400,000. The allowance account before adjustment has a debit balance of $27,100. Bad debt expense is estimated at ½ of 1% of sales. The allowance account before adjustment has a debit balance of $27,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $128,000. The allowance account before adjustment has a credit balance of $17,900. Bad debt expense is estimated at ¾ of 1% of sales. The allowance account before adjustment has a credit balance of $17,900. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $279,000Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above.arrow_forwardAt the end of the current year, the accounts receivable account has a debit balance of $1,935,000 and sales for the year total $26,710,000. a. The allowance account before adjustment has a debit balance of $10,200. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a debit balance of $10,200. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $175,000. c. The allowance account before adjustment has a credit balance of $25,760. Bad debt expense is estimated at 3/4 of 1% of sales. d. The allowance account before adjustment has a credit balance of $25,760. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $170,420. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. 123,350 X a. b. C. d. $ $arrow_forward

- Providing for doubtful accounts At the end of the current year, the accounts receivable account has a debit balance of $1,935,000 and sales for the year total $26,710,000. The allowance account before adjustment has a debit balance of $10,200. Bad debt expense is estimated at 1/2 of 1% of sales. The allowance account before adjustment has a debit balance of $10,200. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $175,000. The allowance account before adjustment has a credit balance of $25,760. Bad debt expense is estimated at 3/4 of 1% of sales. The allowance account before adjustment has a credit balance of $25,760. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $170,420. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. Assumption Amount a. $fill in the blank 1 b. $fill in the blank 2 c. $fill in the blank…arrow_forwardProviding for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,835,000 and sales for the year total $25,690,000. The allowance account before adjustment has a debit balance of $12,500. Bad debt expense is estimated at 1/2 of 1% of sales. The allowance account before adjustment has a debit balance of $12,500. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $162,000. The allowance account before adjustment has a credit balance of $26,810. Bad debt expense is estimated at 3/4 of 1% of sales. The allowance account before adjustment has a credit balance of $26,810. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $171,200. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above.arrow_forwardProviding for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,051,000 and sales for the year total $11,910,000. The allowance account before adjustment has a credit balance of $14,200. Bad debt expense is estimated at 1/2 of 1% of sales.The allowance account before adjustment has a credit balance of $14,200. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $45,400.The allowance account before adjustment has a debit balance of $8,600. Bad debt expense is estimated at 1/4 of 1% of sales.The allowance account before adjustment has a debit balance of $8,600. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $71,400. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning