FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

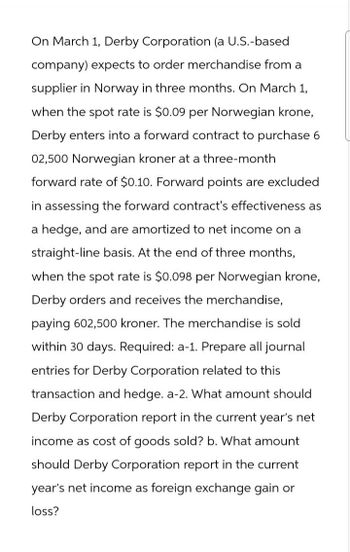

Transcribed Image Text:On March 1, Derby Corporation (a U.S.-based

company) expects to order merchandise from a

supplier in Norway in three months. On March 1,

when the spot rate is $0.09 per Norwegian krone,

Derby enters into a forward contract to purchase 6

02,500 Norwegian kroner at a three-month

forward rate of $0.10. Forward points are excluded

in assessing the forward contract's effectiveness as

a hedge, and are amortized to net income on a

straight-line basis. At the end of three months,

when the spot rate is $0.098 per Norwegian krone,

Derby orders and receives the merchandise,

paying 602,500 kroner. The merchandise is sold

within 30 days. Required: a-1. Prepare all journal

entries for Derby Corporation related to this

transaction and hedge. a-2. What amount should

Derby Corporation report in the current year's net

income as cost of goods sold? b. What amount

should Derby Corporation report in the current

year's net income as foreign exchange gain or

loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On March 1, Derby Corporation (a U.S.-based company) expects to order merchandise from a supplier in Norway in three months. On March 1, when the spot rate is $0.28 per Norwegian krone, Derby enters into a forward contract to purchase 617,500 Norwegian kroner at a three-month forward rate of $0.29. Forward points are excluded in assessing the forward contract's effectiveness as a hedge, and are amortized to net income on a straight-line basis. At the end of three months, when the spot rate is $0.286 per Norwegian krone, Derby orders and receives the merchandise, paying 617,500 kroner. The merchandise is sold within 30 days. Required: a-1. Prepare all journal entries for Derby Corporation related to this transaction and hedge. a-2. What amount should Derby Corporation report in the current year's net income as cost of goods sold? b. What amount should Derby Corporation report in the current year's net income as foreign exchange gain or loss? Complete this question by entering your…arrow_forwardOn March 1, Derby Corporation (a U.S.-based company) expects to order merchandise from a supplier in Norway in three months. On March 1, when the spot rate is $0.45 per Norwegian krone, Derby enters into a forward contract to purchase 527,500 Norwegian kroner at a three-month forward rate of $0.490. Forward points are excluded in assessing the forward contract's effectiveness as a hedge, and are amortized to net income on a straight-line basis. At the end of three months, when the spot rate is $0.482 per Norwegian krone, Derby orders and receives the merchandise, paying 527,500 kroner. The merchandise is sold within 30 days. What amount(s) does Derby report in net income as a result of this cash flow hedge of a forecasted transaction and the related purchase and sale of merchandise? Cost of goods sold of $254,255 plus foreign exchange loss of $4,220 Cost of goods sold of $258,475 Cost of goods sold of $237,375 plus foreign exchange loss of $21,100 Cost of goods…arrow_forwardOn March 1, Derby Corporation (a U.S.-based company) expects to order merchandise from a supplier in Norway in three months. On March 1, when the spot rate is $0.33 per Norwegian krone, Derby enters into a forward contract to purchase 635,000 Norwegian kroner at a three-month forward rate of $0.360. Forward points are excluded in assessing the forward contract's effectiveness as a hedge, and are amortized to net income on a straight-line basis. At the end of three months, when the spot rate is $0.351 per Norwegian krone, Derby orders and receives the merchandise, paying 635,000 kroner. The merchandise is sold within 30 days. What amount(s) does Derby report in net income as a result of this cash flow hedge of a forecasted transaction and the related purchase and sale of merchandise? Multiple Choice Cost of goods sold of $222,885 plus foreign exchange loss of $5,715 Cost of goods sold of $228,600 less foreign exchange gain of $19,050 Cost of goods sold of $209,550…arrow_forward

- Icebreaker Company (a U.S.-based company) sells parts to a foreign customer on December 1, 2020, with payment of 16,000 dinars to be received on March 1, 2021. Icebreaker enters into a forward contract on December 1, 2020, to sell 16,000 dinars on March 1, 2021. The forward points on the forward contract are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis. Relevant exchange rates for the dinar on various dates are as follows: Date Spot Rate Forward Rate(to March 1, 2021) December 1, 2020 $ 3.40 $ 3.475 December 31, 2020 3.50 3.600 March 1, 2021 3.65 N/A Icebreaker must close its books and prepare financial statements at December 31. a-1. Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency receivable, prepare journal entries for the sale and foreign currency forward contract in U.S. dollars. a-2. What is the impact on…arrow_forwardIcebreaker Company (a U.S.-based company) sells parts to a foreign customer on December 1, 2020, with payment of 14,000 dinars to be received on March 1, 2021. Icebreaker enters into a forward contract on December 1, 2020, to sell 14,000 dinars on March 1, 2021. The forward points on the forward contract are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis. Relevant exchange rates for the dinar on various dates are as follows: Date Spot Rate Forward Rate(to March 1, 2021) December 1, 2020 $3.20 $ 3.275 December 31, 2020 3.30 3.400 March 1, 2021 3.45 N/A Icebreaker must close its books and prepare financial statements at December 31. a-1. Assuming that Icebreaker designates the forward contract as a cash flow hedge of a foreign currency receivable, prepare journal entries for the sale and foreign currency forward contract in U.S. dollars. a-2. What is the impact on 2020 net income? a-3.…arrow_forwardPlease help me to solve this problemarrow_forward

- Alman Company sold pharmaceuticals to a Swedish company for 200,000 kronor (SKr) on April 20, with settlement to be in 60 days. On the same date, Alman entered into a 60-day forward contract to sell 200,000 SKr at a forward rate of 1 SKr= $0.167 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were Mc Graw Mill 7 April 20 June 19 Required: a. Prepare all necessary entries related to the foreign transaction and the forward contract. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Skr 1 <-50.170 SKr 1 $0.165 View transaction list Journal entry worksheet < 1 2 Record the sales on account. 3 4 5 6 7 Note: Enter debits before credits. Note: Enter debits before credits. Date April 20 Record entry Effects on net income General Journal Clear entry Debit Credit View general journal D b. What is the effect on net income of Alman's use of the forward…arrow_forwardMaplewood Inc. sells lumber to a number of clients around the world. On December 1, 2020 the company shipped some lumber to a client in the U.S. The selling price was established at US$600,000 with payment to be received on March 1, 2021. On December 3, 2020 Maplewood Inc. entered into a hedge by way of a forward contract with a Canadian Bank at the 90-day forward rate of US$1 = CDN$1.275. Hedge accounting is not applied. Maplewood Inc. received the payment from its American client on March 1, 2021. The company's year-end is on December 31. The two-month forward rate for US dollars was CDN$1.255 on that date. Selected spot rates were as follows: December 1, 2020: US$1 = CDN$1.2355 December 3, 2020: US$1 = CDN$1.2355 December 31, 2020: US$1 = CDN$1.2455 March 1, 2021: US$1 = CDN$1.2480 Required: Part a) Prepare a partial Balance Sheet for Maplewood Inc. on December 31, 2020. Part b) Prepare the journal entries on March 1, 2021.arrow_forwardOn November 1, 2020, Cheng Company (a U.S.-based company) forecasts the purchase of goods from a foreign supplier for 130,000 yuan. Cheng expects to receive the goods on April 30, 2021, and make immediate payment. On November 1, 2020, Cheng enters into a six-month forward contract to buy 130,000 yuan. The company properly designates the forward contract as a cash flow hedge of a forecasted foreign currency transaction. Forward points are excluded in assessing hedge effectiveness and are amortized to net income using a straight-line method on a monthly basis over the life of the contract. The following U.S. dollar–Yuan exchange rates apply: Date Spot Rate Forward Rate (to April 30, 2021) November 1, 2020 $ 0.24 $ 0.225 December 31, 2020 0.23 0.200 April 30, 2021 0.21 N/A As expected, Cheng receives goods from the foreign supplier on April 30, 2021, and pays 130,000 yuan immediately. Cheng sells the imported goods in the local market in May 2021. Prepare all journal entries, including…arrow_forward

- A U.S. firm exports products to a German firm and will receive payment of €200,000 in three months. On June 1, the spot rate of the euro was $1.12, and the 3-month forward rate was $1.10. On June 1, the firm negotiated a forward contract with a bank to sell €200,000 forward in three months. The spot rate of the euro on September 1 is $1.15. the firm will receive $_______ for the euros. 224,000 230,000 220,000 200,000arrow_forwardOn June 1, gons-care ltd (a U.S.-based company) received an order to sell goods to a foreign customer at a price of 130,000 francs. Parker-Mae will ship the goods and receive payment in three months, on September 1. On June 1, Parker-Mae purchased an option to sell 130,000 francs in three months at a strike price of $0.96. The company designated the option as a fair value hedge of a foreign currency firm commitment. The option's time value is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income. The fair value of the firm commitment is measured by referring to changes in the spot rate (discounting to present value is ignored). Relevant exchange rates and option premiums for the franc are as follows: Date Spot Rate Put Option Premium for September 1 (strike price $0.96) June 1 $ 0.96 $ 0.020 June 30 0.90 0.072 September 1 0.85 N/A Parker-Mae Corporation must close its books and prepare its second-quarter financial statements on June 30.…arrow_forwardOn June 1, Parker-Mae Corporation (a U.S.-based company) received an order to sell goods to a foreign customer at a price of 165,000 francs. Parker-Mae will ship the goods and receive payment in three months, on September 1. On June 1, Parker-Mae purchased an option to sell 165,000 francs in three months at a strike price of $1.04. The company designated the option as a fair value hedge of a foreign currency firm commitment. The option's time value is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income. The fair value of the firm commitment is measured by referring to changes in the spot rate (discounting to present value is ignored). Relevant exchange rates and option premiums for the franc are as follows: Date Spot Rate Put Option Premiumfor September 1(strike price $1.04) June 1 1.04 0.020 June 30 0.98 0.072 September 1 0.93 N/A Parker-Mae Corporation must close its books…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education