ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

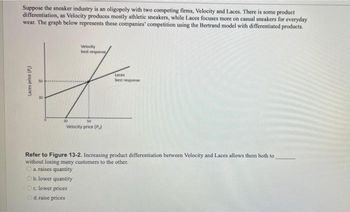

Transcribed Image Text:Suppose the sneaker industry is an oligopoly with two competing firms, Velocity and Laces. There is some product

differentiation, as Velocity produces mostly athletic sneakers, while Laces focuses more on casual sneakers for everyday

wear. The graph below represents these companies' competition using the Bertrand model with differentiated products.

Laces price (P)

50

30

30

30

Velocity price (P)

Velocity

best response

c. lower prices

d. raise prices

Laces

best response

Refer to Figure 13-2. Increasing product differentiation between Velocity and Laces allows them both to

without losing many customers to the other.

O a. raises quantity

b. lower quantity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. Four firms (A, B, C, and D) play a pricing game (i.e. Bertrand). Each firm (i) may choose any price Pi from 0 to ¥, with the goal of maximizing its own profit. Firms A and B have MC = 10, while firms C and D have MC = 20. The firms serve a market with the demand curve Q = 100 – P. All firms produce exactly the same product, so consumers purchase only from the firm with the lowest price. If multiple firms have the same low price, consumers divide their quantities evenly among the low-priced firms. Assume the firms choose price simultaneously. a. There are many equilibria in this simultaneous-move pricing game. Provide one equilibrium combination of prices, and argue that no firm has a unilateral incentive to deviate from these prices. Now assume firm A chooses price first. Firm B observes this choice and then chooses its own price second. Firm C chooses price third, and firm D chooses price last. b. Again, there are many equilibria in this sequential-move pricing game.…arrow_forwardSuppose that two mining companies, Australian Minerals Company (AMC) and South African Mines, Inc. (SAMI), control the only sources of a rare mineral used in making certain electronic components. The companies have agreed to form a cartel to set the (profit-maximizing) price of the mineral. Each company must decide whether to abide by the agreement (i.e., not offer secret price cuts to customers) or not abide (i.e., offer secret price cuts to customers). If both companies abide by the agreement, AMC will earn an annual profit of $36 million and SAMI will earn an annual profit of $24 million from sales of the mineral. If AMC does not abide and SAMI abides by the agreement, then AMC earns $48 million and SAMI earns $6 million. If SAMI does not abide and AMC abides by the agreement, then AMC earns $12 million and SAMI earns $36 million. If both companies do not abide by the agreement, then AMC earns $18 million and SAMI earns $12 million. Complete the following payoff matrix using the…arrow_forwardAnswer the following questions regarding the matrix below, which represents the strategic interaction between the two largest movie production studios, Universal Pictures and 20th Century Fox. They are each deciding the release dates for their own summer blockbuster action movies. They can release their movies in June, July, or August. Because of limited demand for going to the movies, each firm would generally rather release their movies earlier than later. Similarly, they would rather not release their movies at the same time, as it dilutes the demand for their movies. The matrix form of the game is as follows: Universal June July August June 5,5 4,6 7,8 Fox July 6,4 5,5 4,6 August 8,6 6,5 5,4 d) Suppose Universal and Fox make their decisions simultaneously. Are there any Nash equilibria? If so, what are they? Show your work. e) Suppose they move sequentially, and that Fox moves first. First set up the game tree. What will be the equilibrium path of the subgame perfect Nash…arrow_forward

- Company A and Company B are competing oligopolists. Both companies are considering increasing or maintaining their prices. The payoff matrix shows the profits of the companies in millions based on their possible actions.. Company A Increase Price Company B Increase Price Maintain Price $50, $40 Maintain Price $55, $45 $35, $30 $60, $35 The government offers a $5 million subsidy to maintain current pricing. What is the expected outcome of the new payoff matrix, given the subsidy? The Nash equilibrium changes, and both companies will maintain their prices The Nash equilibrium changes, and both companies will increase their prices. The Nash equilibrium remains the same, and both companies will increase their prices Company A will increase its price, while Company B maintains its price. Company A will maintain its price, while Company B increases its pricearrow_forwardFill in the blanks: Consider the department store market that has two rivals, DJs and Myer. Each firm can choose to either Advertise or Not Advertise. These choices are made simultaneously. The payoffs are given below in the following figure.arrow_forwardScenario: Payoff Matrix for Firms X and Y The following payoff matrix depicts the profits for the only two firms in this oligopolistic industry. Firm Y High Price Firm X's profit: $1,800 Firm Y's profit: $2,800 Firm X's profit: $2,000 Firm Y's profit: $2,400 Low Price Firm X's profit: $1,600 Firm Y's profit: $2,500 Firm X's profit: $1800 Firm Y's profit: $2,200 Low Price Firm X High Price Reference: Ref 14-22 (Scenario: Payoff Matrix for Firms X and Y) In the scenario Payoff Matrix for Firms X and Y, if firm X and firm Y wish to maximize joint profit: X chooses Low Price and Y chooses Low Price, i.e L, L H, L O X chooses Low Price and Y chooses High Price, i.e L, H Н, Нarrow_forward

- Assume the following scenarios. First, identify their nature of the situation (that is, which type of game and situation is implied) and second, discuss each one of them in terms of outcomes and possible solutions. (a) A cartel has a collective interest in restricting output to earn a monopoly profit. At the same time, cartel members can increase their individual profits by cheating on the cartel, that is, exceeding their quotas. (b) Abnormally cold winter temperatures bring the threat of a shortage of natural gas for heating buildings and homes.arrow_forwardQUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forwardAndy and Cathy are in the sporting good industry. Andy has developed a new lightweight soccer goal and is trying to decide whether to sell it at a high price or a low price. Selling the good at a higher price will provide higher profits but might entice Cathy to develop and sell a competing lightweight soccer goal. A lower price could deter entry from Cathy. After Andy sets his price, Cathy must decide to enter the market for the new lightweight soccer goal or not. Assume that both Andy and Cathy must make at least $5,000 to make the investment worthwhile. Which price will Andy charge? O high price ● low price What will Cathy do as a result of Andy's choice? O Cathy will enter the market. O Cathy will not enter the market. Indicate each person's final profit. Andy's profit: $ 7000 Cathy's profit: $ 7000 Andy: charges high or low price Andy charges the high price Andy charges the low price Cathy: enter or do not enter Cathy: enter or do not enter Cathy enters Cathy does not enter Cathy…arrow_forward

- The figure below shows the market conditions facing two firms, Brooks, Inc., and Spring, Inc., in the domestic market for large utility pumps. Each firm has constant long-run costs, so that MC0 = AC0. As competitors in a duopoly, there are a number of models to determine output and prices. Assume that the Bertrand duopoly model applies, so that they both set price equal to their marginal cost. Initial output in this market will be 16,000 per year (this is split between the two firms), at a price of $300. Suppose that Brooks, Inc. and Spring, Inc. form a joint venture, River Company, whose utility pumps replace the output sold by the parent companies in the domestic market. Assuming that River Company operates as a monopolist and that its costs equal MC0 = AC0, what is: (f) Assume River Company’s formation leads to technological advances that yield cost reductions, such that MC1 = AC1. Compared to the original equilibrium (in (a)), what is the net effect of River Company’s…arrow_forwardAP CollegeBoard Test Booklet Unit 4 Problem Set Include correctly labeled diagrams, if useful or required, in explaining your answers. A correctly labeled diagram must have all axes and curves clearly labeled and must show directional changes. If the question prompts you to “Calculate," you must show how you arrived at your final answer. Use the graph provided below to answer parts (a)-(e). Marginal Cost Average Total Cost Average Variable Cost 108 100 55 Demand 0 10 21 31 44 57 77 Quantity Marginal Revenue BigMed, a profit-maximizing firm, has a patent on a medical device, making it the only producer of that device. The graph above shows BigMed's demand, marginal revenue, average total cost, average variable cost, and marginal cost curves. (a) Calculate BigMed's total revenue if the firm produces the allocatively efficient quantity. Show your work. (b) Starting at a price of $100, if BigMed were to increase the price by 2%, will the quantity demanded decrease by more than 2%, by less…arrow_forwardProblem # 4 Idea Inc. is a small publishing company operating in the college and textbook market, which is one of the most profitable segments for book publishers. Idea Inc. has a cost of producing, handling, and shipping of about $30 for each additional book. The publisher’s overall marketing and promotion spending (set annually) accounts for an average cost of about $10 per book. Idea Inc.’s best-selling game theory text has a demand curve: P = 200 - Q, where Q denotes yearly sales (in thousands) of books. For this text Idea Inc. pays a $10 per book royalty to the author. a) Determine the profit-maximizing output and price for the game theory text. b) A rival publisher has raised the price of its best-selling game theory text by $20. One option is to exactly match this price hike and so exactly preserve your level of sales. Do you endorse this price increase? (Explain briefly why or why not.) c) To save significantly on fixed costs, Idea Inc. plans to contract out the actual printing…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education