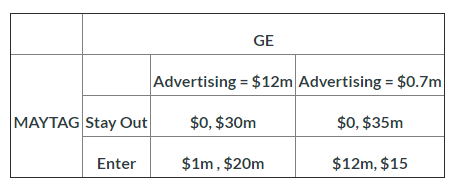

Suppose that GE is trying to prevent Maytag from entering the market for high efficiency clothes dryers. Even though high efficiency dryers are more costly to produce, they are also more profitable as they command sufficiently higher prices from consumers. The following payoffs table shows the annual profits for GE and Maytag for the advertising spending and entry decisions that they are facing.

Based on this information, can GE successfully prevent Maytag from entering this market by increasing its advertising levels? What is the equilibrium outcome in this game?

Suppose that an analyst at GE is convinced that just a little bit more advertising by GE, say another $2m, would be sufficient to deter enough customers from buying Maytag, thus, yield less than $0 profits for Maytag in the event it enters. Suppose that spending an extra $2m on advertising by GE will reduce its expected profits by $1.5 m, regardless of whether Maytag enters or stays out. Would this additional spending on advertising achieve the effect of deterring Maytag from entering? Should GE pursue this option?

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Two firms in a Cournat oligpoly each have the best response function, such that the optimal quantity for each individual firm to produce must satisfy the equation: Q-27-Q/2 What quantity Q will each firm produce in the market? Type your answer...arrow_forwardSuppose Eckerd Pharmacy is the only pharmacy in a particular market, but CVS Pharmacy is thinking about entering the market. Absent entry, Eckerd Pharmacy can maximize profits by producing a small quantity. However, by producing a large quantity, Eckerd Pharmacy can attempt to deter entry by reducing prices and, consequently, profits. Eckerd Pharmacy must choose how much to produce first and then CVS Pharmacy will choose whether to enter the industry. The strategies and corresponding profits for Eckerd (E) and CVS Pharmacy (C) are depicted in the decision tree to the right. What is the Nash equilibrium of the game? OA Eckerd Pharmacy will choose the small quantity and CVS Pharmacy will not enter OB. Eckerd Pharmacy will choose the large quantity and CVS Pharmacy will enter. C. Eckerd Pharmacy will choose the large quantity and CVS Pharmacy will not enter. OD. Eckerd Pharmacy will choose the small quantity and CVS Pharmacy will enter Small Quantity, Large Quantity U Enter Stay Out Enter…arrow_forwardQuestion 2 Consider a Cournot duopoly, the firms face an (inverse) demand function: Pb=268-10Qb. The marginal cost for firm 1 is given by mc1= 6Q The marginal cost for firm 2 is given by mc2=4Q (Assume firm 1 has a fixed cost of $102 and firm 2 had a fixed cost of $104 What are the profits of firm 2? (hint 567.26) How much consumer surplus is created by industry transactions? (hint 1333.34) Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line ...arrow_forward

- Suppose that there are two firms producing a homogenous product and competing in Cournot fashion and let the market demand be given by Q = 360-- Assume for simplicity that each firm operates with zero total cost. Suppose that two firms collude. How much more profit each firm can obtain relative to Cournot competition? 8000 14400 7200 16000arrow_forwardThe firms in a duopoly produce differentiated products. The inverse demand for Firm 1 is The inverse demand for Firm 2 is and P₁ = 52-9₁-0.592. Each firm has a marginal cost of m= $1 per unit. Solve for the Nash-Cournot equilibrium quantities. The Cournot equilibrium quantities are (Enter your responses rounded to two decimal places.) P₂ = 100-92-0.5q1₁. 91 = units 92 units. =arrow_forward6arrow_forward

- . What is the Nash equilibrium in this advertising war?a) Coke advertises; Pepsi does not advertise b) Pepsi advertises; Coke does not advertise c) neither of them advertises d) both of them advertise Explain the reasons for your answer? Was any other equilibrium position possible? advertise do not advertise pepsi-advertise coke profit=$50B coke profit =$20B PEPSI profit =$50B pepsi profit =$100B do not advertise coke profit =$100B coke profit =$80B pepsi profit =$20B PEPSI PROFIT =$80 Barrow_forwardhere are two firms in the market, Pepsi and Coke. Strategies: Low price (price promotion, LP), Medium price (regular price, RP), high price (new price strategy, HP). Payoffs: Coke, Pepsi’s Net Profits; LP, LP: $1.4m, $1.2m; LP, RP: $3.1m, $0.6m; LP, HP: $3.9m, -$1.3m. RP, LP: $1.3m, $1.8m; RP, RP: $2.0m, $1.8m; RP, HP: $4.3m, $-0.3m. HP, LP: -$1.2m, $3.6m; HP, RP: $0.8m, $3.9m; HP, HP: $2.8m, $2.5m. In this game, the NE is (are): (HP, HP) (LP, LP) and (HP, HP) (LP, LP) There is no NE in this game (RP, RP)arrow_forwardContrast the three primary competitive pricing strategies.arrow_forward

- Suppose that GE is trying to prevent Maytag from entering the market for high efficiency clothes dryers. Even though high efficiency dryers are more costly to produce, they are also more profitable as they command sufficiently higher prices from consumers. The following payoffs table shows the annual profits for GE and Maytag for the advertising spending and entry decisions that they are facing. GE MAYTAG Advertising = $12m Advertising = $0.7m Stay Out $0, $30m $0, $35m Enter $1m , $20m $12m, $15 Based on this information, can GE successfully prevent Maytag from entering this market by increasing its advertising levels? What is the equilibrium outcome in this game? Suppose that an analyst at GE is convinced that just a little bit more advertising by GE, say another $2m, would be sufficient to deter enough customers from buying Maytag, thus, yield less than $0 profits for Maytag in the event it enters. Suppose that spending an extra $2m on advertising…arrow_forwardConsider a Cournot duopoly, the firms face an (inverse) demand function: Pb = 530 - 17 Qb.The marginal cost for firm 1 is given by mc1 = 12 Q.The marginal cost for firm 2 is given by mc2 = 9 Q. (Assume firm 1 has a fixed cost of $ 157 and firm 2 has a fixed cost of $ 113 .) How much DWL does the duopoly cause ? Answer: 500.67arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education