ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

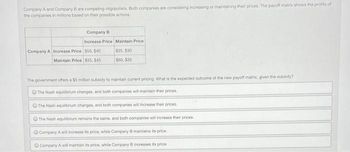

Transcribed Image Text:Company A and Company B are competing oligopolists. Both companies are considering increasing or maintaining their prices. The payoff matrix shows the profits of

the companies in millions based on their possible actions..

Company A Increase Price

Company B

Increase Price Maintain Price

$50, $40

Maintain Price $55, $45

$35, $30

$60, $35

The government offers a $5 million subsidy to maintain current pricing. What is the expected outcome of the new payoff matrix, given the subsidy?

The Nash equilibrium changes, and both companies will maintain their prices

The Nash equilibrium changes, and both companies will increase their prices.

The Nash equilibrium remains the same, and both companies will increase their prices

Company A will increase its price, while Company B maintains its price.

Company A will maintain its price, while Company B increases its price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A small town has a duopoly in its tattoo market. Two firms, "Thread the Needle" and "Ink about it" are both competitors. Daily profit is listed in the payoff matrix. The green payouts belong to "Thread the Needle" and the red, "Ink about it". In this game, what is the Nash Equilibrium? A Thread the Needle: don't advertise, Ink about it: don't advertise B Thread the Needle: don't advertise, Ink about it: advertise C Thread the Needle: advertise, Ink about it: advertise D Thread the Needle: advertise, Ink about it: don't advertisearrow_forwardThe payoff matrix represents hypothetical profits (in thousands of dollars) that could be earned by two kumquat producers who have formed a cartel. Each seller must decide whether to abide by the quota or to exceed the quota. What is true of this game? Fun Fruit Exceed Quota Abide by Quota The Qinyang Terrace Exceed Quota FF = 15 FF = 10 QT = 15 QT = 22 Abide by Quota FF = 22 FF = 18 QT = 10 QT = 18 A. Both firms will choose to abide by the quota because that's where industry profit is maximized. B. Only Qinyang Terrace has a dominant strategy. C. Neither firm has a dominant strategy. D. The Nash equilibrium will occur where industry profit is the lowest possible number of all four outcomes. O E. If Fun Fruit decides to follow a maximin strategy, it will abide by the quota.arrow_forwardConsider the following simultaneous-move game that represents the payoffs from different advertising campaigns (low, medium, and high spending) for two political candidates that are running for a particular office. The values in the payoff matrix represent the share of the popular vote earned by each candidate is given below. The equilibrium in dominant strategies Candidate A-low Candidate A-medium Candidate A-high Ois (low. low). O is (medium, medium). O is (high, high). O is (medium, high) O does not exist. Candidate B-low Candidate B-medium Candidate B-high 50, 50 60,40 80, 20 40, 60 50, 50 65, 35 20, 80 35,65 50, 50arrow_forward

- 2 firms are engaged in Cournot competition; firm A faces the cost curveCA(yA)=40yAand firm Bfaces the cost curveCB(yB)=40yB. The inverse market demand curve isP(y)=100y, whereyrepresents market level of output. a)Define the Cournot game. b)In 1 or 2 sentences explain why a firm has no incentive to deviate from the Cournot Nash equilibrium(holding their opponent’s strategy constant). c)Find the Cournot Nash Equilibrium. d)Now suppose instead of playing their strategies at the same time, firm A moves first and then firm B moves second(sequentialgame).Does firm A earn higher profits in this game or the game in part c)?arrow_forwardThe world has changed a bit. Microsoft and Google could still either cooperate or compete in the market for social media video software currently captured by Tik Tok, but their payoffs have changed. The table below shows their profits in billions of USD in each scenario. Use your mouse to point and click on the Nash equilibrium outcome(s). [There may be more than one so make sure you work out all the best response strategies]. Microsoft Cooperate 3,3 4,0 Cooperate O Don't cooperate O Google Don't cooperate O O 0,4 1,1arrow_forwardPlease no written by hand and no image (Bertrand's duopoly game with discrete prices) Consider the variant of the example of Bertrand's duopoly game in this section in which each firm is restricted to choose a price that is an integral number of cents. Take the monetary unit to be a cent, and assume that c is an integer and a>c+!. Is (c,c) a nash equilibrium of this game? Is there any other nash equilibrium?arrow_forward

- Solve the attahment.arrow_forwardSuppose that there are only two firms in a market in which demand is given by p = 64 - Q, where Q is the total production of the two firms. Each firm can choose either a low level of output, qL = 15, or a high level of output, qH = 20. The unit cost of production for both firms is $4. Write down the normal-form representation of the game in which the strategic variable for each firm is the quantity of output and the firms make their choices simultaneously. Find the pure strategy Nash equilibrium of this game (quantities produced and market price).arrow_forwardEconomics Alpha and Beta are the only firms selling gyros in the upscale town of Delphi. Each firm must decide on whether to offer a discount to students to compete for customers. If one firm offers a discount but the other does not then the firm that offers the discount will increase its profit. The figure shows the payoff matrix for this game. Alpha Offer Don't offer Alpha eams S60,000 Alpha eams $20,000 What is the Nash equilibrium in this game? Offer Bota earns $60,000 Bota earns $100.000 O A. There is no Nash equilibrium Beta Alpha earns $100.000 Alpha earms $80,000 O B. Beta offers a student discount but Alpha does not Don't OC. Both Alpha and Beta offer a student discount Beta eams $20,000 Beta earns $80,000 offer O D. Alpha offers a student discount but Beta does notarrow_forward

- Duopoly: 1. Consider a duopoly game with 2 firms. The market inverse demand curve is given by P(Q) = 120-Q, where Q = 9₁ +9₂ and q; is the quantity produced by firm i. The firm's long run total costs are given by C₁(9₁)=2q₁ and C₂(92)=92, respectively. a. Determine the Nash Equilibrium for Cournot competition, in which firms compete based on quantity. What is each firm's best response as a function of the other firm's output? Graph these best response functions in on the same graph. Compute the associated payoffs for each firm. b. Determine the Nash Equilibrium for Bertrand competition, in which firms compete based on price and stand ready to meet market demand at that price. What is each firm's best response as a function of the other firm's price? Graph these best response functions in on the same graph. Compute the associated payoffs for each firm. Game Tharrow_forwardImagine that there are two snowboard manufacturers (FatSki and WideBoard) in the market. Each firm can either produce ten or twenty snowboards per day. The table below (see attached) shows the profit per snowboard for each firm that will result given the joint production decisions of these two firms. Draw the game payoff matrix for this situation. Does either player have a dominant strategy? If so, what is it? What is the Nash equilibrium solution and how many boards should each player produce each day? Since FatSki and WideBoard must play this game repeatedly (i.e. make production decisions every day), what strategy would you advise them to play in order to maximize their payoff over the long term?arrow_forwardImagine a small town with three car repair shops competing for a limited number of customers. Explain why the three shops working together to keep their prices high is unlikely to be a Nash equilibrium.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education