Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

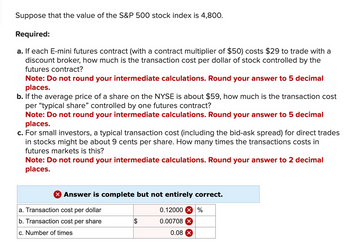

Transcribed Image Text:Suppose that the value of the S&P 500 stock index is 4,800.

Required:

a. If each E-mini futures contract (with a contract multiplier of $50) costs $29 to trade with a

discount broker, how much is the transaction cost per dollar of stock controlled by the

futures contract?

Note: Do not round your intermediate calculations. Round your answer to 5 decimal

places.

b. If the average price of a share on the NYSE is about $59, how much is the transaction cost

per "typical share" controlled by one futures contract?

Note: Do not round your intermediate calculations. Round your answer to 5 decimal

places.

c. For small investors, a typical transaction cost (including the bid-ask spread) for direct trades

in stocks might be about 9 cents per share. How many times the transactions costs in

futures markets is this?

Note: Do not round your intermediate calculations. Round your answer to 2 decimal

places.

X Answer is complete but not entirely correct.

a. Transaction cost per dollar

b. Transaction cost per share

c. Number of times

$

0.12000 x %

0.00708

0.08 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- solve a,b,c and d please. round to nearest dollararrow_forwardYou have written a call option on Walmart common stock. The option has an exercise price of $81, and Walmart’s stock currently trades at $79. The option premium is $1.60 per contract. a. How much of the option premium is due to intrinsic value versus time value? b. What is your net profit if Walmart’s stock price decreases to $77 and stays there until the option expires? c. What is your net profit on the option if Walmart’s stock price increases to $87 at expiration of the option and the option holder exercises the option?arrow_forward21. If Fincorp stock trades in a dealer market with bid price of 55.25 and asked price of 55.50, a) Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b) Suppose you have submitted an order to sell at market. At what price will your trade be executed? c) Suppose you have submitted a limit order to sell at $55.62. What will happen? d) Suppose you have submitted a limit order to buy at $55.37. What will happen?arrow_forward

- The margin requirement on the S&P 500 futures contract is 16%, and the stock index is currently 2,100. Each contract has a multiplier of $50 a. How much margin must be put up for each contract sold? Margin b. If the futures price falls by 1% to 2,079, what will happen to the margin account of an investor who holds one contract? (Input the amount as a positive value.) Margin account by c-1. What will be the investor's percentage return based on the amount put up as margin? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Percentage return ed ok at rices c-2. What would be the current cash balance in the margin account? Cash balancearrow_forwardH3. Show proper step by step calculationarrow_forwardIn a financial market a stock is traded with a current price of 50. Next period the priceof the stock can either go up with 30 per cent or go down with 25 per cent. Risk-freedebt is available with an interest rate of 8 per cent. Also traded are European optionson the stock with an exercise price of 45 and a time to maturity of 1, i.e. they maturenext period.i) Find prices of Arrow-Debreu securities.arrow_forward

- Suppose you buy one SPX call option contract with a strike of 2200. At maturity, the S&P 500 index is at 2218. What is your net gain or loss if the premium you paid was $14? (Input the amount as a positive value.)arrow_forwardSuppose that the value of the S&P 500 stock index is 2,000.a. If each E-mini futures contract (with a contract multiplier of $50) costs $25 to trade with a discount broker, how much is the transaction cost per dollar of stock controlled by the futures contract?b. If the average price of a share on the NYSE is about $40, how much is the transaction cost per “typical share” controlled by one futures contract?c. For small investors, a typical transaction cost per share in stocks directly is about 10 cents per share. How many times the transactions costs in futures markets is this?arrow_forwardF2 please help....arrow_forward

- 3 You are given the following information on some company's stock, as well as the risk- free asset. Use it to calculate the price of the call option written on that stock, as well as the price of the put option. (HINT: You should use the Black-Scholes formula!) (Do not round intermediate calculations and round your final answers to 2 decimal places, e.g., 32.16.) Today's stock - $77 price = Exercise price = $75 Risk-free rate = Option maturity = 5 months Standard deviation of annual stock returns Call price Put price $ $ 3.4% per year, compounded continuously = 59% per year 3.61 x 0.56 X 1arrow_forwardSuppose that on 27 October 2022, Wall Street Journal in New York presents the following price for 27 March 2023 call options on Microsoft stock (in $ USA) strike 75 80 85 price 11 7.96 5.5 while the annual interest rate is 4% per year. On this date (27 October 2022) the Microsoft stock was trading at $81.625. Suppose we decide that the volatility of the market is 30%. Should you buy the call option as the European one with strike price $80? Justify your answer.arrow_forwardSuppose the 6-month Mini S&P 500 futures price is 1,345.99, while the cash price is 1,335.81. What is the implied difference between the risk-free interest rate and the dividend yield on the S&P 500? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Implied difference %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education