Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

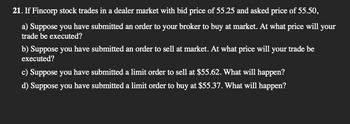

Transcribed Image Text:21. If Fincorp stock trades in a dealer market with bid price of 55.25 and asked price of 55.50,

a) Suppose you have submitted an order to your broker to buy at market. At what price will your

trade be executed?

b) Suppose you have submitted an order to sell at market. At what price will your trade be

executed?

c) Suppose you have submitted a limit order to sell at $55.62. What will happen?

d) Suppose you have submitted a limit order to buy at $55.37. What will happen?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 35. Let p(S, T, X) denote the value of a European put on a stock selling at S dollars, with time to maturity T, and with exercise price X, and let P(S, T, X) be the value of an American put. a. Evaluate p(0, T, X). b. Evaluate P(0, T, X). c. Evaluate p(S, T, 0). d. Evaluate P(S, T, 0). e. Compare your answers to parts (a) and (b). What do you conclude about the possibility that American puts may be exercised early?arrow_forwardWhat are the disadvatages of selling call options LEAP ,which allows the seller to sell shares at a higher strike price?arrow_forwardA three-step binomial tree with terminal stock prices being 1.103, 0.875, 0.695, and 0.552. At time 0, if you have the insider information that at the maturity the stock price will be 0.875. Then, will the option premium at time 0 still be same as if you don't have this information, please choose from the answers below? a) Option premium is irrelevant to the private information (about the underlying) that option holder possesses. b) As in that case, the risk neutral probability of the impossible sample paths become zero.arrow_forward

- Which of the following characteristics accurately describes the stock market? An active market that determines the price of a firm’s shares A fixed-income market where participants buy and sell debt securities The bid-ask spread in a dealer market represents the profit that a dealer would make on a transaction involving a security. Which of the following statements best describes the bid-ask spread? The difference between the closing price of the security and the opening price of the security on the day of the transaction. The sum of the price at which a dealer is willing to buy a security and the price at which a dealer is willing to sell it. The difference between the price at which a dealer is willing to buy a security and the price at which a dealer is willing to sell it. Fernando, a trader, wants to buy 1,000 shares of XYZ stock, while a second trader, Ally, is willing to sell 1,500 shares of the same stock. Unfortunately, Fernando…arrow_forward19. Which is the correct bar chart if the stock's opening price is P15, closing price is P25, highest price is P30, and lowest price is P10? a. d.arrow_forwardSuppose the current ABC stock price is $50 and an option trader speculates this price will fall below $50 soon. Which set of actions is the best strategy for him? buy the Stock and write a $50 call buy $40 call and short $60 call short $40 put and buy $60 put buy $50 call and buy $50 putarrow_forward

- Suppose that a hedge fund enters a market order to immediately sell 1600 shares. Compute the execution price for this trade. Top of the limit order book Price Shares 3400 103.12 2000 102.92 1600 102.71 500 102.50 Asks 100 102.30 Bids 200 102.10 700 101.89 1600 101.69 2100 101.48 3200 101.28 A. The exection price for immediately selling 1600 shares is $102.71 per share. B. The exection price for immediately selling 1600 shares is $101.83 per share. OC.The exection price for immediately selling 1600 shares is $102.10 per share. D. The exection price for immediately selling 1600 shares is $102.50 per share. O E. The exection price for immediately selling 1600 shares is $101.69 per share. O F. The exection price for immediately selling 1600 shares is $101.89 per share. G. The exection price for immediately selling 1600 shares is $102.30 per share.arrow_forward5. Explain and give appropriate use of the following option trading strategies along with their Payoff.: a. Spreads b. Straddles c. Strangles d. Covered Call and Protective Put. State Put-Call Parity theorem for European options. European put and call options with a strike price of Rs. 24 and expiry in 6-months are trading at Rs. 5.09 and Rs. 7.78, respectively. The current stock price is Rs. 20.37 with a risk-free interest rate continuously compounding equal to 7.48%. Is there an arbitrage opportunity? How can it be exploited?arrow_forwardUse the binomal option pricing model to estimate the Call price. Stock price (S) $120.00 Stock price up (Su) $170.00 Stock price down (Sd) $50.00 Strike price (K) $120.00 rf 1.0% Call price up (Cu) Call price down (Cd) D PV(B) Call price (C)arrow_forward

- Please advisearrow_forwardLike a share of stock, EFTs trade _____ A) on an exchange B) once per day C) at an average price and depending upon the broker used may be subject to a _____ A) front end load fee B) back end loan fee C) brokerage commissionarrow_forwardWhat is the difference between the long and the short positions in a contract for the future delivery of the S&P 500 stock index? If you expect stock prices to fall, do you buy or sell stock index futures?View Solution: What is the difference between the long and the shortarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education