Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

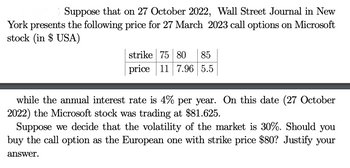

Transcribed Image Text:Suppose that on 27 October 2022, Wall Street Journal in New

York presents the following price for 27 March 2023 call options on Microsoft

stock (in $ USA)

strike 75 80 85

price 11 7.96 5.5

while the annual interest rate is 4% per year. On this date (27 October

2022) the Microsoft stock was trading at $81.625.

Suppose we decide that the volatility of the market is 30%. Should you

buy the call option as the European one with strike price $80? Justify your

answer.

Expert Solution

arrow_forward

Given,

| Stock Price S | $ 80.00 |

| Strike Price K | $ 81.625 |

| Volatility σ | 30.00% |

| Risk Free Rate r | 4.00% |

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The price of a stock, which pays no dividends, is $30 and the strike price of a three-year European call option on the stock is $27. The risk-free rate is 8% (continuously compounded). Which of the following is a precise lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound? Round your answer to 2 decimal places. a. $8.76 b. $8.70 c. $8.42 d. $8.57arrow_forwardSuppose that Stock XYZ is currently trading at $50 and does not pay any dividends. Using a binomial tree with two periods, we would like to price a European down-and-in call option written on this stock with a strike price of $40, barrier level of $48 and expiration date in three months. Assume that annual continuously compounded interest rate is 5% and the volatility of the stock is 20% per year. What is the price of the barrier option? 0.7.28 0.9.45 O101 O 322arrow_forwardA stock is currently priced at $42 and will move up by a factor of 1.23 or down by a factor of .91 each period over each of the next two periods. The risk-free rate of interest is 3 percent. What is the value of a put option with a strike price of $49? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Value of a put optionarrow_forward

- A.K. Scott’s stock is selling for $37 a share. A 3-month call on this stock with a strike price of $38 is priced at $2. Risk-free assets are currently returning 0.28 percent per month. a) What should be the price of a 3-month put option on this stock with a strike price of $38? b) Which of the two options is currently in the money and does that accord with your conclusions about their relative prices?arrow_forwardThe price of a stock, which pays no dividends, is $30 and the strike price of a three-year European call option on the stock is $27. The risk-free rate is 8% (continuously compounded). Which of the following is a precise lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound? Round your answer to 2 decimal places. Question 12Answer a. $8.76 b. $8.42 c. $8.57 d. $8.70arrow_forwardSuppose that call options on XYZ stock with time to expiration 3 months and strike price $90 are selling at an implied volatility of 30% ExxonMobil stock price is $90 per share, and the risk free rate is 4%. Required: a1 If you believe the true volatility of the stock is 32%, would you want to buy or sell call options? a2-Now you want to hedge your option position against changes in the stock price. How many shares of stock will you hold for each option contract purchased or sold?arrow_forward

- i need the answer quicklyarrow_forwardThe price of a stock, which pays no dividends, is $30 and the strike price of a two-year European call option on the stock is $25. The risk-free rate is 8% (continuously compounded). Which of the following is a precise lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound? Round your answer to 2 decimal places. a. $8.42 b. $8.76 c. $8.57 d. $8.70arrow_forwardIBM stock currently sells for 84 dollars per share. Over 8 months the price will either go up by 7.5 percent or down by -3.0 percent. The risk-free rate of interest is 4.5 percent continuously compounded. A call option with strike price 83 and maturity of 8 months has a delta of 0.82766. What is the value of this call option? 0.62579 O2.6708 O4.0788 2.9324 O4.3788arrow_forward

- A stock price is currently $52. Its volatility is 35% p.a. . The risk-free interest rate is 8% p.a. with continuous compounding. What is the value of a 2-year European call option with a strike price of $55, using a 2-step binomial tree? Without doing any calculations, explain what would happen to the value of the option if the stock volatility decreasesarrow_forwardOne month ago you purchased a put option on the S&P500 Index with an exercise price of $900.00. Today is the expiration date, and the index is at $896.46. a. Will you exercise the option? b. What will be your profit?arrow_forwardSuppose that a stock is currently trading at £ 38, and that the current prices for European call and put options on this stock with maturity T 10 years and identical strike price K are equal to £30 and £35, respectively. Assuming that interest is compounded annually at rate 4%, determine the strike price to the nearest pence. Do not type in the pound sign. =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education