FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

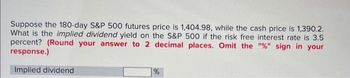

Transcribed Image Text:Suppose the 180-day S&P 500 futures price is 1,404.98, while the cash price is 1,390.2.

What is the implied dividend yield on the S&P 500 if the risk free interest rate is 3.5

percent? (Round your answer to 2 decimal places. Omit the "%" sign in your

response.)

Implied dividend

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- D3(arrow_forwardQuestion 2. What is the price of a European call option on a non-dividend paying stock when the stock price is $52, the strike price is $50, the risk-free interest rate is 12% per annum, the volatility is 30% per annum, and the time to maturity is 3 months?arrow_forwardThe price of an American call on a non-dividend paying stock is $2. The stock price is $15.50, the strike price is $15, the expiration date is in 6 months, and the risk free interest rate is 4% continuously compounded. Which of the following is correct, regarding the option premium of an American put on the stock with a strike price of $15 and an expiration date in 6 months? a. The upper bound for the price of the American put is $14.70 and the lower bound is $0 b. The lower bound for the price of the American put is 0 and the upper bound is $1.50 c. The lower bound for the price of the American put is $1.20 and the upper bound is $1.50arrow_forward

- 15. Find the implied volatility (to 2 decimals, for example, σ = 8.23%) of a Put option with a time to expiration of 11 months and a price of $6.13 2 The stock is currently trading at $47. The riskless rate is 2% per annum, and the strike/exercise price of the option is $50. 3 Hint: compute the Put price using the same formula as in exercise 4, as a function of the volatility σ. Then use Solver to change the volatility cell in order to obtain a price of $6.13 4 5 6 d1 = -0.0614997 7 d2 = 8 9 10 N(d1)= 11 N(d2)= 12 13 N(-d1)= 14 N(-d2)= 15 16 17 18 P = 27.41 19 So= 47 K= 50 r = 2% σ = 2.74% T= 0.91666667arrow_forwardSuppose you buy one SPX call option contract with a strike of 2200. At maturity, the S&P 500 index is at 2218. What is your net gain or loss if the premium you paid was $14? (Input the amount as a positive value.)arrow_forwardWhat is the price of a $25 strike call? Assume S = $23.50, \sigma 0.24, г 0.055, the stock pays a 2.5%continuous dividend and the option expires in 45 days?arrow_forward

- A stock is trading at $300 per share and a call option with strike $300 is priced $10 per share. If hedge ratio is 0.4, what's the call option elasticity? A. -20 B. -18 C. 15 D. 12arrow_forwardAssume the below information to answer the following question. Last Price A. 14.2% B. 18.9% OC. 16.8% OD. 11.0% Company Coupon Maturity Ford (F) 11.0 July 31, 2014 Based on the above table, what is the last yield for this bond? Last Yield 65.50 ? EST EST VOL. Spread UST (000s) 104 10 5,100 }arrow_forwardSuppose a non-dividend paying stock is trading at $175 per share and has a volatility of 20%. What is the fair price of a 3-month European call option with a strike price of $190 per share using 1 binomial period? Assume the risk-free rate is 1%. Round to the nearest $0.01.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education