Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give me answer

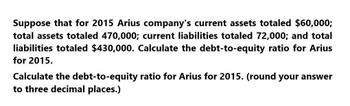

Transcribed Image Text:Suppose that for 2015 Arius company's current assets totaled $60,000;

total assets totaled 470,000; current liabilities totaled 72,000; and total

liabilities totaled $430,000. Calculate the debt-to-equity ratio for Arius

for 2015.

Calculate the debt-to-equity ratio for Arius for 2015. (round your answer

to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Problem: Accountingarrow_forwardAt May 31, 2016, FedEx Corporation reported the following amounts (in millions) in its financial statements: 2016 2015 Total Assets $ 13,200 $ 12,300 Total Liabilities 8,316 7,503 Interest Expense 300 300 Income Tax Expense 480 290 Net Income 1,080 1,000 Required: 1.Compute the debt-to-assets ratio and times interest earned ratio for 2016 and 2015. (Round your answers to 2 decimal places.)arrow_forwardUse the information provided from Sapphire Ltd to calculate the ratios for 2022 (expressed to two decimal places) that would reflect each of the following:1. The profit of the company relative to sales after deducting the cost of sales.2. The ability of the company to profitably utilize its capital, which includes both debt and equity.3. The proportion of the total assets that are financed by total debt.4. The ability of the company to repay its short-term debts under distress conditions, on the assumption that inventories would have no value at all.5. The portion of the company's profit that is allocated to each outstanding ordinary share.6. An indication of the percentage of profit that has been put back into the company.arrow_forward

- Based on the following information as of December 31,2020, compute the company’s debt-equity ratio. Assume current liabilities are all interest-bearing. Round to nearest two decimal places. Current assets: 15 Non-current assets: 12 Current Liabilities: 22 Non-current Liabilities: 4 Debt to Equity Ratio = ?arrow_forwardIf you are told that LSJ Company accounts payable at December 31, 2023 represents 15% of the company's total liabilities on their balance sheet…this would represent an example of what type of analysis: a. Vertical Analysis b. Horizontal Analysis c. Ratio Analysisarrow_forwardFlounder Company has been operating for several years, and on December 31, 2017, presented the following balance sheet. FLOUNDER COMPANY BALANCE SHEET DECEMBER 31, 2017 Cash $20,900 Accounts payable $80,000 Receivables 117,000 Long-term notes payable 181,000 Inventory 75,000 Common stock (no par) 110,000 Plant assets (net) 354,000 Retained earnings 195,900 $566,900 $566,900 The net income for 2017 was $43,000. Assume that total assets are the same in 2016 and 2017.arrow_forward

- Some recent financial statements for Smolira Golf Corporation follow. Find the following financial ratios for Smolira Golf Corporation (use year-end figures rather than average values where appropriate): (Enter the profitability ratio answers as a percent rounded to 2 decimal places, e.g., 32.16. Round the remaining answers to 2 decimal places, e.g., 32.16.) 1. Long-term Solvency Ratios 2020 2021 Total debt ratio times times Debt-equity ratio times times Equity multiplier times times 2. Times interest earned times Cash coverage ratio times 3. Profitability Ratios Profit margin % Return on Assets % Return on Equity %arrow_forwardI need assistance on the following regarding the attached balance sheet and income statement: Required: a) Calculate the following financial ratios for 2016 and 2017 13. Debt-to-equity ratio 14. Times-interest-earned ratio 15. Operating-cash-flow-to-capital-expenditures ratioarrow_forwardCompute these values and ratios for 2021 and 2022. (Round Earnings per share to 2 decimal places, e.g. $2.78 and Current Ratio and Debt to assets ratio to 1 decimal place, e.g. 15.2. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)arrow_forward

- How much long-term debt did the firm have?arrow_forwardCalculate the following ratios for 2025 and 2026. (Round current ratio to 2 decimal places, e.g. 12.61, debts to assets and gross profit rate to 0 decimal places, e.g.12, and all other answers to 1 decimal place, e.g. 12.6%) Please show your work. 1. Current ratio 2. Debts to assets 3. Gross profit rate 4. Profit margin 5. Return on assets (Total assets at November 1, 2024, were $35,180) 6. Return on common stockholder's equity (Total common stockholders' equity at November 1, 2024, was $25, 180. Dividends on preferred stock were $16,800 in 2025 and $18,000 in 2026)arrow_forwardCalculate the following ratios for 2021 using working Excel formulas. Make sure to label each appropriately using the following cell (number of days, number of times, etc.) Round each answer to 2 decimal places (example: ROE of .1678 should display as 16.78%): Current Ratio Quick Ratio Debt to Equity Ratio Equity Multiplier Times Interest Earned Dividend Yield Inventory Turnover Days’ Sales in Inventory Receivables Turnover Days’ Sales in Receivables Total Asset Turnover Profit Margin Return on Assets Return on Equity P/E Ratio 2.Calculate Return on Equity (ROE) for 2021 using the Dupontarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning