Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

PPE

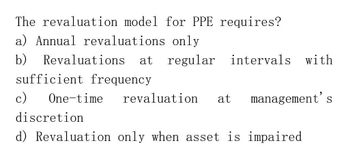

Transcribed Image Text:The revaluation model for PPE requires?

a) Annual revaluations only

b)

Revaluations at regular intervals with

sufficient frequency

c)

One-time revaluation at management's

discretion

d) Revaluation only when asset is impaired

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following methods should be used when the expected benefits to be received from an asset will decline each period? a. Straight-line b. Units-of-production c. Sum-of-the-years'-digits d. Compound-interestarrow_forwardThe optimal switch from declining balance depreciation to straight-line depreciation occurs when what condition is met? a. The first time the depreciation deduction from straight-line depreciation is greater than thesalvage value of the asset b. The first time the depreciation deduction from straight-line depreciation is less than would result if declining balance were continued c. The first time the depreciation deduction from straight-line depreciation is greater than would result if declining balance were continuedd. The asset is no longer in service.arrow_forward46. Evaluate the following statements: S1. In the sum-of-the-years'-digits method, residual value is not used in the computations of depreciation expense. S2. Straight-line depreciation assumes equal usefulness in each time period, and the periodic charge is not affected by asset productivity or efficiency variations. S3. The residual value of an asset is deducted from the depreciable base when calculating double-declining-balance depreciation. a. True, False, True b. False, True, False c. False, False, True d. False, False, False e. True, True, False f. True, True, True g. False, True, Truearrow_forward

- Why is depreciation expense recognized? Select one: a. To provide a better estimate of the market value of the depreciated assets. b. So that the balance sheet value of plant assets will more accurately reflect the replacement cost of the assets. c. To ensure that cash will be available at the end of the assets' useful life in order to replace it. d. To match the cost of the asset against the revenue using a reasonable allocation. method. Save AnswersNextarrow_forwardWhich of the following methods applies a declining depreciation rate each period to an asset's constant value? a.Double-declining-balance methodb.Straight-line methodc.Sum-of-the-years'-digits methodd.Units-of-production methodarrow_forwardWhat is the systematic periodic transfer of the cost of a fixed asset to an expense account during its expected useful life called (also thought of as the decline in usefulness of the fixed asset over time)? Group of answer choices fixing costing amortization depreciationarrow_forward

- A fixed asset's estimated value at the time it is to be retired from service is called market value book value carrying value residual valuearrow_forwardIn a replacement analysis, the market value of the currently owned asset a. does not impact the cash flows of the replacement asset(s) in the opportunity cost approach b. does not impact the cash flows of the current asset in the cash flow approach if the current asset is kept c. is treated as a salvage value for the current asset in the cash flow approach if the current asset is kept d. is added to the first cost of the replacement asset(s) in the opportunity cost approach.arrow_forwardRestrictive short-term financial policies with regard to current asset management include three basic actions. List and briefly describe each action.arrow_forward

- Under U.S. GAAP, what should be included in the calculation of depletion? Estimated future exploration costs O Estimated units that can be extracted O The number of units sold during the period O Interest costs to unwind the discount on restation costsarrow_forward4. The most appropriate definition of depreciation is: A. A means of determining the decrease in the market value of an asset over time B. A means of allocating the cost of an asset over a number of accounting periods C. A means of setting funds aside for the replacement of the asset D. A means of estimating the current value of the assetarrow_forwardExpected return and standard deviation a. What is the expected return of asset b?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning