Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Gibbs

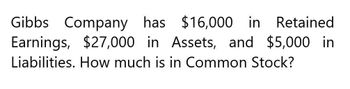

Transcribed Image Text:Gibbs Company has $16,000 in

Retained

Earnings, $27,000 in Assets, and $5,000 in

Liabilities. How much is in Common Stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lei Materials' balance sheet lists total assets of $1.05 billion, $127 million in current liabilities, $435 million in long-term debt, $488 million in common equity, and 54 million shares of common stock. If Lei's current stock price is $51.38, what is the firm's market-to-book ratio?arrow_forwardThe following information is available for the Oil Creek Corporation. Accounts Receivable $19,000 Sales $195,000 Current assets $36122 Total assets $147,000 Long term debt $48,000 Current liabilities $42311 Equity $50469 net income $11972 Number of shares outstanding 13035 Current stock price per share $14.81 What is the price to book value ratio?arrow_forwardPolinezo Industries' balance sheet reflects an equity of $650 million, the stock price is $90 per share, and its aggregate market value (MVA) is $60 million. Determine the common stock outstanding.arrow_forward

- (Market value analysis) Lei Materials' balance sheet lists total assets of $1.17 billion, $197 million in current liabilities, $435 million in long-term debt, $538 million in common equity, and 50 million shares of common stock. If Lei's current stock price is $54.48, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forwardFollow the Instructionarrow_forwardWhite Lily Company has prior year total assets of $7,111,885, current year total assets of $7,917,054, prior year shareholder equity $1,925,728, and current year shareholder equity of 2,717,735. What is its equity multiplier? Round the answer to two decimals.arrow_forward

- Given the following data for the Novak Corp.: Current liabilities $560 Long-term debt 460 Common stock 780 Retained earnings 200 Total liabilities & stockholders’ equity $2000 How would common stock appear on a common size balance sheet?arrow_forwardA company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forwardMitchell Co. has $1.1 million of debt, $2 million of preferred stock, and $1.8 million of common equity. What would be its weight on preferred stock?arrow_forward

- United Company provided the following: Cash, P600,000; Equity investments at Fair Value Through Profit or Loss, P800,000; Accounts Receivable (net), P3,500,000; Merchandise Inventory, P1,500,000; Share Capital, P5,000,000; Share Premium, P2,000,000, Retained Earnings, P500,000; Treasury Shares, P300,000. What amount should be reported as total shareholders' equity? A P5,600,000 B) P6,600,000 P7,200,000 D P6,400,000arrow_forwardA company has a net income of $865,000; it's weighted average common shares....arrow_forwardThe following information pertains to Sunland Company. Assume that all balance sheet amounts represent average balance figures. Total assets Stockholders' equity-common Total stockholders' equity Sales revenue Net income Number of shares of common stock Common dividends Preferred dividends What is Sunland's payout ratio? O 24.6%. O 9.6%. O 17.9%. O 37.9%. $355000 235000 294000 97000 21100 6000 5200 8500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning