FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I need assistance on the following regarding the attached

Required:

a) Calculate the following financial ratios for 2016 and 2017

13. Debt-to-equity ratio

14. Times-interest-earned ratio

15. Operating-cash-flow-to-capital-expenditures ratio

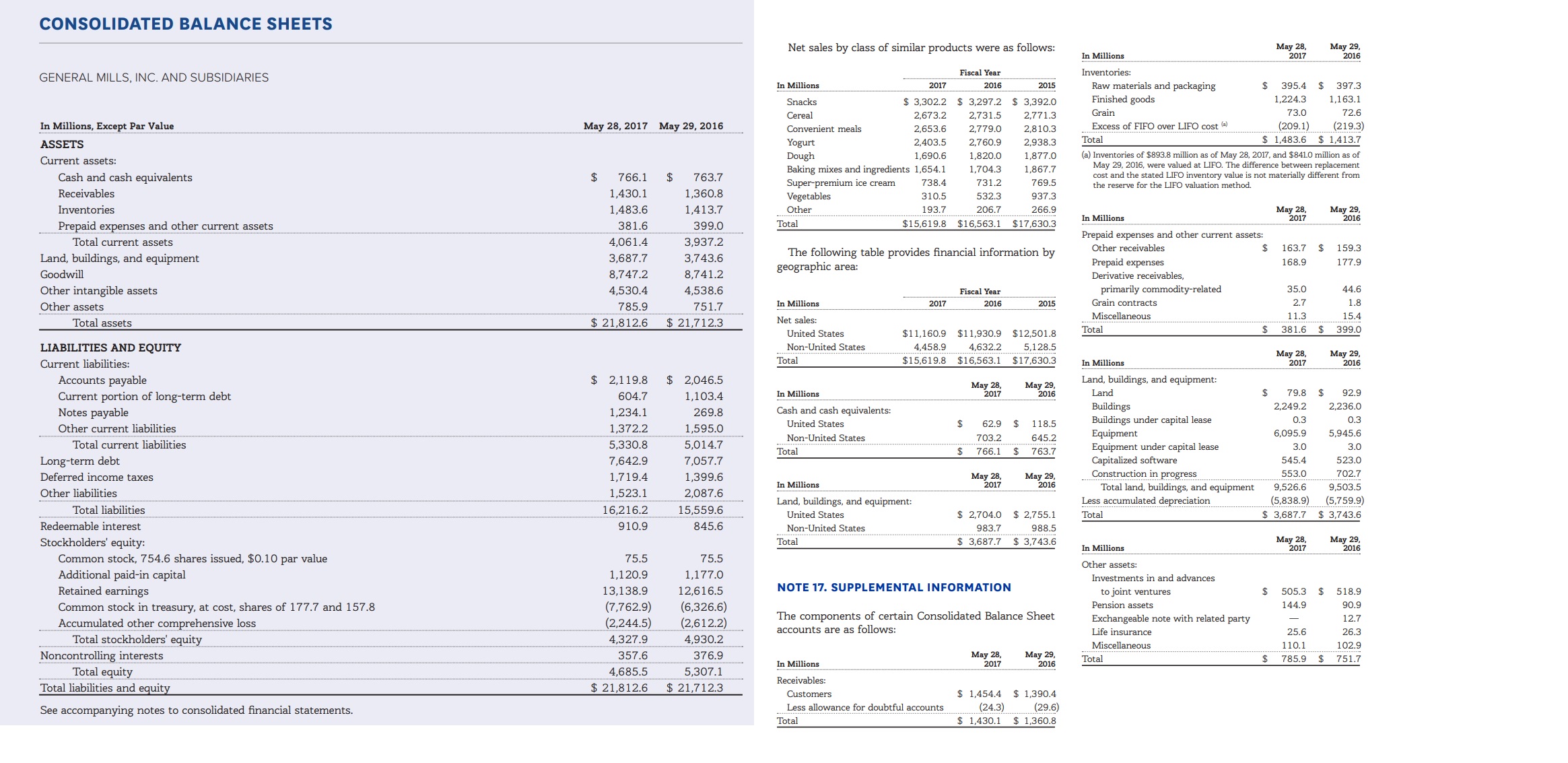

Transcribed Image Text:CONSOLIDATED BALANCE SHEETS

May 28,

2017

May 29,

2016

Net sales by class of similar products were as follows:

In Millions

Inventories:

Fiscal Year

GENERAL MILLS, INC. AND SUBSIDIARIES

Raw materials and packaging

Finished goods

In Millions

2017

2016

2015

395.4

397.3

1,224.3

1,163.1

$ 3,302.2 $ 3,297.2 $ 3,392.0

Snacks

Grain

73.0

72.6

Cereal

2,673.2

2,731.5

2,771.3

(209.1)

1,483.6 $1,413.7

(219.3)

In Millions, Except Par Value

May 29, 2016

Excess of FIFO over LIFO cost (a)

May 28, 2017

Convenient meals

2,653.6

2,779.0

2,810.3

Total

Yogurt

Dough

Baking mixes and ingredients 1,654.1

Super-premium ice cream

2,403.5

2,760.9

2,938.3

ASSETS

(a) Inventories of $893.8 million as of May 28, 2017, and $8410 million as of

May 29, 2016, were valued at LIFO. The difference between replacement

cost and the stated LIFO inventory value is not materially different from

the reserve for the LIFO valuation method.

1,690.6

1,820.0

1,877.0

Current assets:

1,867.7

1,704.3

Cash and cash equivalents

$

763.7

1,360.8

$

766.1

738.4

731.2

769.5

Receivables

1,430.1

Vegetables

310.5

532.3

937.3

Мay 29,

2016

Inventories

1,483.6

1,413.7

Мay 28,

2017

Other

193.7

206.7

266.9

In Millions

$15,619.8

$16,563.1 $17,630.3

Total

Prepaid expenses and other current assets

381.6

399.0

Prepaid expenses and other current assets:

Total current assets

4,061.4

3,937.2

163.7

Other receivables

159.3

The following table provides financial information by

geographic area:

Land, buildings, and equipment

3,687.7

3,743.6

Prepaid expenses

168.9

177.9

Goodwill

8,747.2

8,741.2

Derivative receivables,

primarily commodity-related

Grain contracts

Other intangible assets

35.0

44.6

4,530.4

4,538.6

Fiscal Year

2.7

1.8

In Millions

2017

2016

2015

Other assets

785.9

751.7

Miscellaneous

11.3

15.4

Net sales:

Total assets

$ 21,812.6

$ 21,712.3

381.6 $

Total

399.0

$11,160.9 $11,930.9 $12,501.8

United States

4,632.2

LIABILITIES AND EQUITY

Non-United States

4,458.9

5,128.5

May 28,

2017

Мay 29,

2016

$15,619.8 $16,563.1

$17,630.3

Total

In Millions

Current liabilities:

Land, buildings, and equipment

Accounts payable

$ 2,119.8

2,046.5

Мay 28,

2017

May 29,

2016

$

Land

79.8

92.9

In Millions

Current portion of long-term debt

Notes payable

604.7

1,103.4

2,236.0

Buildings

Buildings under capital lease

Equipment

Equipment under capital lease

Capitalized software

Construction in progress

Total land, buildings, and equipment

Less accumulated depreciation

2,249.2

Cash and cash equivalents:

1,234.1

269.8

0.3

0.3

United States

$

62.9

$

118.5

Other current liabilities

1,372.2

1,595.0

6,095.9

5,945.6

Non-United States

703.2

645.2

Total current liabilities

5,330.8

5,014.7

3.0

3.0

Total

766.1

763.7

Long-term debt

7,057.7

7,642.9

545.4

523.0

553.0

702.7

Мay 28,

2017

Deferred income taxes

1,719.4

1,399.6

Мay 29,

2016

In Millions

9,526.6

9,503.5

Other liabilities

2,087.6

1,523.1

Land, buildings, and equipment:

(5,838.9)

(5,759.9)

Total liabilities

16,216.2

15,559.6

$ 2,704.0

$ 2,755.1

Total

3,687.7

3,743.6

United States

Redeemable interest

910.9

845.6

Non-United States

983.7

988.5

May 28,

2017

May 29,

2016

Stockholders' equity:

$ 3,687.7

$ 3,743.6

Total

In Millions

Common stock, 754.6 shares issued, $0.10 par value

Additional paid-in capital

75.5

75.5

Other assets:

1,120.9

1,177.0

Investments in and advances

NOTE 17. SUPPLEMENTAL INFORMATION

Retained earnings

13,138.9

12,616.5

505.3 $

to joint ventures

518.9

(6,326.6)

(2,612.2)

Pension assets

(7,762.9)

144.9

90.9

Common stock in treasury, at cost, shares of 177.7 and 157.8

The components of certain Consolidated Balance Sheet

accounts are as follows:

Exchangeable note with related party

12.7

(2,244.5)

Accumulated other comprehensive loss

Total stockholders' equity

Life insurance

25.6

26.3

4,327.9

4,930.2

Miscellaneous

110.1

102.9

Noncontrolling interests

Total equity

Total liabilities and equity

Мay 28,

2017

357.6

376.9

May 29,

2016

Total

785.9

751.7

In Millions

4,685.5

5,307.1

Receivables:

$ 21,712.3

$21,812.6

$ 1,454.4

(24.3)

$ 1,430.1 $ 1,360.8

$ 1,390.4

Customers

(29.6)

Less allowance for doubtful accounts

See accompanying notes to consolidated financial statements.

Total

Transcribed Image Text:Fiscal Year

2015 (a)

In Millions, Except Per Share Data, Percentages and Ratios

2017

2016

2014

2013

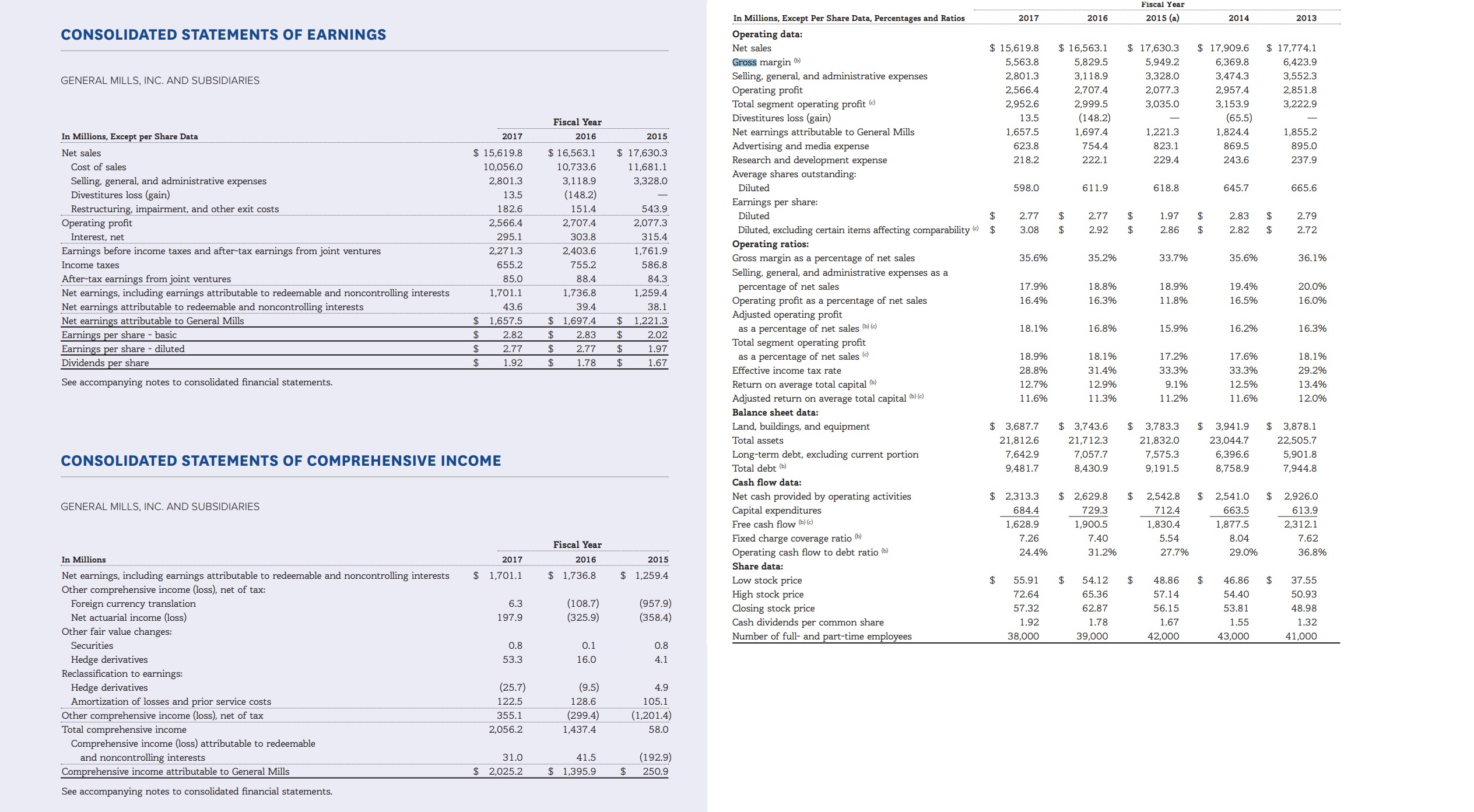

CONSOLIDATED STATEMENTS OF EARNINGS

Operating data:

$ 17,630.3

$ 17,774.1

$15,619.8

$ 16,563.1

17,909.6

Net sales

Gross margin b)

Selling, general, and administrative expenses

Operating profit

Total segment operating profit (e

Divestitures loss (gain)

Net earnings attributable to General Mills

Advertising and media expense

Research and development expense

5,563.8

5,829.5

5,949.2

6,369.8

6,423.9

3,328.0

2,801.3

3,118.9

3,474.3

3,552.3

GENERAL MILLS, INC. AND SUBSIDIARIES

2,566.4

2,707.4

2,077.3

2,957.4

2,851.8

2,952.6

2,999.5

3,035.0

3,153.9

3,222.9

(148.2)

(65.5)

13.5

Fiscal Year

1,657.5

1,697.4

1,221.3

1,824.4

1,855.2

In Millions, Except per Share Data

2017

2016

2015

754.4

623.8

823.1

869.5

895.0

$ 17,630.3

Net sales

$ 15,619.8

$ 16,563.1

243.6

218.2

222.1

229.4

237.9

Cost of sales

10,056.0

10,733.6

11,681.1

Average shares outstanding:

Selling, general, and administrative expenses

Divestitures loss (gain)

Restructuring, impairment, and other exit costs

Operating profit

3,118.9

3,328.0

2,801.3

Diluted

598.0

611.9

618.8

645.7

665.6

(148.2)

13.5

Earnings per share:

182.6

151.4

543.9

$

$

Diluted

2.77

2.77

1.97

2.83

2.79

2,566.4

2,707.4

2,077.3

Diluted, excluding certain items affecting comparability $

Operating ratios:

Gross margin as a percentage of net sales

$

3.08

2.92

$

2.86

$

2.82

2.72

$

Interest, net

295.1

303.8

315.4

Earnings before income taxes and after-tax earnings from joint ventures

2,271.3

2,403.6

1,761.9

35.6%

33.7%

35.2%

35.6%

36.1%

655.2

586.8

Income taxes

755.2

Selling, general, and administrative expenses as a

After-tax earnings from joint ventures

Net earnings, including earnings attributable to redeemable and noncontrolling interests

Net earnings attributable to redeemable and noncontrolling interests

85.0

88.4

84.3

percentage of net sales

Operating profit as a percentage of net sales

Adjusted operating profit

19.4%

17.9%

18.8%

18.9%

20.0%

1,701.1

1,736.8

1,259.4

16.3%

11.8%

16.4%

16.5%

16.0%

43.6

39.4

38.1

$ 1,697.4

$ 1,657.5

Net earnings attribut able to General Mills

1,221.3

as a percentage of net sales (b) (c)

Total segment operating profit

18.1%

16.8%

15.9%

16.2%

16.3%

Earnings per share basic

Earnings per share diluted

Dividends per share

$

2.82

2.83

2.02

$

2.77

2.77

1.97

$

as a percentage of net sales

Effective income tax rate

18.9%

18.1%

17.2%

17.6%

18.1%

$

1.92

1.78

1.67

$

$

28.8%

31.4%

33.3%

33.3%

29.2%

See accompanying notes to consolidated financial statements.

Return on average total capital

12.7%

12.9%

9.1%

12.5%

13.4%

Adjusted return on average total capital b)e)

11.6%

11.3%

11.2%

11.6%

12.0%

Balance sheet data:

$ 3,687.7

Land, buildings, and equipment

Total assets

$3,743.6

$

3,941.9

3,878.1

3,783.3

21,812.6

23,044.7

21,712.3

21,832.0

22,505.7

6,396.6

Long-term debt, excluding current portion

7,642.9

7,057.7

7,575.3

5,901.8

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Total debt (b)

9,481.7

8,430.9

9,191.5

8,758.9

7,944.8

Cash flow data:

$ 2,313.3

$

2,542.8

712.4

$

2,926.0

613.9

$ 2,629.8

$ 2,541.0

Net cash provided by operating activities

Capital expenditures

Free cash flow (b) (e)

GENERAL MILLS, INC. AND SUBSIDIARIES

729.3

684.4

663.5

1,628.9

1,900.5

1,830.4

1,877.5

2,312.1

Fixed charge coverage ratio ()

Operating cash flow to debt ratio (b)

7.26

7.40

5.54

8.04

7.62

Fiscal Year

24.4%

31.2%

27.7%

29.0%

36.8%

2016

In Millions

2017

2015

Share data:

$ 1,701.1

$ 1,259.4

1,736.8

Net earnings, including earnings attributable to redeemable and noncontrolling interests

Other comprehensive income (loss), net of tax:

Foreign currency translation

Net actuarial income (loss)

Low stock price

$

$

55.91

54.12

48.86

46.86

37.55

High stock price

Closing stock price

72.64

65.36

57.14

54.40

50.93

(957.9)

(358.4)

(108.7)

(325.9)

6.3

57.32

62.87

56.15

53.81

48.98

197.9

Cash dividends per common share

1.92

1.78

1.67

1.55

1.32

Other fair value changes:

Number of full- and part-time employees

38,000

39,000

42,000

43,000

41,000

Securities

0.8

0.1

0.8

Hedge derivatives

Reclassification to earnings:

Hedge derivatives

53.3

16.0

4.1

(25.7)

(9.5)

4.9

Amortization of losses and prior service costs

Other comprehensive income (loss), net of tax

Total comprehensive income

Comprehensive income (loss) attributable to redeemable

122.5

128.6

105.1

(299.4)

(1,201.4)

355.1

2,056.2

1,437.4

58.0

(192.9)

and noncontrolling interests

Comprehensive income attributable to General Mills

31.0

41.5

$ 2,025.2

1,395.9

250.9

See accompanying notes to consolidated financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What amounts did Target report for the following items for the year ended January 30, 2016?a. Total Revenuesb. Income from current operationsc. Net income or net lossd. Total assetse. Total equityarrow_forwardRequired: For each of the following accounts, what amount will Voltac report on its 2024 financial statements? a. Inventory b. Cost of goods sold c. Sales d. Accounts receivable e. Accounts payable f. Casharrow_forwardWith a given information below: (A) Prepare Income Statement and Balance Sheet in the Year 2020. (B) Analyze Income Statement and Balance Sheet in the Year 2020 Vertically. (C) Compute Financial Ratios: (1) ROE, (2) ROA, (3) Average Collection Period, (4) Debt to Asset, (5) Debt to Equity, (6) Time Interest Earned, (7) Total Assets Turnover, (8) Operating Profit Margin, (9) Return On Common Equity (ROCE), (10) Net Working Capital Ratio, (11) Quick Ratio, (12) Current Ratio. Cash $6,000 Sales $100,000 Utility Expense $8,000 Buildings $65,000 Common Stock $45,000 Accounts Payable $12,000 Supplies $4,000 Cost of Goods Sold $58,000 Interest Expense $5,000 Additional Paid in Capital $20,000 Bonds Payable $40,000 Supplies Expense $3,000 Salaries Expense $16,000 Accounts Receivable $10,000 Inventories $45,000 Retained Earnings $5,000 (beg. bal.) Income Tax Rate 20%arrow_forward

- The image uploaded is the calculation of Societe Generale Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardIndustry benchmarks can be drawn from quantitative financial ratio information calculated from individual firms. All of the following are key financial ratios that can help establish benchmarks except: Group of answer choices D. Funds from operations/total assets A. EBITDA C. Long-term debt/capital B. Operating income/salesarrow_forwardBelow are three independent scenarios concerning the GST account balance and the effect on the Statement of Financial Position in the previous year (2023) and the current year (2024). SFP as at 31/3/2023 Scenario 1 GST liability of $267 Scenario 2 GST asset of $267 Scenario 3 GST asset of $267 SFP as at 31/3/2024 GST asset of $769 GST asset of $769 GST liability of $769 Required: Correctly insert the opening and closing balances into the three independent GST general ledger accounts provided in the answer booklet. Balance each of the three GST general ledger accounts and insert the opening balance for 1 April 2024.arrow_forward

- Required: (a) You are required to calculate the following ratios:(i) Gross profit margin(ii) Operating profit margin(iii) Expenses to sales(iv) Return on Capital Employed(v) Asset turnover(vi) Non-current asset turnover(vii) Current Ratio(viii) Quick Ratio(ix) Inventory days(x) Receivables days(xi) Payable days(xii) Interest cover (b) In light of your calculations comment on the performance of the company over thelast two years.arrow_forwardPresent formulas and examples of the following financial ratios (Financial ratios)a. gross marginb. profit margin on salesc. return on equity (ROE)arrow_forwardRequired: Compute the following ratios for 2020: 1. Current Ratio 2. Quick Ratio 3. Receivable Turnover 4. Average Collection Period 5. Inventory Turnover 6. Average Sales Period 7. Working Capital 8. Debt Ratio 9. Equity Ratio 10. Debt to Equity Ratio 11. Time Interest Earned 12. Gross Profit Ratio 13. Operating Profit Margin 14. Net Profit Margin 15. Return on Assetsarrow_forward

- Calculate the following profitability ratios for 2018 and 2019. a. Gross profit ratio b. Return on assets c. Profit margin d. assets turnoverarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardAccounting Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education