Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

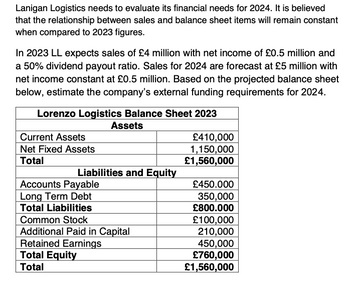

Transcribed Image Text:Lanigan Logistics needs to evaluate its financial needs for 2024. It is believed

that the relationship between sales and balance sheet items will remain constant

when compared to 2023 figures.

In 2023 LL expects sales of £4 million with net income of £0.5 million and

a 50% dividend payout ratio. Sales for 2024 are forecast at £5 million with

net income constant at £0.5 million. Based on the projected balance sheet

below, estimate the company's external funding requirements for 2024.

Lorenzo Logistics Balance Sheet 2023

Assets

Current Assets

£410,000

Net Fixed Assets

1,150,000

Total

£1,560,000

Liabilities and Equity

Accounts Payable

£450.000

Long Term Debt

350,000

Total Liabilities

£800.000

Common Stock

£100,000

Additional Paid in Capital

210,000

Retained Earnings

450,000

Total Equity

£760,000

Total

£1,560,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 2. Assume that today is December 31, 2021 and you need to determine the firm value of CoolTech, Inc. You have decided to apply the free cash flow valuation model to the firm's financial data that you've developed from a variety of data sources. The key values you have compiled are summarized in the following table: Free Cash Flow Year FCF Other Data Growth rate of FCF, beyond 2025 to infinity = 3% Weighted average cost of capital = 8% 700,000 800,000 950,000 980,000 2022 %3D 2023 %3D 2024 2025 What is the value of the entire CoolTech's entire company? + Factac F%arrow_forwardBroussard Skateboard's sales are expected to increase by 20% from $8.6 million in 2019 to $10.32 million in 2020. Its assets totaled $3 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 6%, and the forecasted payout ratio is 60%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. $______arrow_forwardBroussard Skateboard's sales are expected to increase by 25% from $7.2 million in 2019 to $9.00 million in 2020. Its assets totaled $5 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450000 of accounts payable, $500000 of notes payable, and $450000 of accruals. The after-tax profit margin is forecasted to be 3%, and the forecasted payout ratio is 55%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forward

- Calculate the terminal value of the Canopy project in 2003 and the adjusted free cash flow value for 2003.arrow_forwardYou are creating a pro forma balance sheet for the upcoming year. You have already prepared a pro forma income statement, and are predicting total assets will increase by $185,000 due to the increase in sales you are anticipating. How will you choose to finance this new growth in order to make sure the balance sheet balances?arrow_forwardThe following table presents forecasted financial and other information for Scandinavian Furniture: Projected EBIT Earnings after tax Free cash flow Havasham's WACC Expected growth rate in FCFs after 2014 Warranted MV firm/FCF in 2014 Warranted P/E in 2014 O $3,628 million O $363 million O $3,833 million 2012 $317 197 135 O $161 million 8.2% 4.0% What is an appropriate estimate of Scandinavian Furniture's terminal value as of the end of 2014, using the perpetual-growth equation as your estimate? 19.4 18.7 2013 $339 210 144 2014 $363 225 155arrow_forward

- JenBritt Incorporated had a free cash flow (FCF) of $76 million in 2019. The firm projects FCF of $255 million in 2020 and $640 million in 2021. FCF is expected to grow at a constant rate of 4% in 2022 and thereafter. The weighted average cost of capital is 10%. What is the current (i.e., beginning of 2020) value of operations? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to two decimal places. $ millionarrow_forwardQuestion is in the screen shotarrow_forwardFinancial statements Net operating revenues Operating expenses Operating income Non-operating items: Interest expense Other Net income Total assets Total shareholders' equity S 2020 33.8 28.9 4.9 (1.2) (0.6) 3.1 $ $ 200.0 78.0 - Xarrow_forward

- Rachel the chief financial officer of sunrise fruit snakcs, needed to determine the compnays projected cost of capital for next year, to do so , wshe needed to know the following infomraiont expect a) the proejcted equity level for next year b) the projected intereset rate on next years debt The projected debt level for next year D0 the projected cash balance for next yeararrow_forwardNet Income for Company A is $200,000 in 2014, $300,000 in 2015, $400,000 in 2016, $500,000 in 2017, and $600,000 in 2018. The expected growth for all years after 2018 is 5%, the 90-Day T-Bill Rate is 20%, and the appropriate percentage above risk-free rate is 12%. Using this information, what is the appropriate discount rate? A. O.32 B. 0.02arrow_forwardThe total in rate sensitive assets for a financial institution is $120 million and the total in rate sensitive liabilities is $95 million. What is the cumulative pricing gap (CGAP) and what is the interest rate sensitivity gap ratio if total assets equals $195 million? What would the projected change to net income be if interest rates rose by 2% on both assets and liabilities? What would the projected change to net income be if interest rates declined by 2% on both assets and liabilities? What would the projected change to net income be if interest rates rose by 1.8% on assets and 1.5% on liabilities? What would the projected change to net income be if interest rates declined by 1.8% on assets and 1.5% on liabilities?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education